- With seven consecutive bullish months, Bitcoin has now consistently surged past the previous month's figures since September 2023.

- The last time this occurred was in 2012 when Bitcoin price moved from $4.89 to $12.37.

With March seeing a $73,777 top, the benchmark cryptocurrency may be poised for a continued rally. Some analysts have maintained that the price may more than double before the close of the year. With Hedge fund manager Mark Yusko putting the price at $150,000 by year-end.

Bitcoin is King

As traders closed their positions for March, Bitcoin settled for $70,000 as its price after a tumultuous first quarter. Fueled by the Exchange traded-funds mania, the price of pioneer cryptocurrency recovered gradually from the last quarter of 2023 into a roaring surge in its price.

This rally, characterized by an appetizing daily chart, moved the price of Bitcoin up 65% in Q1. However, exhaustion looms. The rally may slow down as the price goes into correction.

The rapid rise in price since the beginning of the year may make it a difficult task for the bulls to maintain momentum.

Despite this, the second quarter of the year may be pivotal to the continued positive outlook for cryptocurrencies in general. With events like the Bitcoin halving, London Stock Exchange ETNs, continued interest in spot Bitcoin ETFs, and a probable approval of spot Ethereum ETFs, occurring in Q2, the next few months will be action-packed. All of these may serve as catalysts to push the price upward.

In Q1, holders of Bitcoin saw huge gains. The initial drop in crypto stock at the launch of spot Bitcoin ETFs was short-lived as Bitcoin quickly recouped and saw other cryptocurrencies cruise to glorious prices. By surpassing the $73,000 level in March, Bitcoin is up about 150% over the past year.

Top Regulated Brokers

Companies like MicroStrategy and Coinbase also saw huge jumps in their stock values. MicroStrategy is up 146% since January, while Coinbase has seen a 52% rise amidst legal battles with the US Securities and Exchange Commission (SEC).

With these numbers in mind, Mark Yusko, Morgan Creek Capital Management CEO and Chief Investment Officer, told CNBC’s “Fast Money,” that he thinks that investors should have at least 1% to 3% allocated to Bitcoin in their portfolios.

The fund manager noted that Bitcoin will only more than double this year to $150,000. And it will “go up 10x from here easily over the next decade.”

“Bitcoin is the king. It is the dominant token. It is a better form of gold,” he added.

Increased Accumulation

Bulls' grip on the market seems to be yielding more positive results. Recent data has suggested that many investors are buying more Bitcoin and altcoins in anticipation of a continued uptick.

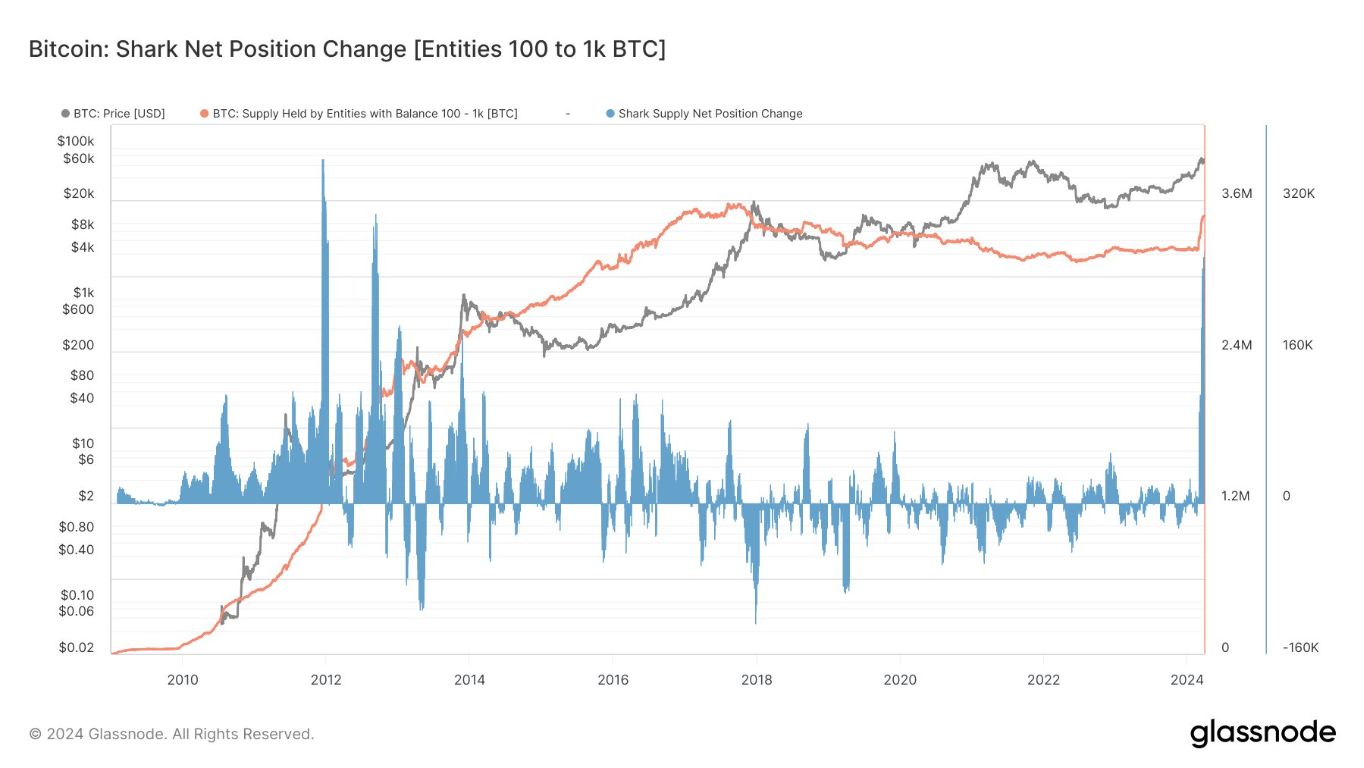

Bitcoin sharks (holders of between $7 million to $70 million worth of Bitcoin) have gradually increased their positions in the last 30 days. Data from research firm Glassnode shows that this category of investors has accumulated an estimated 268,441 BTC, resulting in an investment of $18.6 billion at the current price.

This is a strong indicator that high net-worth individuals or institutional investors anticipate that Bitcoin will see a higher price soon. It also points to a positive shift in the broader market sentiment, which may lay the groundwork for a continued bullish win.

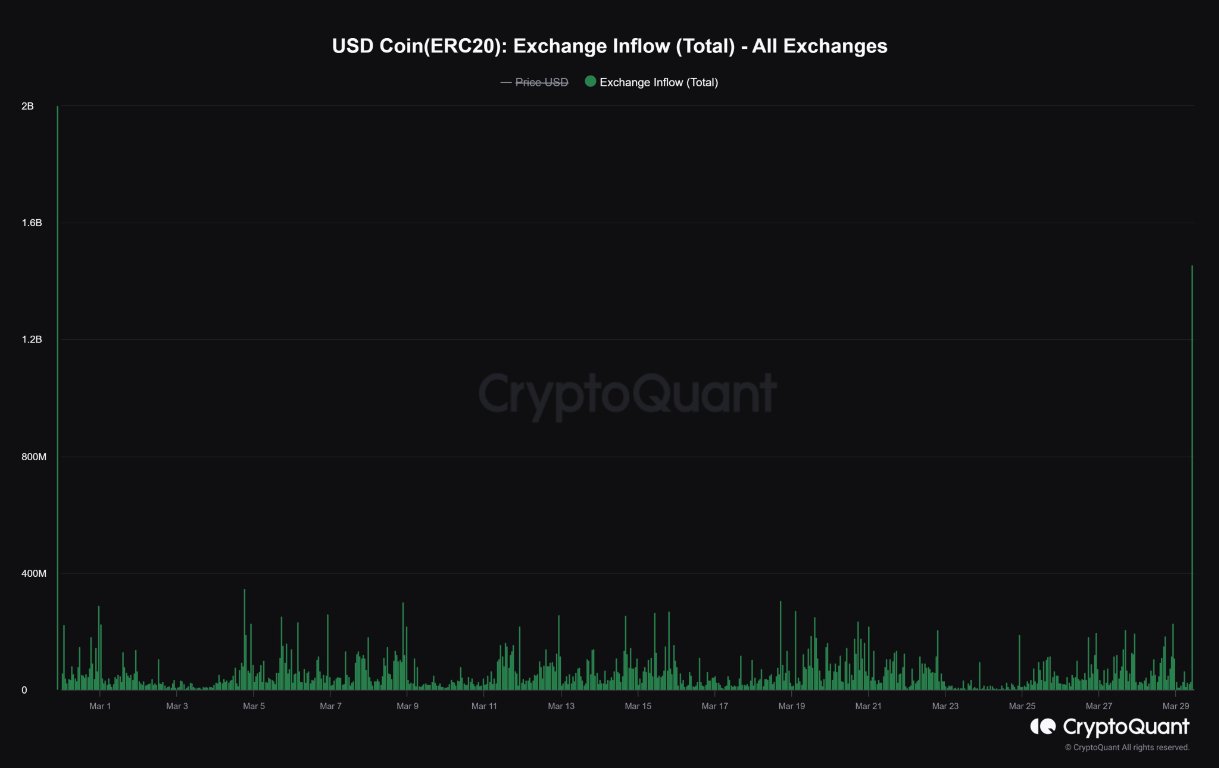

In addition, a CryptoQuant report shows that Coinbase recently saw an influx of USDC stablecoin amounting to $1.4 billion. Market analysts have noted that this increase in stablecoin deposits is a sign of robust buying interest. This will help facilitate entrance into the market as USDC will help provide liquidity.

ETFs didn't do badly in March. Net fund flow analysis shows that BlackRock (IBIT) had a significant influx of more than $7790 million, which points to strong investor interest. Fidelity (FBTC) comes second at $3220 million, and Ark/21 shares come third attracting $787.78 million.

While volatility among ETFs has continued to range between 68-69%, there's still a strong investor appetite for the investment vehicle.

Powell Shows Restraint For Rate Cuts

Though the uncertain climate might be driving investor appetite for risk assets like Bitcoin, Chairman of the US Federal Reserve Jerome Powell has shown renewed confidence in the current market.

But as the Purchasing Managers Index (PMI) has recovered after a protracted period of weakness, there's reason to believe there's investor confidence in the economy's overall health.

Speaking in an interview at the Macroeconomics and Monetary Policy Conference in San Francisco, California, Powell noted that the Fed was not actively pursuing interest rate cuts.

“Growth is strong right now, the labour market is strong right now and inflation has been coming down,” he said.

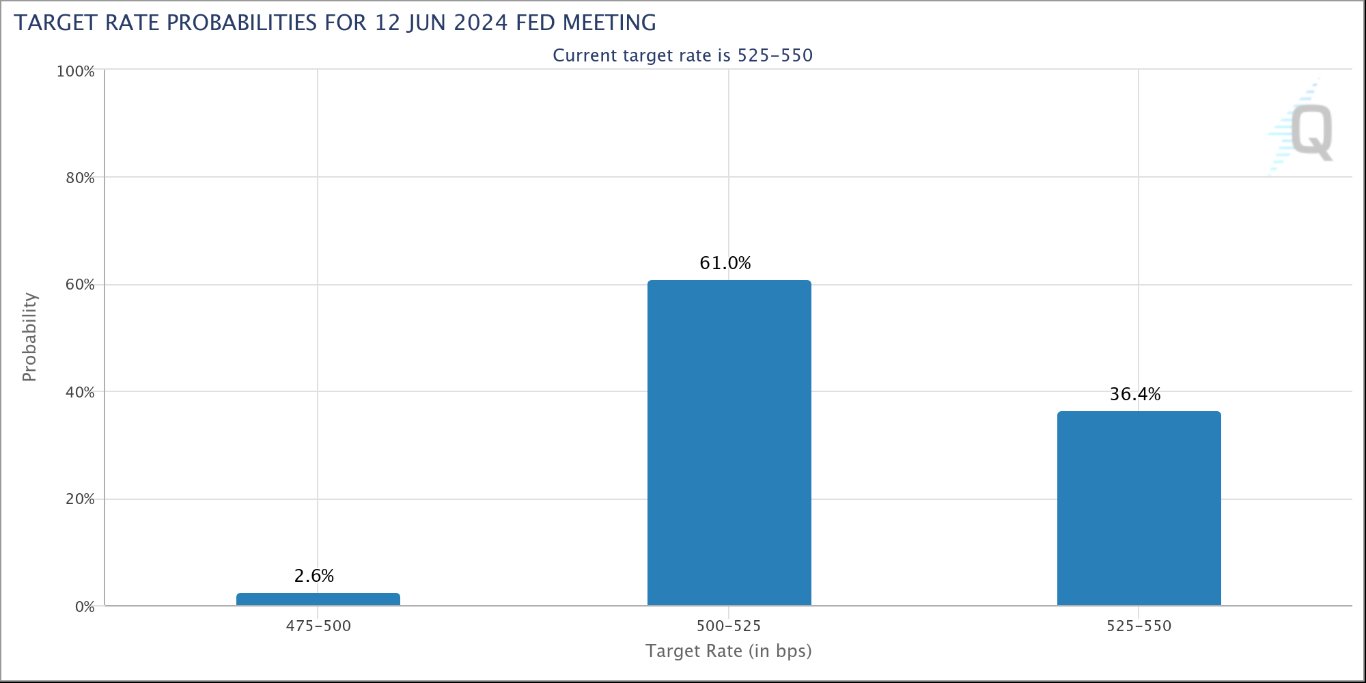

Data from CME Group's Fedwatch Tool suggests that June might be the first month for a rate cut. The odds stand at 61% for a 0.25% reduction at that month’s Federal Open Market Committee (FOMC) meeting.

Conclusion

Bitcoin’s seven months bullish streak cements the pioneer crypto's place beside the moon. There's no doubt that the market is now positive towards the year as investors continue to accumulate.

While there might be slips in the next few months, a significant fall close to that of the crypto winter is not envisaged.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.