Today's Potential signal:

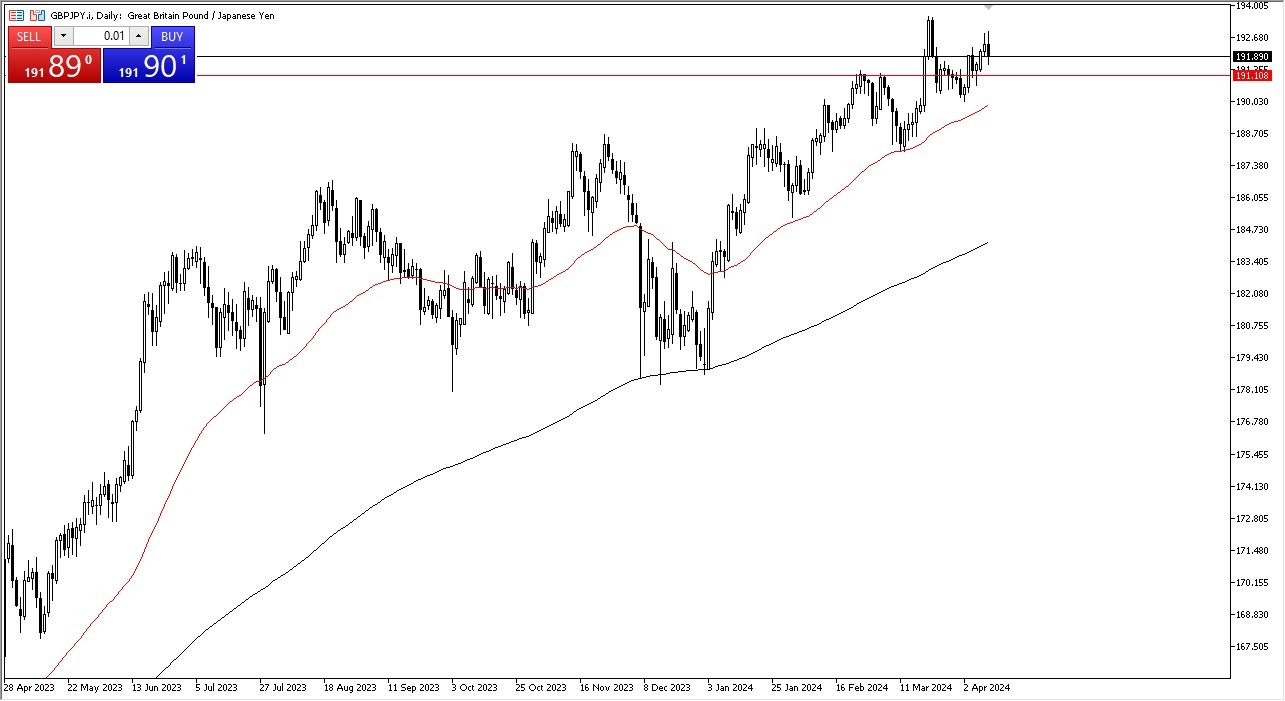

I am a buyer of this pair and have no interest in shorting it. I added during the trading session, using a small position to an already existing holding. At this point I would keep the stop loss at the ¥190.75 level, aiming for the ¥193.75 level above.

- The British pound has been all over the place against the Japanese yen during the trading session on Wednesday, as the market continues to see a lot of noisy behavior.

- In general, I think this is a situation where we have to look at this through the prism of an uptrend, but it also makes a certain amount of sense that we had to pull back as we may have gotten just a little bit overextended during the last couple of days.

That being said, the reality is that the CPI numbers coming out hotter than anticipated in the United States has seen the British pound shrink bed, as the GBP/USD pair has fallen. Some of negative momentum is found itself in the GBP/JPY pair, but at the end of the day it’s worth noting that the US dollar has taken off against the Japanese yen as well, and eventually we will focus on the Japanese yen and see this go higher. After all, the interest rate differential is wide enough to drive a truck through, and you get paid to hang on to this pair, something that most retail traders don’t pay enough attention to mainly due to the fact that a lot of retail brokers are horrible about actually paying swap.

Top Regulated Brokers

Buying On the Dips

I am still a buyer of this pair on each and every dip, and I think it’s only a matter of time before we would see a lot of value hunting come back into this market, with the ¥191 level underneath offering a certain amount of support, and most certainly the ¥190 level doing the same. All things being equal, this is a situation where the 50 day EMA is also starting to run close to that area, and I think a lot of traders will be paying attention to it.

This is a longer term uptrend, and it of course continues to pay you at the end of every day. With that being the case, I just don’t see how you fight this pair, because you have to pay swap at the end of every day in order to start buying the Japanese yen. Remember, the Bank of Japan has no real way to its interest rates much further than they have already.

For additional & up-to-date info on brokers please see our Forex brokers list.