- Crude oil markets initially pulled back just a bit during the trading session on Friday but have seen quite a bit of bullish pressure enter late in the day.

- Ultimately, there are a whole plethora of reason to think that they continue to go higher, regardless of the grade of crude oil you are talking about.

WTI Crude Oil

The West Texas Intermediate Crude Oil market initially pulled back during the day on Friday as we were waiting for the jobs number. The job summer came and went, and at that point in time traders started to step in and take advantage of the short-term pullback, and it looks like we have continued to see plenty of value hunters come in to try to take advantage of this.

The $85 level underneath will continue to be a massive support level, and the price action on Friday will only have reiterated how supported it will be, due to the fact that it would take quite a bit of effort to sell the market off to reach that region. At this point, I fully anticipate that the WTI Crude Oil marketers looking to the $87.50 level next, followed by the $90 level above.

Top Regulated Brokers

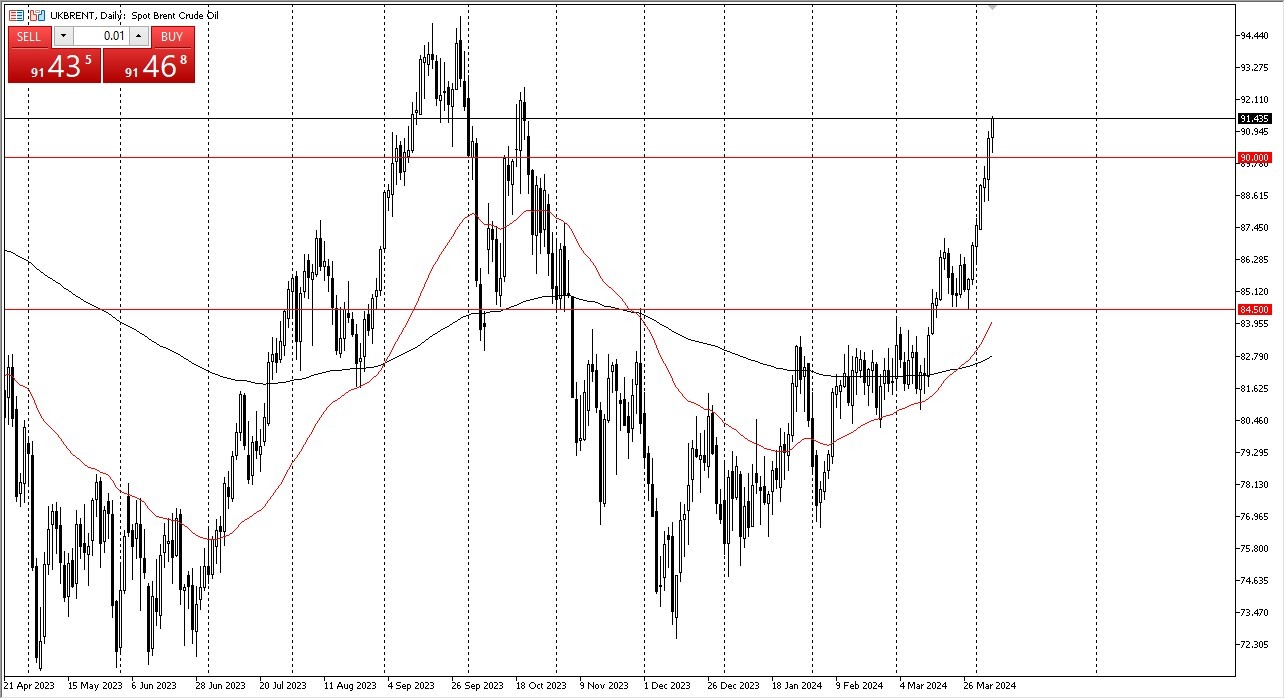

Brent

Brent markets also initially pulled back a bit during the trading session on Friday, finding a significant amount of support at the $90 level. The $90 level courses a large, round, psychologically significant figure, and in area or that would continue to cause quite a bit of market memory to come into play. We bounced enough to break above the $91 level, and therefore I think we’ve got a very real possibility of going to the $92.50 level based upon previous resistance. With this being the case, the market remains very bullish, but it is also a bit overextended. The overextension of the market could lead into exhaustion, but there are far too many reasons to think that we are going to continue to see buyers regardless.

Keep in mind that the conflict in the Middle East seems to be expanding, and therefore it could offer even more upward pressure to this market. Furthermore, we also have to understand that supply is a bit stretched, therefore it does make quite a bit of sense that we could see the fundamentals continue to come into the picture and lift this market.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.