- The S&P 500 was slightly positive in the early hours on Thursday, as the PPI numbers have come and gone, albeit slightly hotter than anticipated.

- The market seems to be shrugging this off.

Top Regulated Brokers

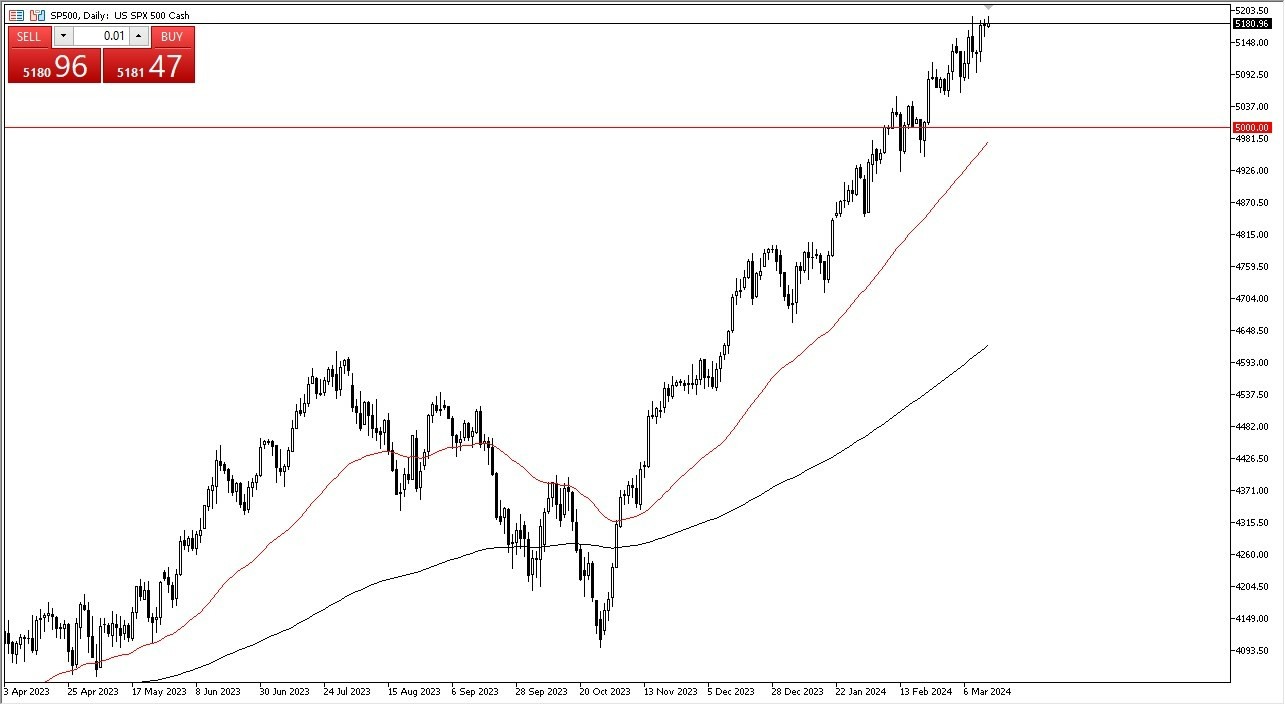

S&P 500 Continues to Look Very Strong

The S&P 500 has shown itself to be a little bit resilient during the trading session on Thursday as PPI numbers came out a little bit hotter than anticipated, but it was not a big deal. At this point in time, it looks like we see more of the buy on the dip type of trading that we have become so accustomed to and therefore I think you've got a situation where you have to look at this through the prism of whether or not it is offering value. If it is, meaning that it has dipped, then you should be a buyer. The 5,000 level underneath I think remains the big major floor in this market, but we'll have to wait and see whether or not that actually ends up being tested. Right now, I just don't see how it will happen anytime soon. Quite frankly, if you have been betting on the market pulling back significantly, you’ve been losing a lot of money.

Furthermore, the 50 day EMA is right around the 5,000 level and that of course will provide a little bit of a hard floor in the market, so keep that in mind. All things being equal, I think this is a situation where you have to look at this from the prism of buying every dip until the market changes its attitude. We've been at a 45 degree angle for quite some time and with that being the case.

I don't think there's any real shot at trying to short. The market probably goes looking to the 5200 level sooner rather than later, and ultimately, I think we do break above there. If and when we do, then it will just reset again and continue going higher. Worst case scenario, I suspect that the S&P 500 will just go sideways for a little bit, trying to work off some of the excess froth in the market. But right now, there's no real argument for that.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.