- The crude oil markets have been very noisy over the last several days, and at this point in time it’s obvious to me that the market is going to continue to search for some type of stability.

- After all, we have seen a massive run higher, followed by a massive selloff that has made both grades of crude oil that I follow very difficult to hang onto.

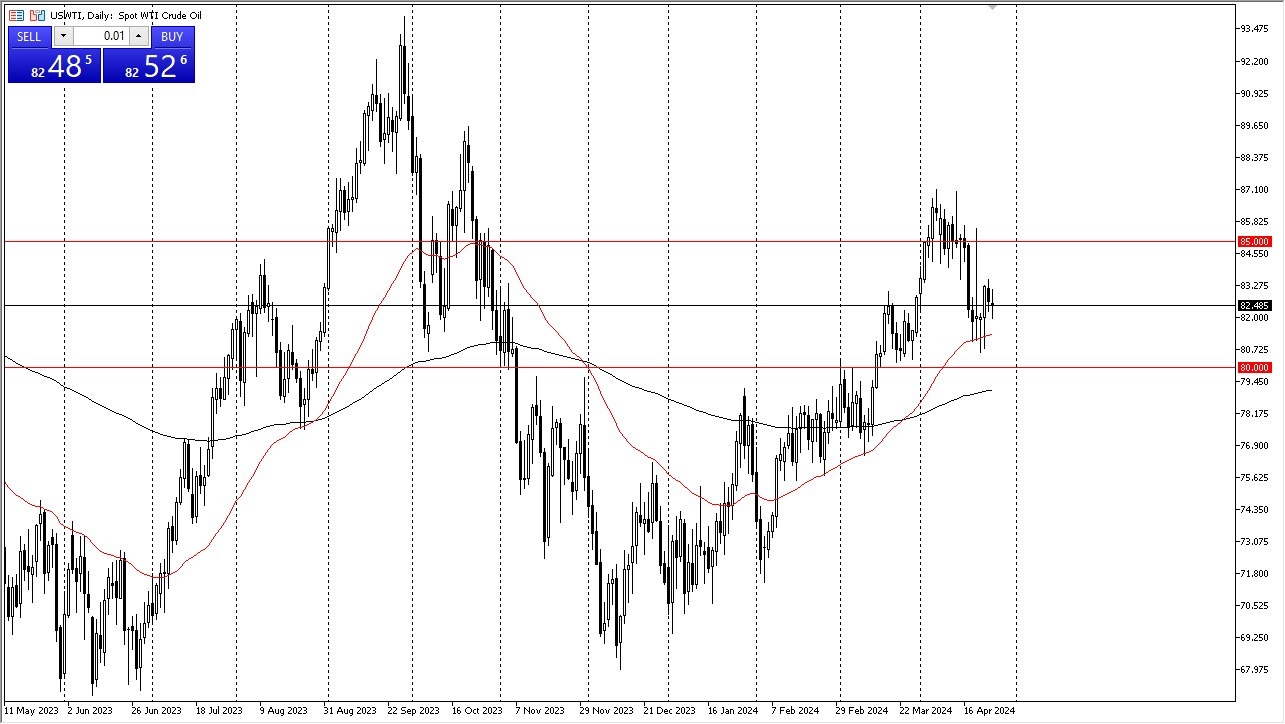

West Texas Intermediate Crude

The WTI Crude market has gone back and forth during the early hours on Thursday, as we continue to dance around the $82.50 level. Furthermore, we also have the 50-Day EMA underneath offering support, and we are essentially in the middle of the overall consolidation range between the $80 level on the bottom, and the $85 level on the top. As things stand right now, this is a market that looks very neutral, but it seems as if we are completely ignoring a lot of the geopolitical propellants out there that could jump into this market.

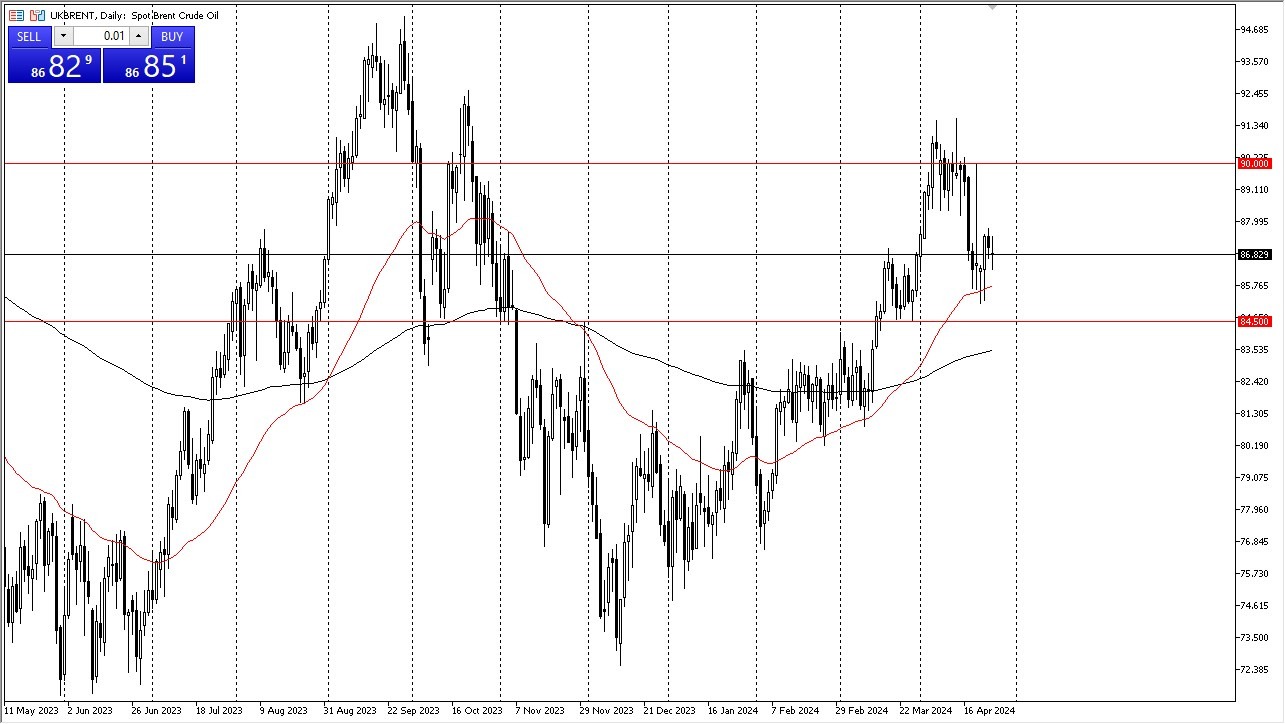

Brent Crude

Brent markets of course have behave very similarly, with the 50-Day EMA hanging around the $85.75 level. This is a market that seems like it is trying to sort out what it was to do as well, with the $84.50 level underneath being a major support level, and the $90 level above being a major resistance barrier. As we are close to the middle of the market, I don’t necessarily think we are in a scenario where you would see a lot of certainty, so therefore I think you have to look at this through the prism of either a longer-term trade that is trying to set up, or to simply trading back and forth.

Top Regulated Brokers

Looking at the overall situation around the world, supply is still an issue, and we obviously have a lot of geopolitical concerns. Those geopolitical concerns could cause massive headaches for crude oil markets, and then of course the latest headlines coming out of Iran or Israel could have a direct effect on these markets. Because of this, be very cautious with your position sizing.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.