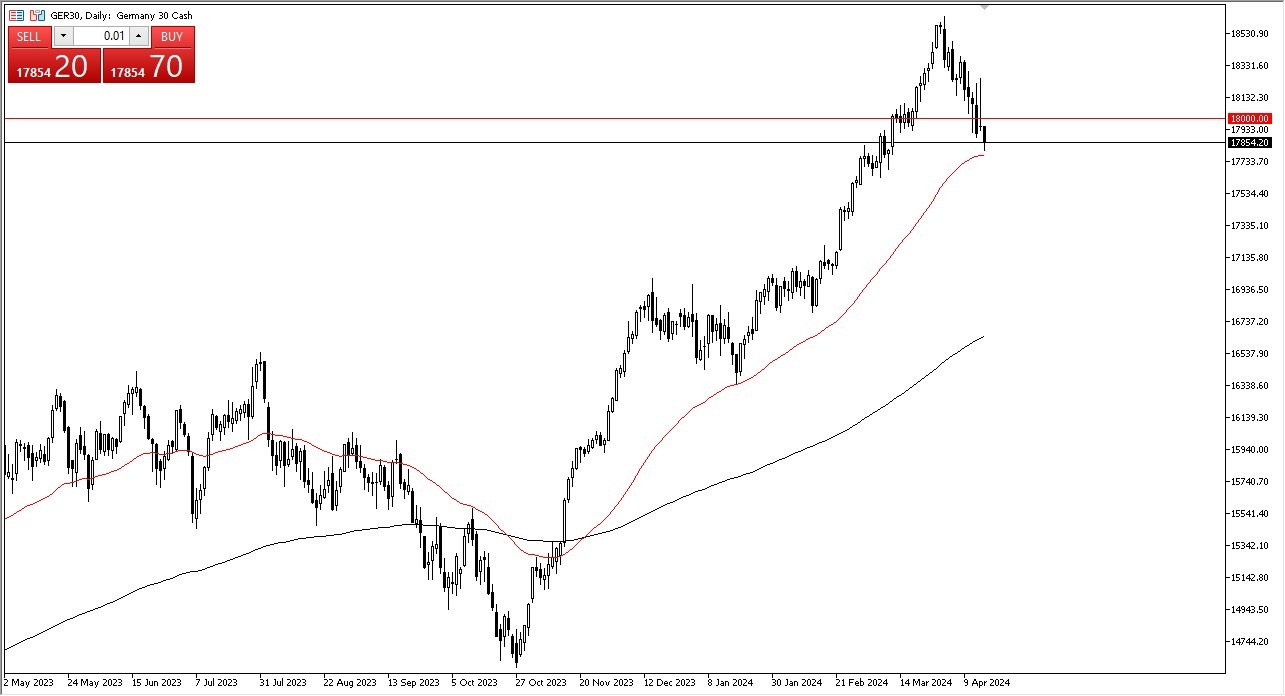

- The DAX fell a bit during the early hours on Tuesday, but it does look like the 50 day EMA is going to have some type of influence.

- If we can recapture the 18,000 euro level, then I suspect that the uptrend will continue.

- That being said, it's difficult to imagine that breaking above there is going to be easy because we have seen a lot of selling pressure, but a lot of this comes down to fears of inflation and central banks around the world trying to tighten monetary policy in the future, or at least not looking to loosen it.

- It has most stock traders freaking out. Higher rates in the bond market, of course, has a major negative influence on stocks as well.

The European Central Bank

That being said, keep in mind that the European Central Bank has to loosen monetary policy later this year if they stick to the latest press conference. If that's going to be the case, then it's very possible that the DAX could get a bit of a boost from there. But we need to see momentum come back into this picture. And at this point, I think if we break above the inverted hammer from the Monday session, then we'll see a lot of FOMO momentum come back into the DAX.

Top Regulated Brokers

Remember that the DAX is the first place that a lot of people look to as far as investing in the European Union. So, this could be a bit of a harbinger for other indices that you may or may not be involved in, such as the AMX in Amsterdam, the CAC in Paris, et cetera. With that being said, I do think this is a market that eventually bounces, but I'm waiting to see whether or not we get any follow through here before putting a lot of money to work. I think you are better off gradually building a position more than anything else at this point in time.

At the end of the day, I do like the DAX, but also recognize that volatility will continue to cause headaches for a lot of traders. The position sizing that you choose could make a massive difference as to what your results are like.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.