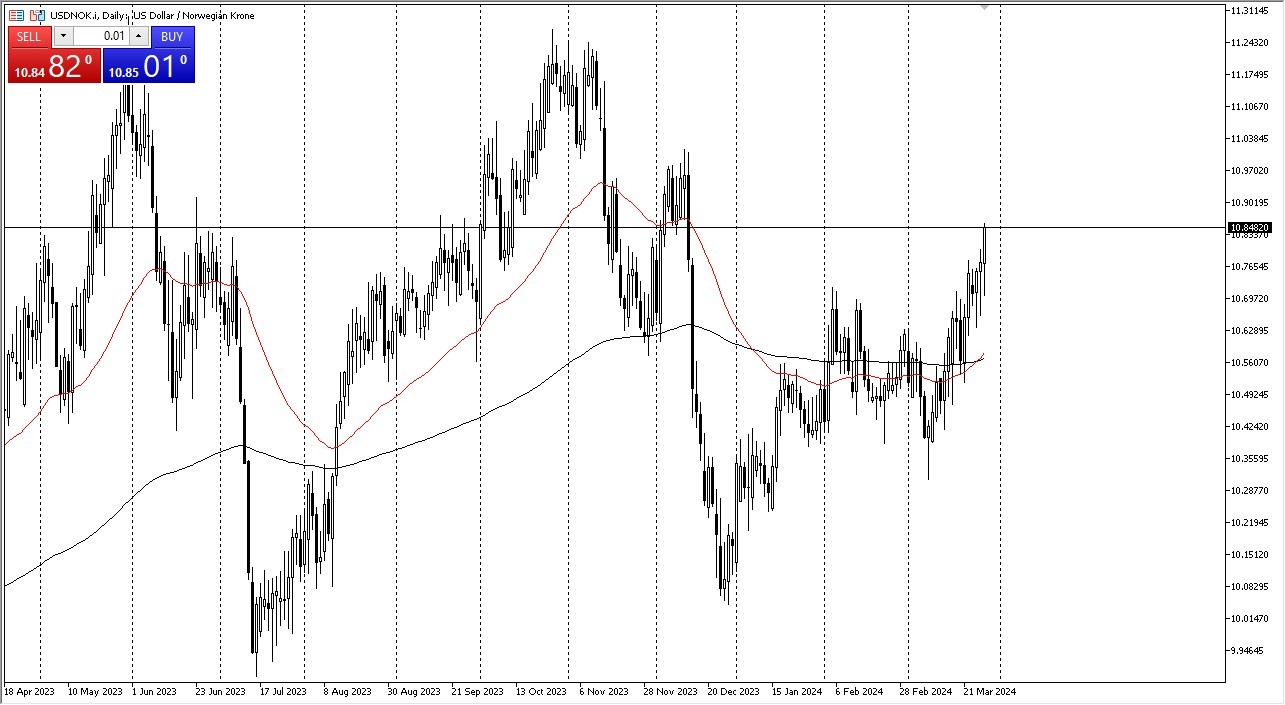

- The US dollar initially fell against the Norwegian krone early on Thursday, but then turned around to show signs of life again.

- Ultimately, looks like we are heading toward the 11 NOK level, an area that obviously has a certain amount of psychology attached to it and it is probably an area that I think a lot of resistance will appear.

- Furthermore, the past trading in that general vicinity has caused a bit of a short-term ceiling as well.

Crude oil

Crude oil markets have a major influence on the Norwegian krone as well, and although the crude oil markets have been strong, it looks like people are paying more attention to the fact that the Federal Reserve is likely to keep its monetary policy tight for longer than most other central banks. Furthermore, it’s probably worth noting that the Norges Bank raised interest rates in December to 4.5% and signaled that it would remain unchanged going forward. If that’s going to be the case, it’s a reason we may see the krone drop a bit in value. Furthermore, we now have to look at this through the prism of a potential rate cut later this year, as they are starting to hint.

Top Regulated Brokers

In general, I think this is a market that continues to be more or less “buy on the dip”, as there are a lot of US dollar bulls out there. Furthermore, if we have major problems around the world, it could put a little bit of pressure on some of the smaller currencies like the Norwegian krone. Beyond that, the European Union gets a lot of its oil from Norway, and it certainly looks as if it is heading into a recession as well.

Underneath, the 10.70 NOK level is a previous resistance barrier the people will be looking at for support, as there should be a significant amount of “market memory” in that general vicinity. If we can break above the 11 NOK level, then it’s likely that this pair could go looking to the 11.15 level in a relatively short timeframe.

Ready to trade our Forex daily forecast? We’ve shortlisted the top forex brokers in the industry for you.