- The euro rallied significantly during the course of the trading session on Wednesday, as we have now broken above the 200-Day EMA.

- Quite frankly, this is the market that I think continues to see a lot of noisy behavior, and the fact that we have bounce should not be a huge surprise considering that we have been in a range for some time.

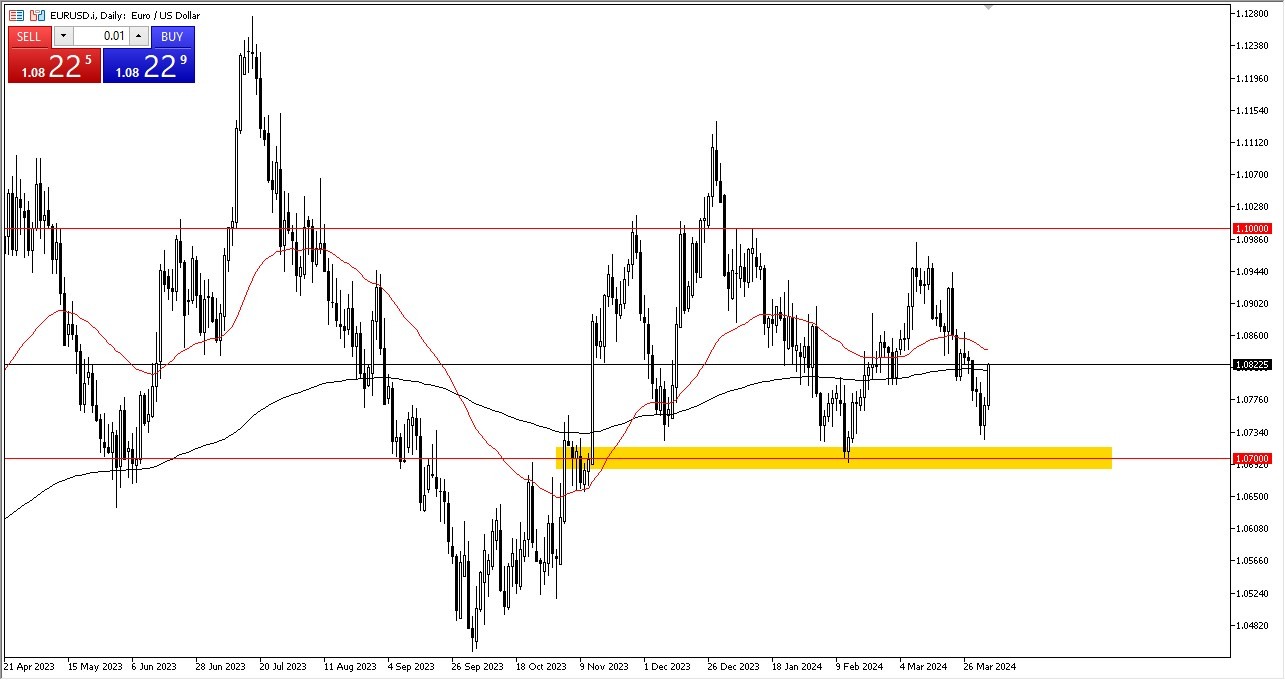

- Underneath, the 1.07 level is an area that I think a lot of people will be paying close attention to, as it is previous support.

On the upside, the 1.10 level above is a significant ceiling that a lot of people will be watching closely. All things being equal, we have been stuck in a 300 point range, and this is a situation where traders will continue to go back and forth and as we had gotten a bit oversold, it does make quite a bit of sense that we are now bouncing toward the middle.

Top Regulated Brokers

Nonfarm Payroll

The Nonfarm Payroll announcement comes out on Friday, and I think a lot of people will be paying close attention to it. All things being equal, this is a market that continues to see a lot of questions asked about both central banks, and quite frankly both central banks are likely to cut rates later this year. Having said that, it is a bit difficult to get overly aggressive at this point, especially as the jobs number comes out so quickly from here. In general, this is a scenario where I think we are “reverting to the mean”, near the 1.0850 level.

The size of the candle is rather strong for the Wednesday session, therefore I think it makes quite a bit of sense that we will continue to see momentum driving trading occasionally, but in general this is a situation where the we will continue to see a lot of noisy behavior, but as we are getting closer to “fair value”, if you have played this bounce like I had talked about a couple of days ago, it might be time to get out of this pair as Thursday will more likely than not be quiet and then of course we have the jobs figures coming out on Friday.

Ready to trade our Forex daily forecast? We’ve shortlisted the best European brokers in the industry for you.