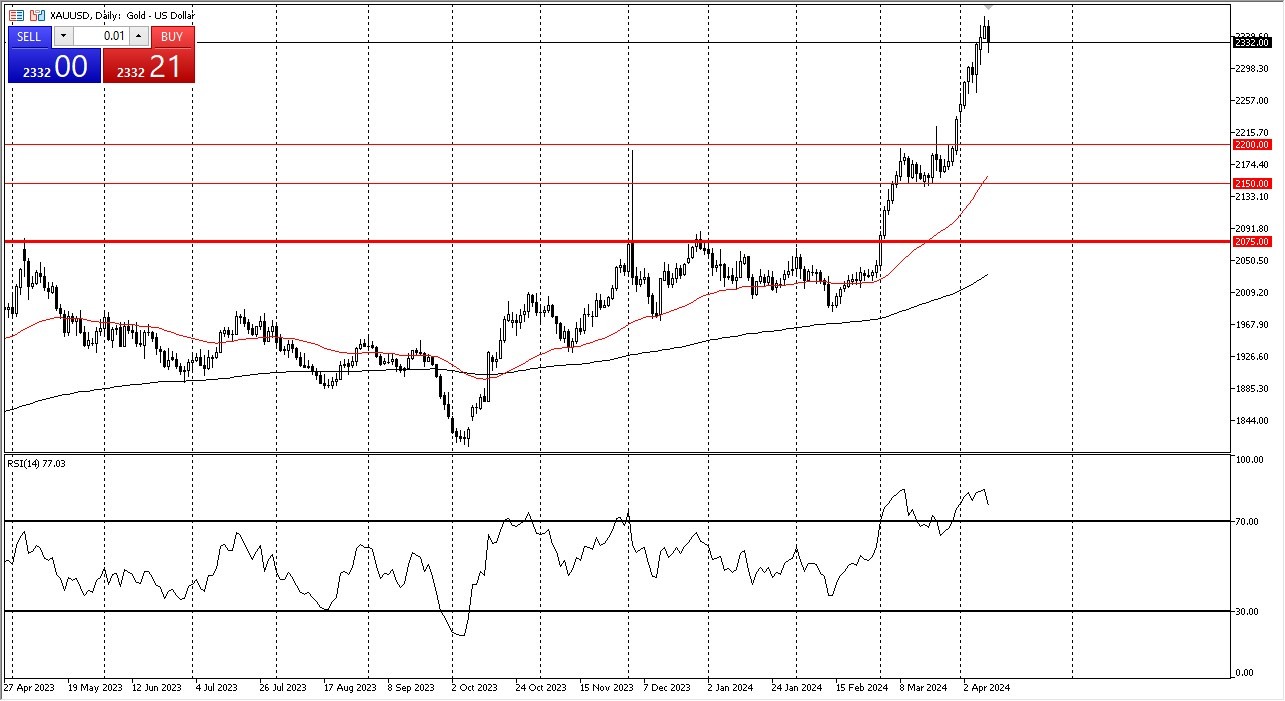

- Gold has fallen a bit during the trading session here on Wednesday as the CPI numbers came out hotter than anticipated.

- By doing so, it does shake the market up a little bit, but we are already starting to see traders come back in and try to pick it up again.

- With that being the case, I think we will see one of two things, neither of which is negative for the longer-term.

I believe that we will either see some type of consolidation and sideways grind in this general vicinity, or we will finally get some type of pullback. I would love to buy gold closer to the $2,200 level, but I don't know if I get that opportunity. The relative strength index is well above the 70 level, but that doesn't necessarily mean that we have to sell off. After all, there are a lot of reasons to think that gold could go higher. The first one, of course, is geopolitics and all of the danger out there around the world. Beyond that, we also have central banks around the world likely to cut interest rates, and this could make a lot of sense to see the gold markets react one way or another.

Top Regulated Brokers

Its Only a Matter of Time

So, I do think that it is probably only a matter of time before that comes into the picture as well. The market is currently I believe aiming for the $2,500 level on the longer term, but again, I think we could probably get some sideways action. The second scenario would be a significant pullback. I just don't see that happening though, at least not the way it's behaving.

The markets have decidedly gone very bullish with gold and until central banks around the world change their attitude and of course stop buying gold and geopolitics cools off. I just don't see how you can bet against gold. In this market, you either are long or you're on the sidelines. There's nothing else that you can do at the moment.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.