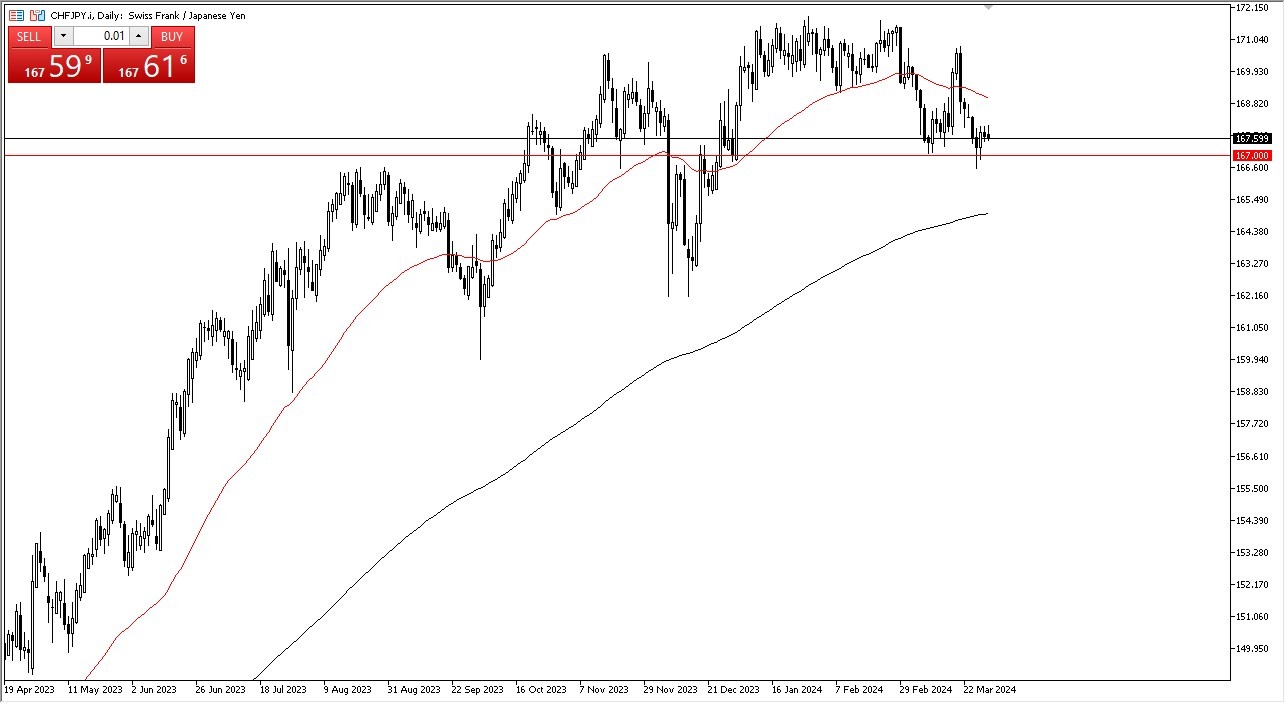

- The Swiss franc has been back and forth during the trading session on Monday, as this market is going to continue to see a lot of noisy behavior.

- The ¥167 level underneath has been offered support a couple of times, and therefore I think it’s possible that we would see a situation where we have a lot of noise in this area.

A Battle Between Funding Currencies

The Swiss franc initially did try to rally against the Japanese yen, but as it pulled back it looks like we are just simply settling into some type of short-term range. This is a pair that I watch quite often, due to the fact that one of the facts of life when trading currencies is that you are trying to move with interest rates. The Swiss franc and the Japanese yen are two of the world’s favorite funding currencies, and even though the Bank of Japan recently increased interest rates to a whopping 0.1%, the reality is that the Swiss National Bank has recently cut rates. That’s part of why we are seeing a downtrend in the short-term, but in the longer term we still see an interest rate differential that pays you to own this pair at the end of the day. Granted, it’s not a lot but it’s enough to continue to favor shorting the Japanese yen.

Top Regulated Brokers

Ultimately, this is a situation where if we can break above the 50-Day EMA above, which is closer to the ¥169 level, then we could see quite a bit of upward momentum. In that environment, I would anticipate that the Japanese yen would get eviscerated against most currencies, not just this one. After all, this will be the “weakest currency” to match up against the Japanese yen, so this will give you a good idea as to how many people will be jumping into short the yen, and start buying other currencies in pairs like the GBP/JPY, NZD/JPY, and AUD/JPY currency markets. In other words, this chart is a bit of a harbinger for what happens with the JPY overall.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.