- The S&P 500 was a bit choppy early during the trading session on Tuesday as we continue to look to the upside.

- But I think at this point in time, we may be lacking a real reason to get moving.

- After all, the major announcement of the week is on Friday, so I think a little sideways action does make a certain amount of sense.

There is no real reason for ‘big money’ to jump into the markets and push things in one direction or another. We are in a “steady as she goes” type of market at the moment, and I don’t see that happening.

That doesn't necessarily mean that I would be selling short-term drops. Actually, I look at pullbacks at this point in time as a nice buying opportunity to take advantage of. After all, we're in an uptrend for a reason, not the least of which would be the fact that the Federal Reserve is in fact cutting rates later this year. They've admitted it. Momentum is the main driver of stocks anymore, and momentum is to the upside. That doesn't necessarily mean it has to be to the upside today.

Top Regulated Brokers

Keep an Eye on Longer-Term Trends and Behaviors

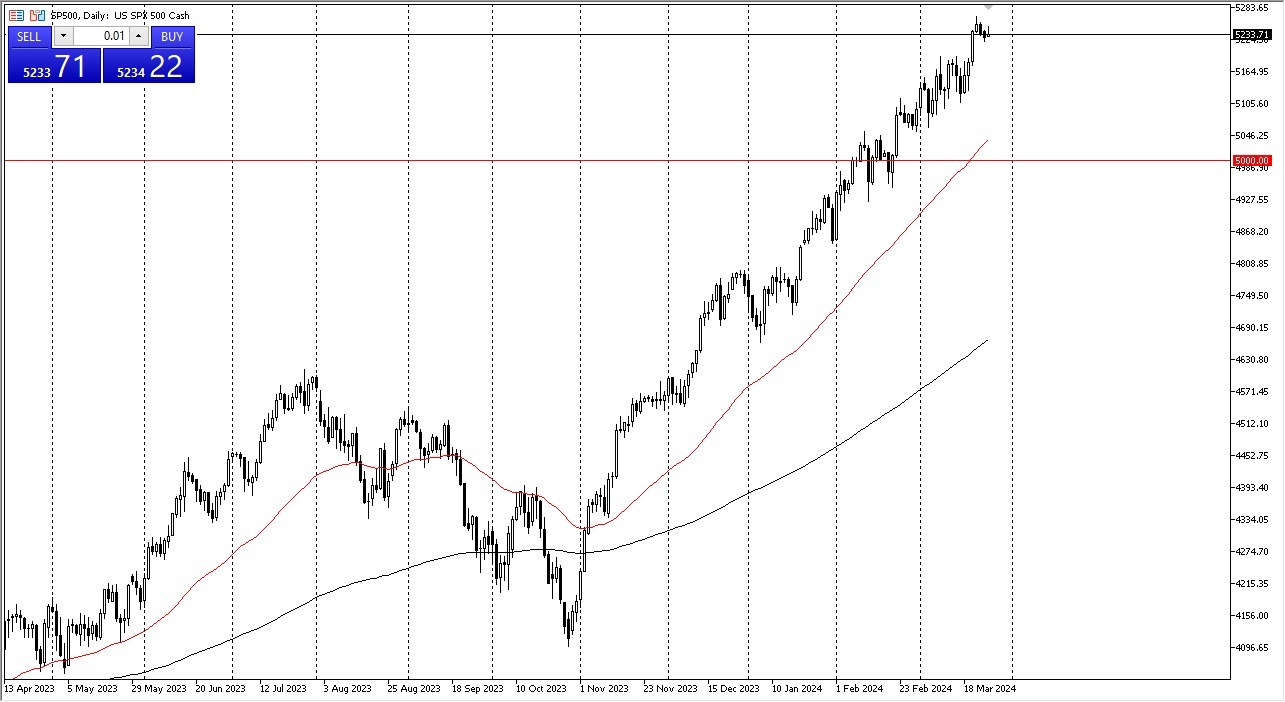

But in the longer term, if you continue to buy dips, you will do much better, at least until something fundamentally shifts. At this point, the 5,000 level for me is the bottom of the market, with the 50 day EMA sitting just above there. I'd be particularly interested in the S&P 500 closer to the 5,185 level, which was an area of previous resistance, and therefore I think a little bit of market memory comes into play at that region.

If we break the highs of last week, then we could very well go looking to the 5,300 level, which I think we hit sooner or later, regardless of which direction we go next. I'm just looking for value. I think that's the way you have to play this. You have to be patient, you have to scale in, and you have to buy it when it pulls back. What the economy is actually doing is totally irrelevant. We're in a nice uptrend.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.