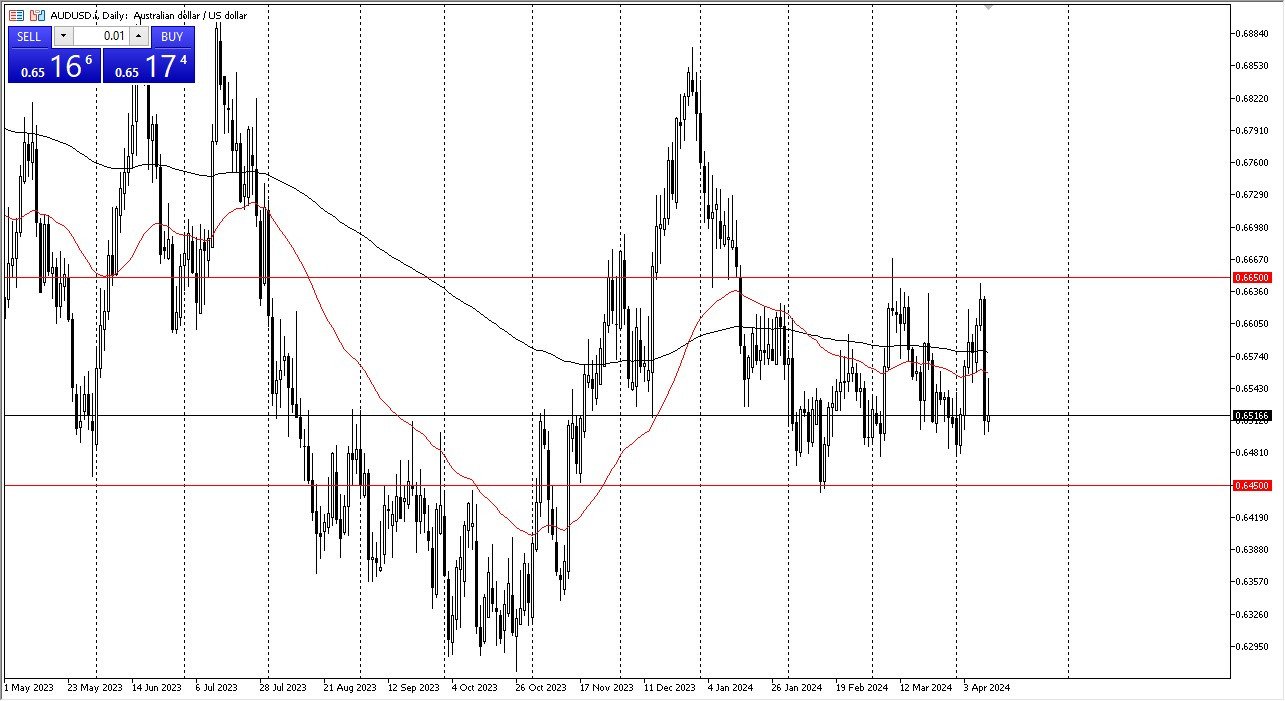

- The Australian dollar spiked higher during the trading session on Thursday, reaching toward the 50-Day EMA.

- However, we have given back those gains to form an inverted hammer and it does suggest that perhaps we are going to continue to see a bit of downward pressure.

- If we break down below the bottom of the wicked candlestick from the Wednesday session, that could really start to unravel the Aussie dollar.

However, it’s worth keeping in the back of your mind that we have a massive support level near the 0.6450 level, an area that was tested 2 months ago and caused a bit of a bounce. It’s not until we break down below there that I think the Australian dollar crumbles. On the other hand, if we turn around a break above the 50-Day EMA, then it’s likely that we could go looking to the 0.6650 level above, which has been a bit of a ceiling in this market.

Top Regulated Brokers

Range bound

I believe that the Australian dollar will remain somewhat range bound, but we don’t necessarily have anything to push the market higher at the moment. It probably becomes more or less a drift higher if we do stay in this range. That being said, if we were to break out of the overall consolidation, then it allows the Australian dollar to move 200 points, perhaps even further than that as this is a market that just simply has no real way to determine which direction it wants to go.

Keep in mind that the Australian dollar is highly sensitive to the global economy, commodities, and of course global trade. The US dollar course is considered to be a safety currency, and as long as the Federal Reserve is likely to continue to be somewhat tight, we will more likely than not stay in this range overall. That being said, keep an eye on the 2 major levels that I have mentioned, because we can break out of them, it could lead to a huge trade. For those of you who are more short-term minded, then you would be looking at this through the prism of trading back and forth.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.