- While most of you don’t pay attention to the CHF/JPY currency pair, I believe you do this at your own peril.

- This ignores a very basic tenet of the Forex world, that money tends to go to where it is treated best.

- The Swiss franc in the Japanese yen are both very low yielding currencies and are quite often used to fund so-called “carry trades.”

- This is where a trader will buy a higher yielding currency with a lower yielding one, collecting swaps at the end of the day.

It’s also worth noting that the true “carry trade” often involves bonds, so for example somebody might buy New Zealand dollars with Japanese yen, and then go get a higher yield in New Zealand through the bond trade than they could in Japan. By borrowing in yen, it makes your funding process much cheaper than it would be to go into a bank in Wellington. Obviously, this is something that large funds do and not the average retail person, but the average retail person doesn’t move the market.

Top Regulated Brokers

Technical Analysis and its Influence on Other Pairs

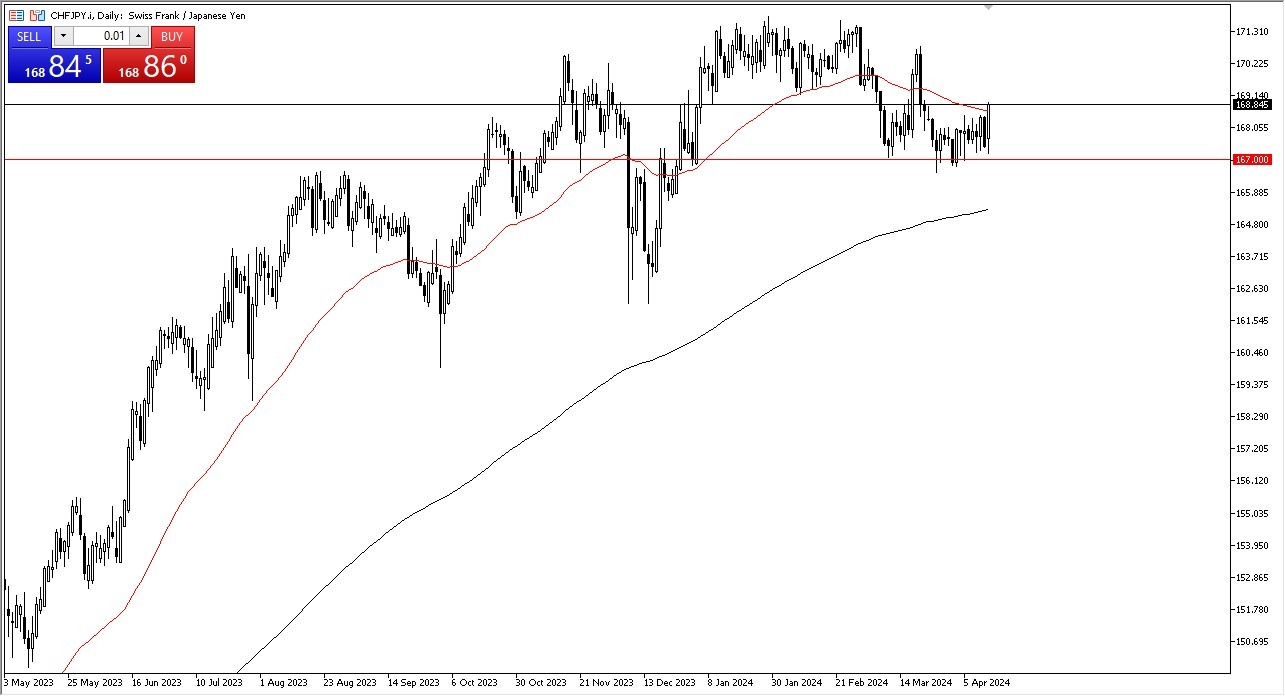

One of the biggest things that I pay the most attention to in this pair is which currency is strengthening over the other. As the Swiss franc has turned around the rally quite significantly against the Japanese yen, even breaking up above the 50-Day EMA, it suggests that the Japanese yen is the weaker of the 2 currencies. We have recently pulled back to the ¥167 level, only to see the Swiss franc gain again. What this means is that the Swiss franc is probably going to continue to strengthen against the Japanese yen, despite the fact that the Swiss National Bank recently cut interest rates, making it the first of the major central banks to do so.

Keep in mind that the Bank of Japan has raised rates to essentially zero, and while that is a step in the right direction for the currency, it’s very unlikely that they can continue to do so. The Swiss franc offers more in interest, and therefore you get paid to hold despair. However, that’s not what I’m doing here. What I use this pair for is to decide which currency to short, be it the Japanese Yen or the Swiss franc. What this chart tells me is that buying pairs like the GBP/JPY, NZD/JPY, USD/JPY, and so on will continue to be the trade. It’s not that you can’t short the Swiss franc, it’s just that you’ll get more momentum shorting the Japanese yen.

Not sure which broker to choose? We've made a list of the best forex brokers for you.