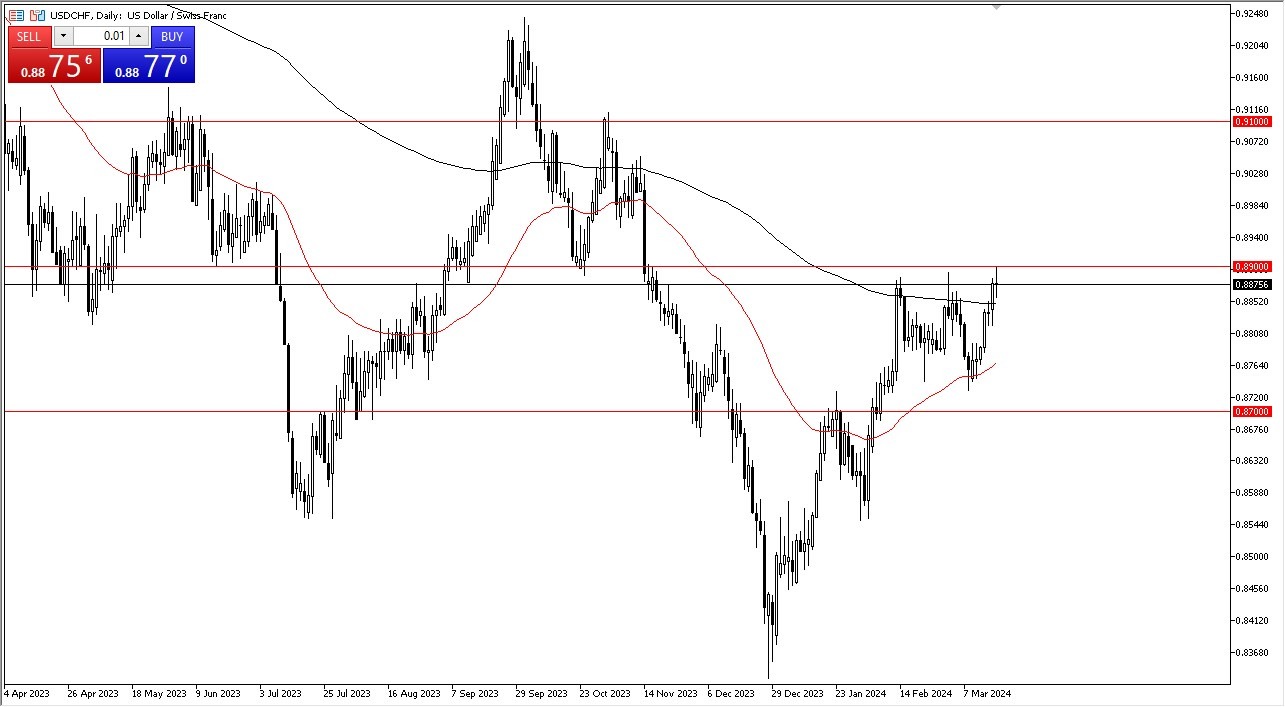

- The US dollar has been all over the place against the Swiss franc early on Tuesday as we touched the crucial 0.89 level and then pulled back.

- This makes a certain amount of sense because people are expecting the Swiss national bank to cut rates quicker than most other central banks around the world.

You also have to keep in mind that we have an interest rate decision from both of these central banks in the next couple of days. So in other words, I would anticipate a lot of volatility. But at this point, it certainly looks as if the USD/CHF has probably turned.

Top Regulated Brokers

Is the Franc About to Turn Around?

We had seen a lot of Swiss strength and I think that may be coming to an end. If we can get a move above the 0.89 level, then I would be much more bullish and start to get aggressive for a move to the 0.91 level. If we do pull back from here, I think the 200 day EMA followed very quickly by the 50 day EMA both could offer support levels that people will be watching. Underneath there, then you have the 0.87 level. All things being equal, I do like the idea of buying pullbacks in order to pick up a little bit of value here and there, so do keep that in mind.

In general, I think this is a situation where traders will continue to have a lot of longer term trader thinking driving the market higher while a lot of short term thinking making the volatility. The interest rate differential continues to favor the US dollar and probably will for most of the year. So, with that being said, I do favor the upside. I don't really have any interest in shorting at least not as things stand currently. I believe that with both of these central banks entering the picture over the next few days, this could be a mover, that unfortunately a lot of retail traders tend to forget about. It typically isn’t volatile, but when it does make a sudden shift – its typically drastic.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.