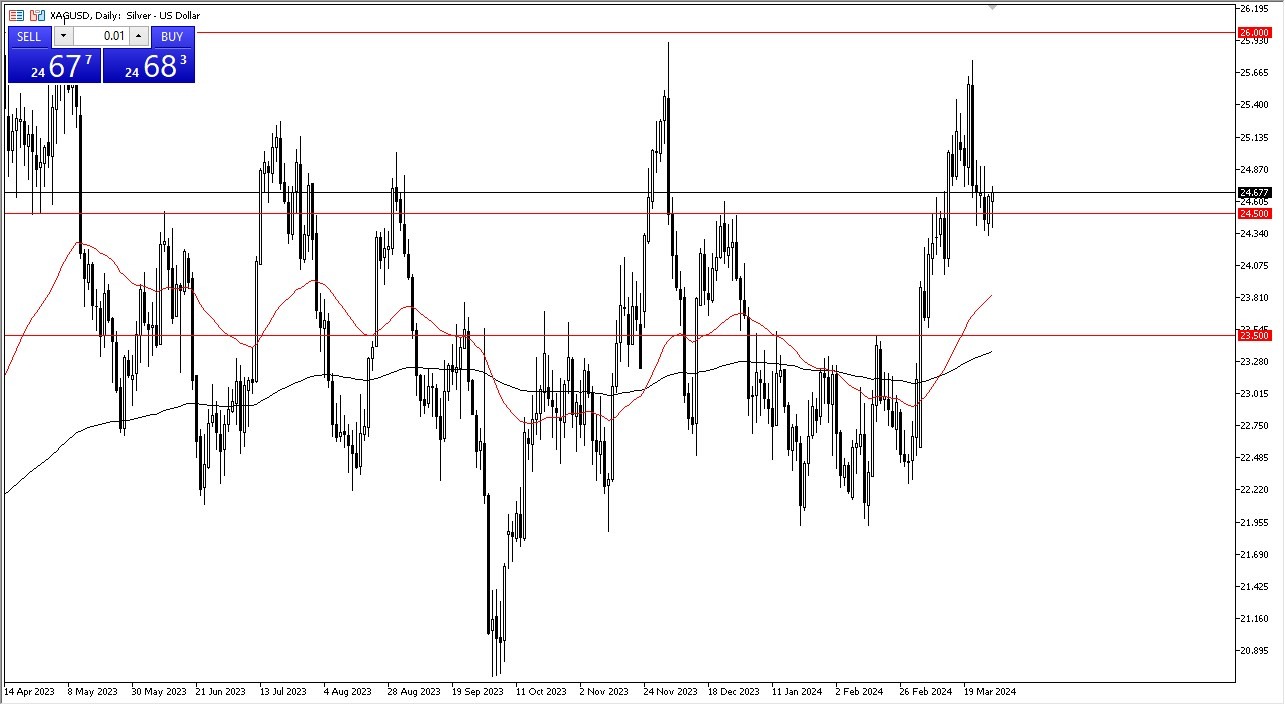

- Silver markets continue to find support right around the $24.50 level.

- It is worth noting that on Friday we'll have a shortened trading session, but there will still be business conducted.

- The $24.50 level is an area that previously had been major resistance, so it does make a certain amount of support since.

After all, market memory comes into play and therefore a bounce isn't necessarily that surprising. The question now is whether or not this is a bounce that we can build off of or if we're just simply going to consolidate.

Top Regulated Brokers

$26 Above Matters

The main reason I say that is that the $26 level above is a massive resistance barrier that traders have been very well accustomed to over the last couple of years and therefore whether or not we can break above there is a completely different question. Unlike gold, silver isn't necessarily always used for a precious metal. It's also an industrial one and therefore it does have a little bit different behavior. Beyond that there have been multiple fines against JP Morgan for manipulating the market. This is a known known and the paper market in silver offers more ounces than there actually are in the world. So therefore, you have to understand the game you're playing.

I think in the short term we could very well get a bit of a pop, but I also recognize that it would be very difficult to break above that $26 level. If we did, then there would be a massive, short covering rally. In the meantime, I also pay close attention to $24.25 because if we break down below there, the $23.50 level would be the next target as that was a previous resistance level and has shown supportive action in the past. Anything below there would be a bit of a death knell for the silver markets. The silver market is always a noisy and dangerous place to be, and therefore you have to be cautious about the position sizing, and when you jump in. A lower leveraged position makes sense at this point in time, and that’s how I will be playing it.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.