- The euro rallied a bit during the trading session on Thursday, breaking above the 1.37 level.

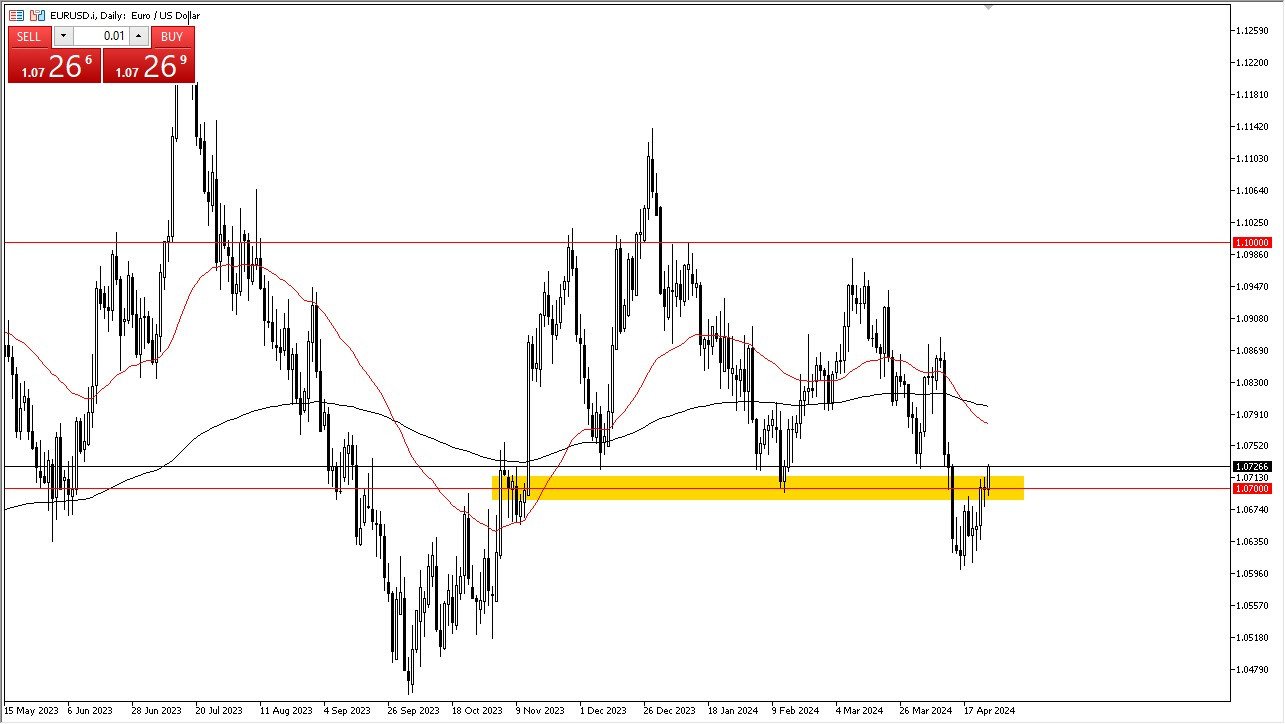

- The 1.07 level is an area that previously had been support, so it is a little bit of a surprising move, but it doesn't necessarily change much because we have a lot of work to do regardless.

Keep in mind that a lot of what's going on is a questioning of central bank policy. In the United States, the Federal Reserve is likely to cut rates sooner or later, but later might be the key word. And it could even be next year. In Europe, we have the ECB that is very likely to start cutting sometime this summer, which is essentially what the latest Swing Low was about.

Top Regulated Brokers

Fibonacci Levels

That being said, there are a lot of different things that we can look at. for example, we could look at a Fibonacci retracement. And if the market pulls up just a little bit higher than where it presently sits, we would be testing the 50% Fibonacci retracement. And it could be an area where you see a bit of exhaustion.

It's also worth noting that the 61.8% Fibonacci retracement level is right at the 50 day EMA, and so that's also an area that you'll need to pay attention to. If and when we can get through all of that, then we could make a move towards 1.10. I'm more inclined to fade signs of exhaustion at this point, but I also recognize that neither one of these central banks are going to be big winners against each other.

It's going to be more stagnation like it was last year. We bounced around between the 1.05 level on the bottom and the 1.1250 level on the top. I suspect that's the longer term trajectory of the EUR/USD pair for the year, but in the short term, I still think that it's going to be difficult to grind a lot higher but am willing to flip the bias if we can break above the 200 day EMA above.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.