- The Euro initially pulled banks just a bit but at this point in time has turned around the show signs of life during the Tuesday session.

- This is not a huge surprise considering that the market has been consolidating for some time.

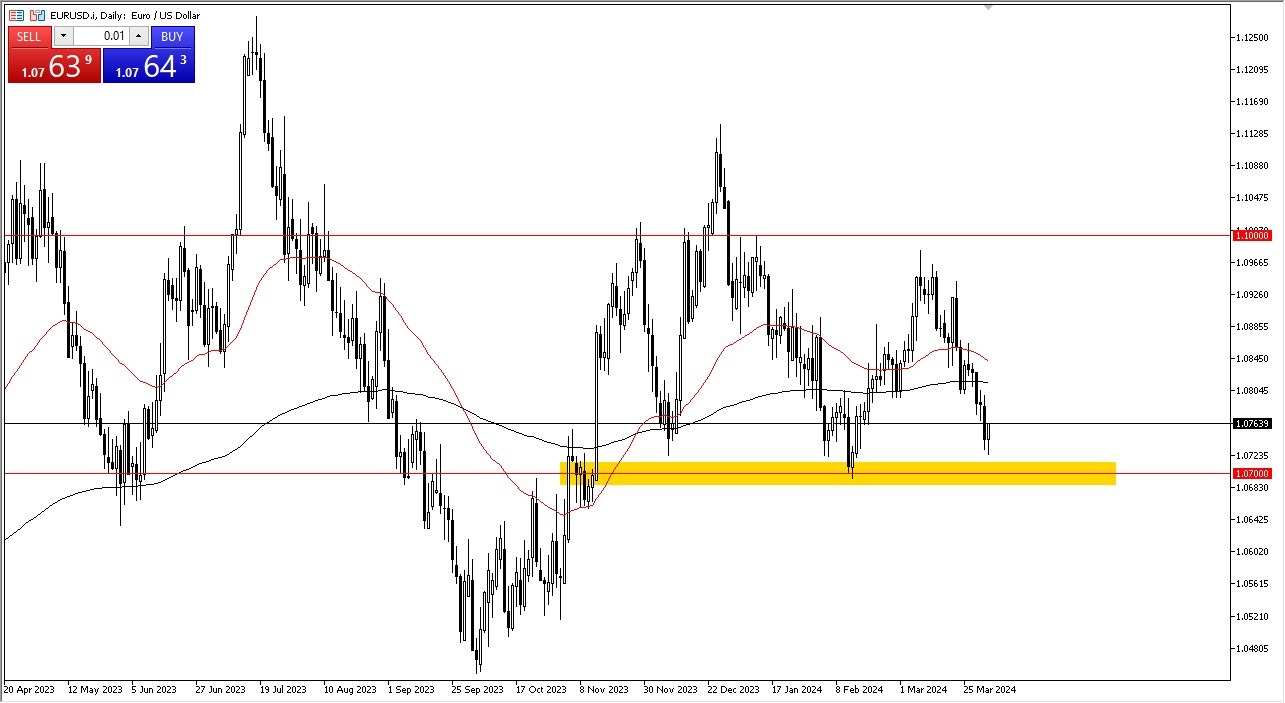

- I think it does make a certain amount of sense that the market has to bounce from a major support level when you have a scenario that just shows itself to be just kind of back and forth and without any real conviction.

Jobs Number Comes Out on Friday

Top Regulated Brokers

We have the jobs number on Friday, so the market is going to continue to see a lot of back and forth, but as we are extended all the way down to the bottom, it is likely that if nothing else, some short covering comes in. The jobs numbers will cause a lot of noise. In general, I think you have a situation where you just have to be cautious and recognize that we have a scenario where we may get a bounce towards the 1.09 level maybe just above the 200 day EMA. If we can break that, then the 1.10 level above will be the next target.

On the other hand, if we were to turn around and break down below the 1.07 level, then we could open up a move down to the 1.05 level. That of course would be a huge dollar positive move and you would probably see the US dollar strengthening against everything. That being said, I think over the next couple of days we will probably drift a little higher. At this point, I think you have a situation where we will eventually find stability that we can take advantage of. The EUR/USD market could pullback a bit further, but with enough patience I think you will get a lot of value to take advantage of.

While I do think that the market will bounce, I also recognize that this is a market that is short-term focused, and therefore I wouldn’t hang onto a position for too long. I think this is a trade only, not some kind of massive investment waiting to happen.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.