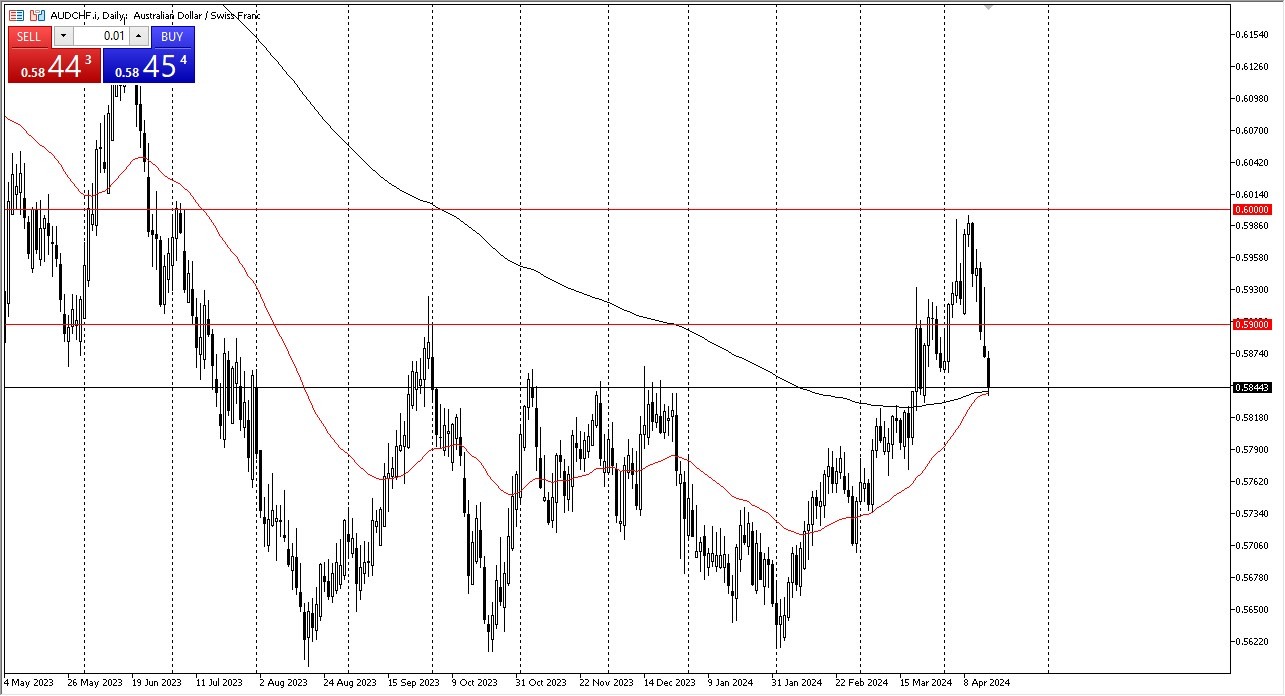

- The Australian dollar has fallen during the trading session on Tuesday to reach the 200 day EMA and the 50 day EMA indicators simultaneously against the Swiss franc.

- At this point, the 0.5850 level takes center focus as it was previous resistance and now, at least in theory, should be support.

Based on market memory, I suspect that a lot of people will be watching this as well. However, keep in mind that this is a smaller currency pair, so you also have to pay attention to how the AUD/USD currency pair, and the USD/CHF pairs are behaving to get an idea as to which one of these currencies will be stronger than the other.

Top Regulated Brokers

Several Levels Above

I think at this point in time, it's very important to look at this market and see if it can recapture the 0.59 level. If we were to do that, I think it's very likely that the Australian dollar reaches towards the 0.6 level again. Keep in mind that the Swiss National Bank has recently cut interest rates, the first major central bank to do so, and therefore, the Swiss franc is not necessarily a currency you want to own.

Having said that, the Swiss franc is considered to be a safety currency. So, if we get a major risk off type of situation, then this pair will continue to fall. However, if markets pick their feet back up in the risk attitude, then this is a pair that should move higher. I think this pullback is an area that will attract a certain amount of value hunting. So, I am watching it very closely, but I need to see a little bit of a bounce in order to start putting money to work. If we break down below the 0.58 level, then it's very possible that we could drop all the way back down to the 0.56 level. This pair is one of my favorites for measuring risk appetite and therefore I think it’s likely that we will continue to see it all over the place, but it can be a very rewarding pair if you get the directionality correct.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.