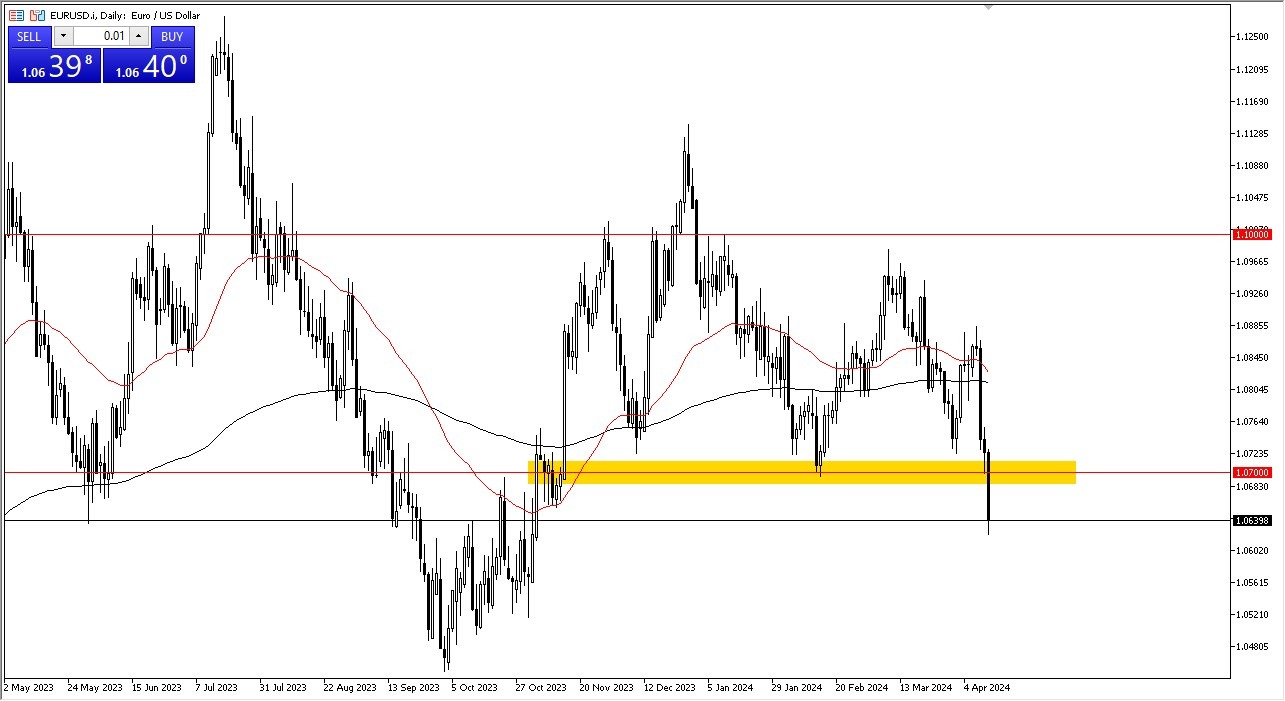

- The euro had a very rough Friday, as we broke below the crucial 1.07 level.

- This is an area that had been the bottom of the larger consolidation area, so breaking through their course will capture the attention of a lot of traders.

- At this point, the market is likely to continue to look at the 1.07 level as an important level, so if we do rally from here, then it could offer overhead resistance.

If we were to break down below the bottom of the candlestick for the Friday session, then it is likely that we will continue to see momentum to the downside, possibly sending the euro down to the 1.05 level. With this being the case, we would see a lot of US dollar strength across the board, so even if you are not trading the euro, the reality is likely that we will see the greenback destroy everything in its path.

Top Regulated Brokers

Major Breakdown?

The question now is whether or not there’s any follow-through. I would anticipate that it’s likely there could be, mainly due to the fact that during the ECB Press Conference, Christine Lagarde suggested that the European Central Bank could be cutting rates as soon as June, and that of course puts a lot of downward pressure on the currency. That being said, there are still a lot of questions as to when the Federal Reserve will start cutting, and that obviously has an effect on the market as well. I expect a lot of noisy behavior, but this major breakdown could be the beginning of something fairly large.

If we do turn around and take out the height of the Thursday candlestick, then I would be convinced that we are simply going to hang around in the consolidation area that we had been in for ages. Keep in mind this is a year that is probably going to see both central banks cut interest rates, so I don’t know that we will break down below the 1.05 level. It’s worth noting that we reached that level last year also, only to turn around and bounce up into the larger consolidation phase. In other words, the downside is probably somewhat limited.

Ready to trade our Forex daily analysis and predictions? Here are the best European brokers to choose from.