- The euro initially felt during the course of the early hours on Wednesday but turned around the show selling strength again against the British pound.

- At this point, I think that this market is trying to do everything it can to recover, and we are building a larger base from everything that I see.

- That being said, please keep in mind that this pair tends to grind more than anything else, and therefore you need to be patient with any move, as it will take a significant amount of time.

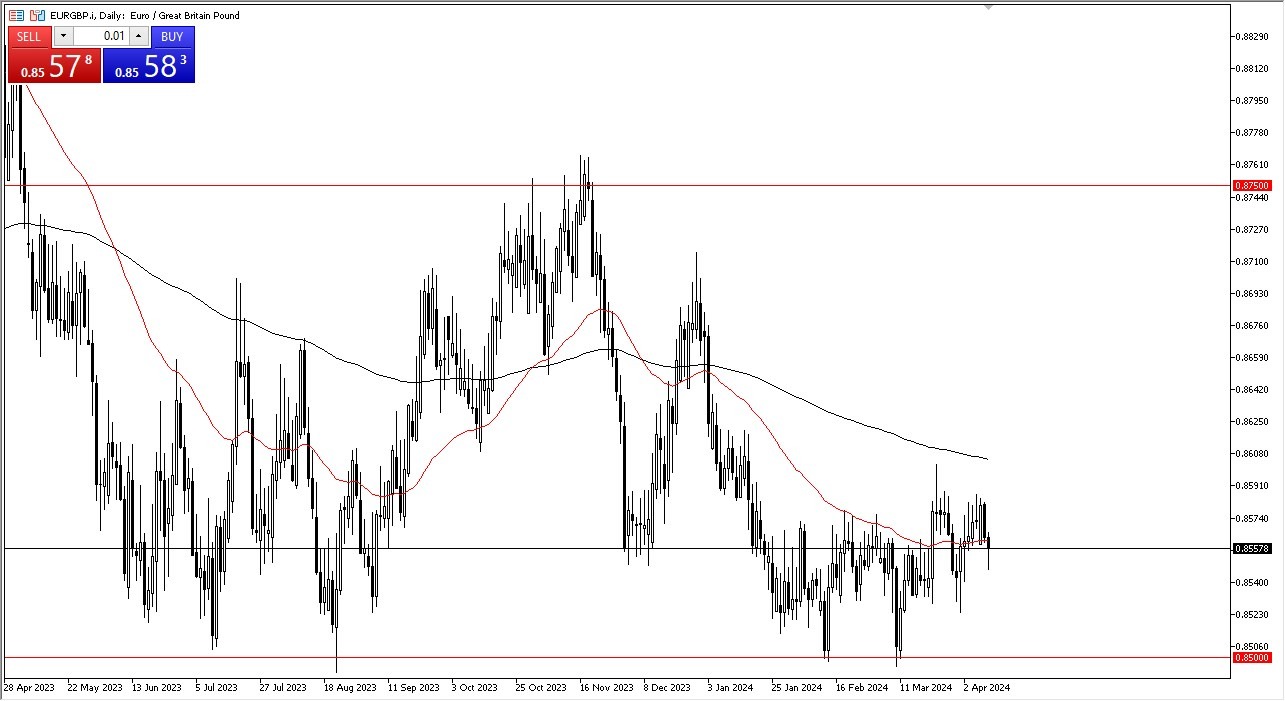

We are currently hanging around the 50-Day EMA, which of course is an indicator that a lot of people pay close attention to. With that being said, the market is likely to continue to reach toward the 200-Day EMA, which sits near the 0.86 level. The 0.86 level is an area that has been significant resistance anyway, so the fact that we have the 200-Day EMA sitting there as well also offers a bit of a short-term ceiling. If we can break above that, it’s likely that this parable goal all the way to the 0.8750 level. That being said, you have to pay close attention to the fact that the swap is slightly negative, but it’s not overly restrictive as far as I can see.

Top Regulated Brokers

Are We Bottoming?

At this point, it looks like we are forming a bit of a “rounded bottom”, and it suggests that the market is trying to capture some type of momentum and bounce from extreme lows. It’s worth noting that the 0.85 level is a massive support level from longer term charts as well, so that being said, the market is likely to continue to see a lot of interest in this area. That being said, the market is likely to see a lot of volatility during the Thursday session due to the fact that there is a European Central Bank interest rate decision and of course press conference during the day. Because of this, I think it’s probably only a matter of time before we get some type of big move, but as long as we stay above the 0.85 level, I continue to look at this through the prism of the market that might be trying to escape from what might be a “accumulation phase.”

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.