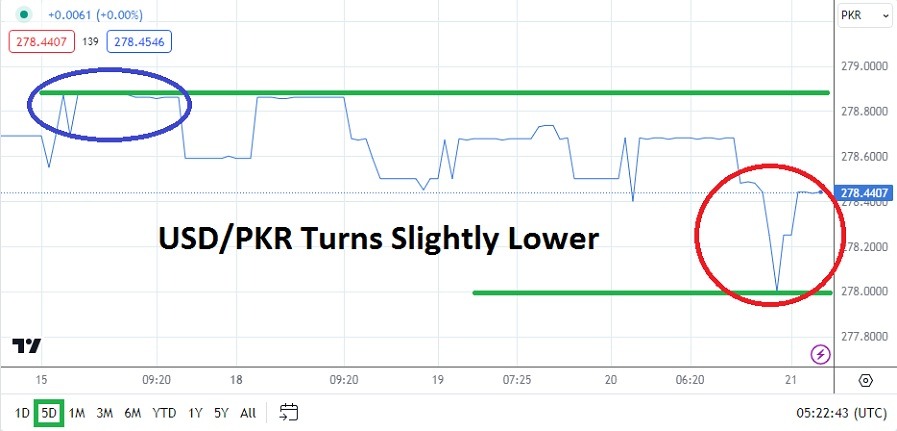

- After trading near a value of 278.4860 yesterday the USD/PKR moved to a depth of nearly 278.0000 briefly as the U.S Federal Reserve held its interest rate policy in place.

- The broad Forex market also saw many major currencies gain against the USD in trading late on Wednesday, this as Fed Chairman continued to speak about the desire of the U.S central bank to cut the Federal Funds Rate three more times during 2024.

While the USD/PKR certainly traded lower and then reversed slightly upwards and the current price of the currency pair is near the 278.4407 vicinity, traders need to understand the currency pair does not have a lot of transactional volume. Speculators pursuing the USD/PKR need to use entry price orders and make sure they are receiving ‘fills’ they expect. Transaction fees for trading the USD/PKR must also be considered.

The Tight Range of the Pakistan Rupee Remains a Fixture

The USD/PKR is not a ‘free’ moving currency pair, the value is essentially pegged and officially given its price by the very diligent State Bank of Pakistan. Trading the USD/PKR should be done with the knowledge that the value being seen on your broker’s platform is essentially a ‘notional’ value pronounced by the Pakistan government. The movement of the USD/PKR has produced a bearish trend however that speculators may find opportunistic.

The value of the USD/PKR hit lows yesterday which were last seen on the 23rd of October 2023. What may intrigue speculators who are looking at long-term charts of the USD/PKR is the realization that the value level which was last seen in October took place during the start of a bullish run higher which essentially began from the 277.7300 ratio a couple of days earlier.

Top Regulated Brokers

Risk Taking Tactics in the USD/PKR

Traders of the USD/PKR are undertaking wagers in a ‘specialty’ Forex pair. Meaning the currency pair should be pursued only by speculators with a lot of knowledge and those who understand the complications caused by transactional fees like overnight charges, large spreads between bids and asks, and the potential for sudden unexplained spikes and gaps.

- If a trader wants to pursue the USD/PKR they will need the patience for the currency pair to move towards their targeted take profit order, which may take a couple of days or longer.

- The ability to accept the costs of holding the currency pair while using leverage, or a large amount of cash to produce a profitable trade is also important for USD/PKR traders.

- The trend lower in the USD/PKR has been noteworthy, but betting on the momentum to continue is speculative.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.5120

Current Support: 278.3250

High Target: 278.6890

Low Target: 278.2120

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Pakistan to check out.