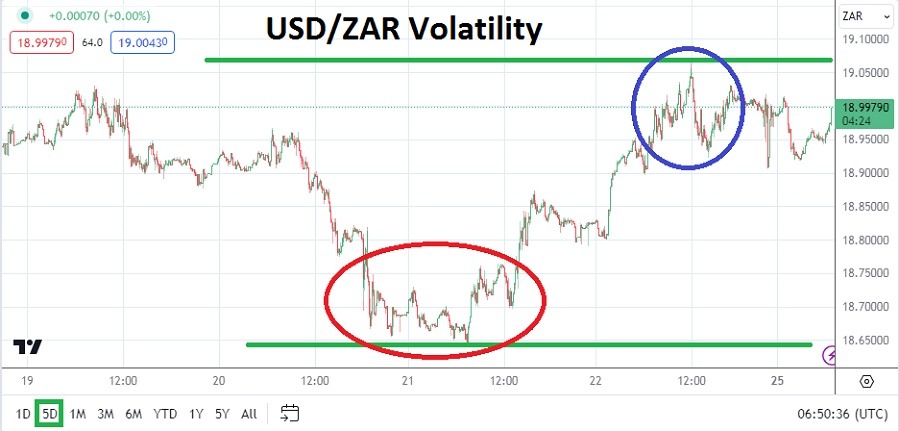

- The USD/ZAR as of this writing is near the 18.99025 mark as its trading seems to be glued to the 19.00000 region for speculative bets early on today.

- However the USD/ZAR has demonstrated a week’s worth of rather turbulent results which has been mirrored by the broad Forex market as behavioral sentiment tries to get a grasp on exactly what the U.S Federal Reserve will be doing over the mid-term.

Answers regarding U.S Fed outlook remain abundant, but perhaps too numerous for many financial institutions which find the rather whipsaw flourishes of strength from the USD across global Forex rather troublesome. Traders of the USD/ZAR clearly have the 19.00000 ratio as a key psychological level, but trading above and below this mark have been demonstrated for not only the last month, but since the second week of May in 2023.

Shifting Sentiment as U.S Data Causes Confusion and Mayhem

While it would be easy to blame the volatile trading of the USD/ZAR on the mismanagement of the South African government, U.S economic data and the Federal Reserve have provided no favors the past handful of months. In December the Fed stated rather confidently that the end of the hiking of interest rates had finished and interest rate cuts would start to develop.

The Fed made it sound like the Federal Funds Rate would start cutting potentially in the early spring of 2024. However U.S inflation data has remained stubborn and the Fed has backtracked and has begun to sound rather cautious again and now most financial institutions only expect two to three interest rate cuts the remainder of this year. Choppy results in the USD/ZAR have been the result.

Top Regulated Brokers

The Short and Near-Term could be Dangerous in the USD/ZAR

The Fed will be under pressure to cut interest rates because this is an election year in the U.S, but the reality is that unless jobs numbers start to come in worse that the Fed will become more uncomfortable. Trading in the USD/ZAR has mirrored this frustration, a low of nearly 18.63600 was seen on early Thursday, but then a strong reversal was demonstrated. Trading will be affected from the U.S by tomorrow’s CB Consumer Confidence numbers.

But more crucial data from the U.S GDP numbers on Thursday and the inflation numbers on Friday are coming. Traders in the USD/ZAR should use risk management wisely. There is a chance the data could be below estimates and spark selling of the USD/ZAR, but if the numbers are stronger than anticipated a sustained bullish move above 19.00000 could not be ruled out.

- Traders may believe in the short-term the USD/ZAR has been overbought, but sellers should not get overly ambitious with their targets today if they are aiming for nearby technical support levels.

- A sustained move above 19.0000 today and early tomorrow could also take place in the USD/ZAR, but traders looking for upside potential early this week should also be very conservative regarding higher momentum.

USD/ZAR Short Term Outlook:

Current Resistance: 19.00460

Current Support: 18.97400

High Target: 19.03010

Low Target: 18.93200

Ready to trade our daily Forex forecast? Here’s some of the best trading platforms in South Africa to check out.