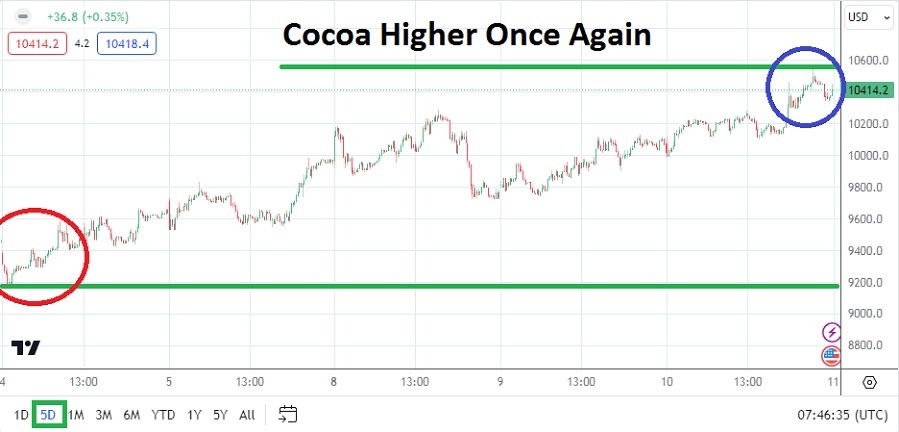

Cocoa has gained once again and as of this writing is near the 10,414.0 mark as record values achieved yesterday remain in sight and speculatively adventurous.

- Gravity has not struck yet in the price of Cocoa. In early trading this morning the 10,414.0 ratio is being challenged. Yesterday’s record high of 10,555.0 did not grab headlines in many financial circles because of the higher U.S Consumer Price Index numbers.

- However, the price of Cocoa is certain to not help inflation concerns. The commodity has kept an upwards trajectory and while there have been some sharp reversals lower demonstrated occasionally, the value of Cocoa has remained speculatively strong.

Wagering on more upside in Cocoa may feel like the right thing to do, but at some point it does seem logical the commodity will run of powerful buyers. Betting against the trend higher does feel tempting too, but it might also be a one way ticket to the ‘poor house’ for many day traders. If you are considering speculating on Cocoa all of your risk management tactics must be used.

Price Velocity and Higher Realms

On the first of April the price of Coca touched the 10,400.0 mark. The lowest depth the commodity has touched since the start of April was around the 9,180.0 level on the 4th. But on the very next day, Cocoa was again above 10,000.0 USD per metric ton. The price velocity of the commodity has been fierce and speculators need to use entry price orders when making pursuit.

Intriguingly the record values of Cocoa made yesterday did not cause a violent reversal lower. The price of Cocoa has sustained the 10,000.0 mark since early Tuesday relatively well. Lows around the 9,725.0 vicinity were touched at the end of this Monday and into the next day. Yesterday’s climb upwards simply proved resistance remains vulnerable and large speculators may still be looking for higher values. However, day traders also need to understand that if and when Cocoa does start to break lower, price velocity could become lightning quick.

Top Regulated Brokers

How High Can Cocoa Go?

Traders of Cocoa are likely wondering how high the price of the commodity can reach compared to the downwards potential the commodity can muster. Having produced a significant climb over the past half year, with outlandish gains made over the past three months it would be illogical to simply say Cocoa cannot go higher and traverse values we assumed impossible only a few months ago. Yet, the question of gravity needs to be considered too.

- Which is more likely in Cocoa – a price of 11,000.00 USD plus, or a price of 9,000.00 to 8,500.00?

- And because this is commodity with a strong speculative component it is possible both will be seen?

- Timeframes must be considered too by day traders. Leverage is extremely dangerous when used in Cocoa and traders need to remain logical and not get overly ambitious about their targets.

Cocoa Short Term Outlook:

Current Resistance: 10,510.0

Current Support: 10,275.0

High Target: 10,680.0

Low Target: 9,900.0

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.