- Stock markets are essentially stuck in a feedback loop around the world, and the S&P 500 of course will be no different.

- The S&P 500 is the largest stock index in the world, and therefore it is worth paying close attention to what it’s doing.

- I do believe that we continue to see bullish behavior due to the fact that traders simply feed on momentum more than anything else.

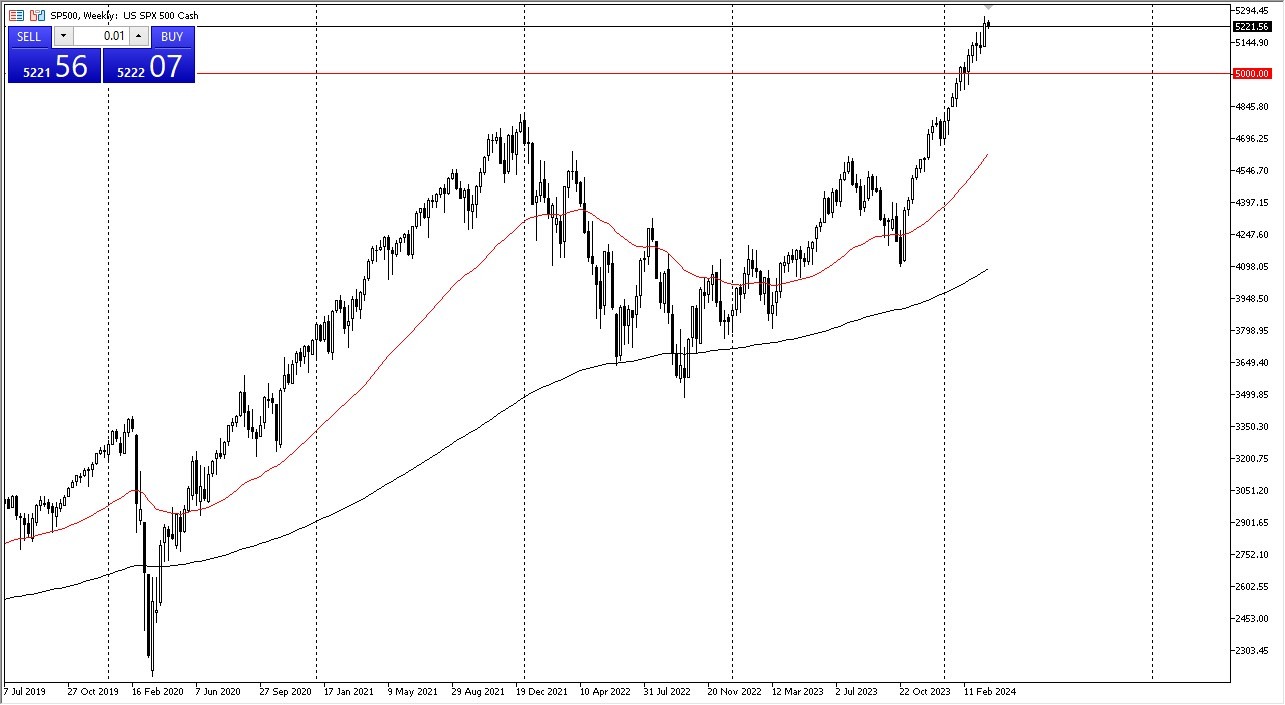

- During the course of March, we have most certainly seen quite a bit of buying again, but it’s probably worth noting that we are just simply going up in a very rigidly defined channel.

At this point in time, I do think that the market could probably use a little bit of a pullback, and for what it is where we have recently seen a lot of noisy choppy volatility. This does suggest that perhaps we might get a short-term pullback, but I think at this point in time it’s obvious that the short-term pullbacks continue to get bought into. After all, the S&P 500 is not an equal weighted index, and of course the traders on Wall Street are all gung ho for the idea that the Federal Reserve is going to cut rates this year. If they do, that obviously could help stock markets in general, so I think this is about a self-fulfilling prophecy.

Keep It Simple

There’s no reason to overthink the entirety of the market right now. The S&P 500 is not equal weighted, so as long as the handful of stocks that everybody loves continues to attract inflows from retirement funds, pension funds, investment banks, etc., then it makes quite a bit of sense that the S&P 500 will be forced to go higher. Yes, the move was absolutely ridiculous, and I do think that a pullback is desperately needed. However, it does not matter what I think, what matters is what will happen.

Top Regulated Brokers

At this point in time, I think it’s simply a matter of buying into the S&P 500 every time it pulls back significantly, because it does give you an opportunity to pick up a little bit of value. I see the 5100 level as a value level that I’d be very interested in, and of course I would be even more interested in the 5000 level. I have no interest in shorting this market and look at any significant selloff as a buying opportunity for longer-term investors.

Ready to trade our SP 500 monthly forecast? Here’s a list of some of the best stocks brokers for you to check out.