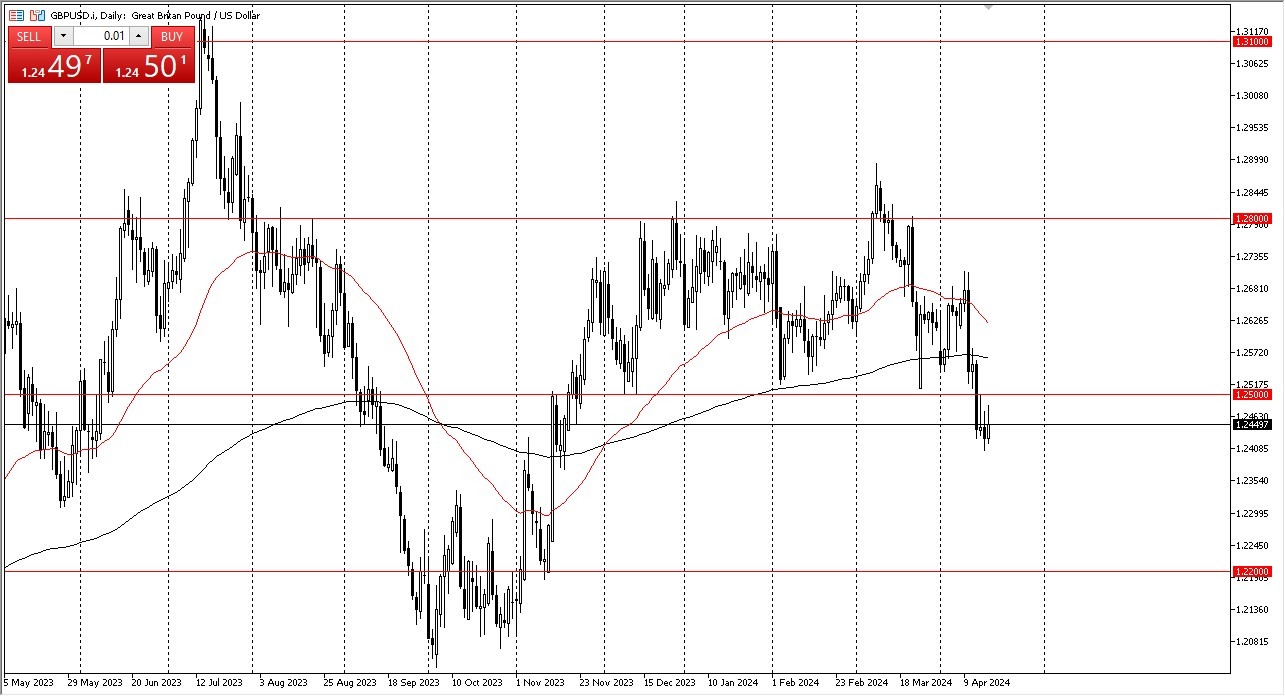

- The British pound has rallied significantly during the early hours on Wednesday but has given back some of the gains to show signs of exhaustion.

- This does make a certain amount of sense as the 1.25 level has been important more than once, therefore I think we have a situation where traders will continue to look at that area as a potential “market memory” place that a lot of people will paying close attention to.

Risk Appetite

At this point in time, everything is about risk appetite. It looks like interest rates are going higher in the United States, so that in and of itself will continue to favor the greenback, but we also have to worry about risk appetite as it seems like the world has lost its mind all of the sudden, with the massive amount of geopolitical concerns. Anytime you get that going on, you have the demand for bonds in America as being a very real thing, therefore it drives up the value of the US dollar.

Top Regulated Brokers

Ironically, it’s the lack of demand for bonds in America in the short term that has been driving everything, as it makes interest rates rally. Either way, everything is pointing to a stronger US dollar, and the fact that the 1.25 level has offered significant resistance is also something worth paying close attention to.

If we were to break above the 200-Day EMA, then we might get a little bit more of a correction, perhaps in the British pound to the 1.27 level. Underneath, if we were to break down below the 1.24 level, then it’s likely that the British pound goes looking to the 1.22 level, an area that has been important more than once in the past. Either way, this is a market that I think you continue to see a lot of choppy volatility in, but it certainly looks as if the downward pressure is somewhat relentless at this point.

Keep in mind that volatility is going to continue to be a major issue, as the market participants continue to see a lot of questions asked about the global economy, the bond markets, and of course everything else in the world. With that being the case, I think there are a lot of nervous traders out there.

Ready to trade our daily Forex analysis? Here are the best regulated trading platforms in the UK to choose from.