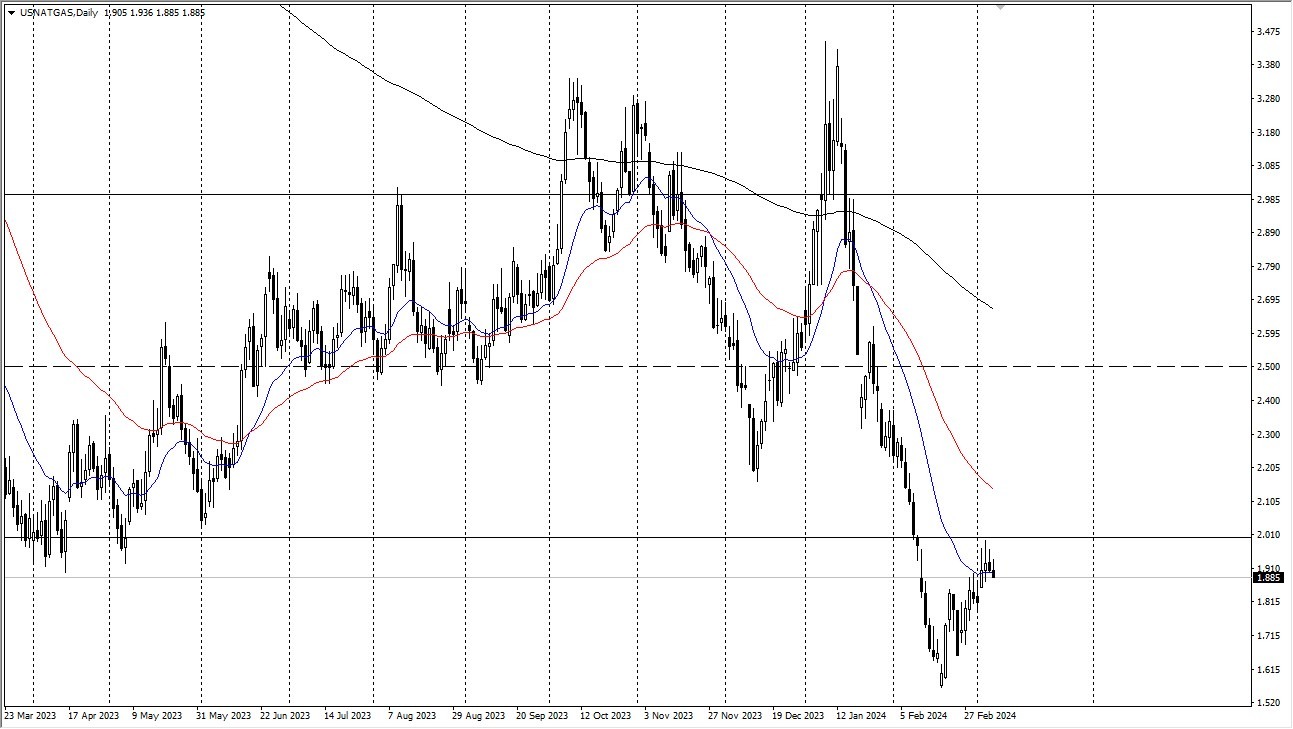

- The natural gas markets are still exhibiting a lot of erratic behavior right above and around the critical $2.00 level.

- As a result, I believe we may be in the position to benefit from a brief decline in price that would allow us to make longer-term "buy-and-hold" investments.

Looking at the natural gas market, it is evident that at this point in time, the market is a little hesitant. Naturally, there is a lot of psychology surrounding the $2 level on Thursday, given that it remains a significant resistance level. As a result, it's highly probable that we will continue to regard that area as crucial.

The market will continue to be noisy, but I think there is an opportunity

That being said, there will be a lot of noisy behavior in this market going forward. Naturally, we are currently attempting to determine whether or not we can continue rising. If we are able to breach the two-dollar mark, however, I believe there is a good chance that the natural gas market will stabilize for the time being.

We have a chance to move to $2.50 if it does. Having said that, you do need to be aware that, unless there is a scenario where there is a significant heat wave later in the year, which could also have an impact on the market, we may need to pay special attention to the fact that this is the wrong time of year and see a massive shot higher.

Top Forex Brokers

Having said that, I do believe that many longer-term traders will view this as a chance to acquire value. However, I believe you have to exercise extreme caution and acknowledge that you must use minimal leverage. In the long run, I believe that we will revert to more historical norms, but for some reason, we don't seem to be prepared to do so just yet. Because I am a very patient person, I will start taking ETF positions on dips when I see the $1.50 mark as a possible sign of a market weakness.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodity trading brokers to check out.