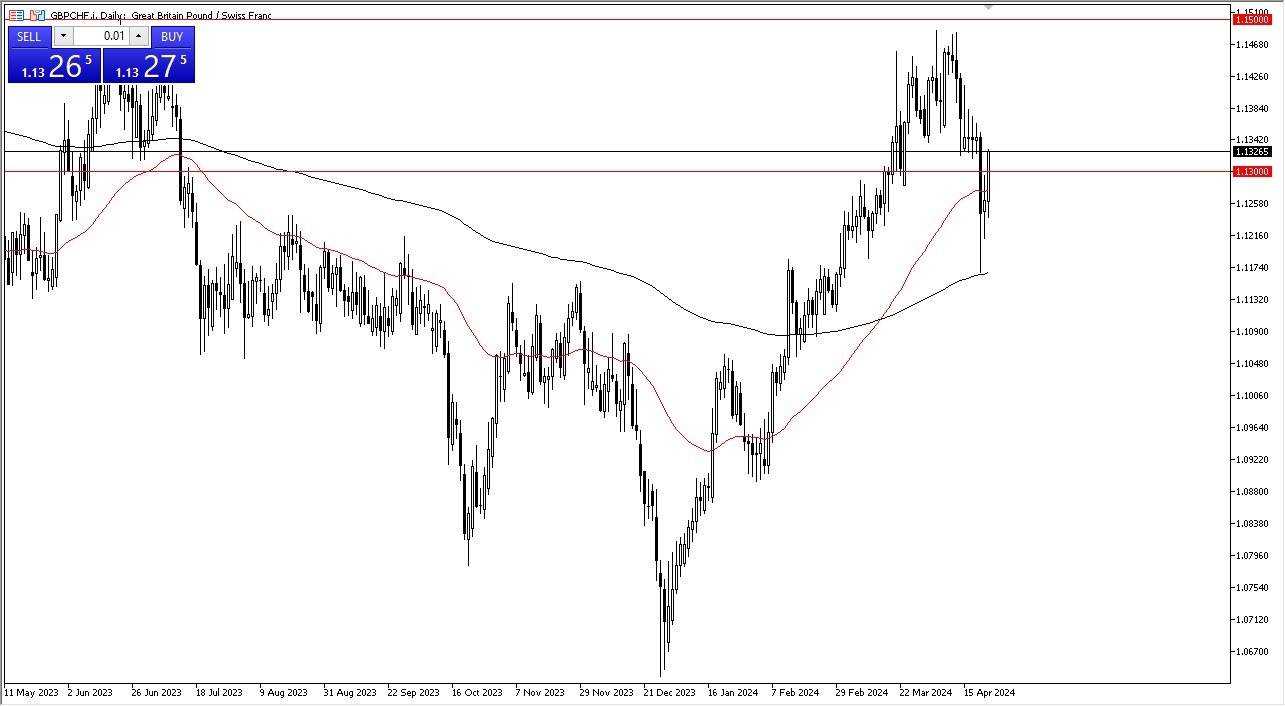

- The British pound has rallied significantly during the course of the trading session on Tuesday to break above the 1.13 CHF level.

- This is an area that previously had been important, and it’s probably worth noting that we are now above the 50-Day EMA as well, so that makes the move technically very bullish.

- Part of this may be just a simple continuation of the bounce from the 200-Day EMA underneath.

That being said, it’s probably also worth noting that the British economy has now exited recession, so it does make the British pound, to be of the British economy, much more attractive. On the other side of the equation, you have the Swiss National Bank, which has cut rates already, and could very possibly do so in the future. In other words, we have gotten back to the idea of a “carry trade” looking attractive as interest rate differential get you paid at the end of every day.

Top Regulated Brokers

Buying on the dips

At this point, I still like the idea of buying on the dips in this pair, due to the fact that we are clearly seen some type of major shift in the overall attitude of traders, and it’s likely that we could go looking to the 1.15 CHF level above, which is a major resistance barrier on longer-term charts. If we can break above there, then it’s likely that we go much higher than that, and I think you have a scenario where you start to see a lot of momentum jumping into this market.

Underneath, the 200-Day EMA, which sits at the 1.1150 level is an area where there is a significant amount of support, so I do think that a lot of people will be paying close attention to it. As long as we can say above that level, then it’s likely that the British pound will continue to accelerate against the Swiss franc, which I think is going to be in serious trouble later this year as it is the first central bank to start cutting rates, and therefore becomes a “funding currency” for a lot of traders.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.