- The euro has gone back and forth during the course of the trading session on Friday, as we saw a massive reaction to the Israeli attack on Iran, as traders ran toward the US dollar for safety.

- In general, this is a market that I think you need to continue to pay close attention to because it is a good way to look at the US dollar in general and could give you a bit of a “heads-up” as to where the greenback might go against multiple currencies.

Consolidation

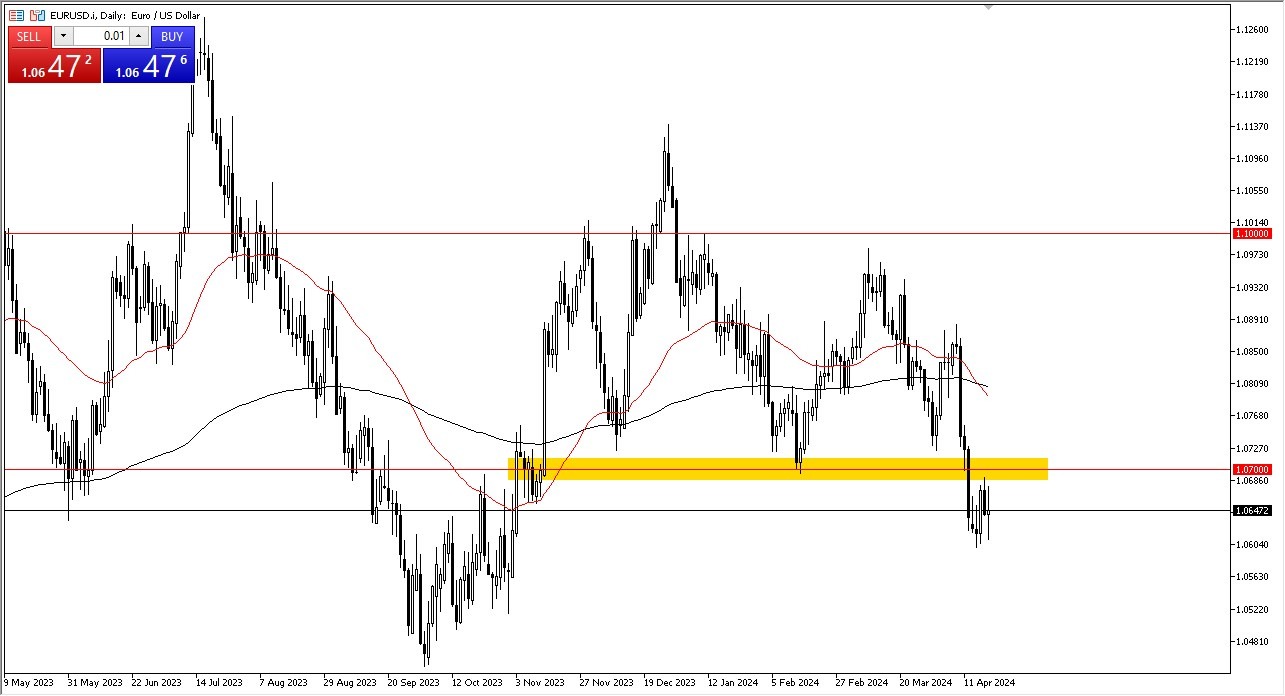

All things being equal, I think we continue to consolidate, with the 1.07 level above offering resistance, and the 1.06 level underneath offers significant support. Even though we did break back and forth on Friday, the reality is that the market has found a range that it’s willing to trade in, and that’s all we are doing at the moment. In fact, the fact that the trading session ended up basically unchanged tells me just how indecisive the market is at the moment.

Top Regulated Brokers

The European Central Bank is likely to continue to look loose at the moment, with the possibility of cutting rates sometime this summer. If that’s going to be the case, that will continue to weigh upon the Euro, especially against the US dollar which has the Federal Reserve backing it with tight monetary policy, and the reality is that the market is likely to continue to see the Federal Reserve have to push back the timeframe of interest rate cuts that everybody is waiting for.

That being said, if we can break out of this 100 point range, according to technical analysis it opens up a move for 100 points in whichever direction we finally go. I do think that it’s easier to sell this market that it is to buy it, but if we did break above the 1.07 level, the 1.08 level has the 50-Day EMA hanging around it as well, so I think even if we do take off to the upside, the reality is that it only has so much momentum to go higher. If we break down below the 1.06 level, then it’s likely that we could go down to the 1.05 level which has been important multiple times.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Europe to check out.