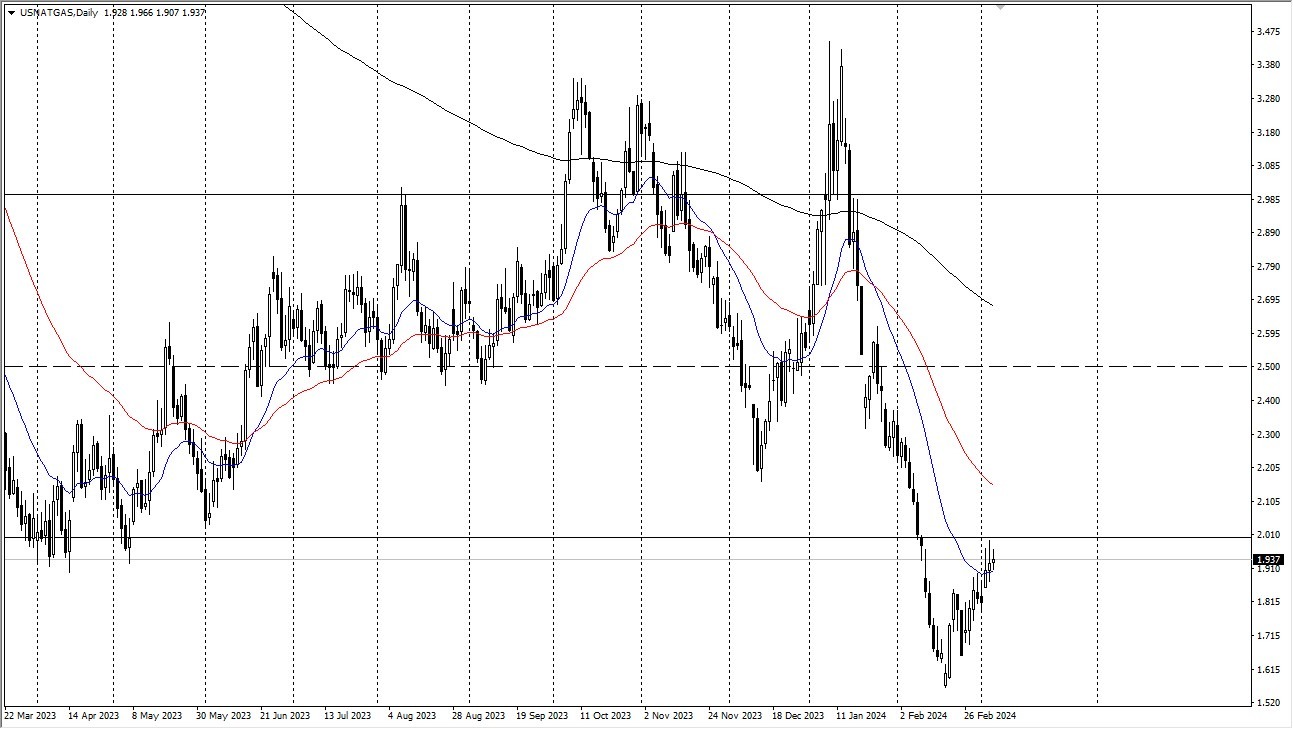

The natural gas markets are still teasing us with the possibility of breaking above the $2 mark, but I believe it is still too soon to assume that this will happen quickly. After all, this market has seen an incredible beatdown, and winter is officially almost over. Having said that, a longer-term trade could be about to happen.

Natural Gas

The $2 level above is a major psychological barrier and an area where we've seen a lot of prior support, so it appears that we are trying to break through it. The natural gas markets rallied slightly during the Wednesday trading session, which has been its pattern for several sessions as of late.

Therefore, I do believe that there is a very real chance that this market will keep an eye on market memory in that region and respond accordingly. After all, one would think that there would be a lot of options for positions in the area of $2. Naturally, this is a field that has proven crucial on numerous occasions in the past. A significant level of support is the 1.50 level underneath. Therefore, I believe that right now, we are attempting to identify some kind of basis upon which to resurrect. This setup has a long duration. You aren't scalping this, to be honest with yourself. When the demand will increase is unknown.

Top Regulated Brokers

The northern hemisphere could experience a winter storm between now and spring, or it could be something akin to a heat wave later in the year that raises the price of NAD gas. However, if you are a swing trader, brief declines ought to present chances for you to increase your position. I wouldn’t be aggressive though – take your time in this market.

However, I wouldn't be searching for significant moves immediately. At that point, the only way I would trade this would be in a scenario with extremely low leverage. For example, to avoid worrying about the day-to-day nuances of this market, you could use an ETF or a very small position in a CFD. To be honest, there is still a bit of an overabundance of natural gas available, so that will also be a problem.

Ready to trade FX Natural Gas? Here are the best commodity trading brokers to choose from.