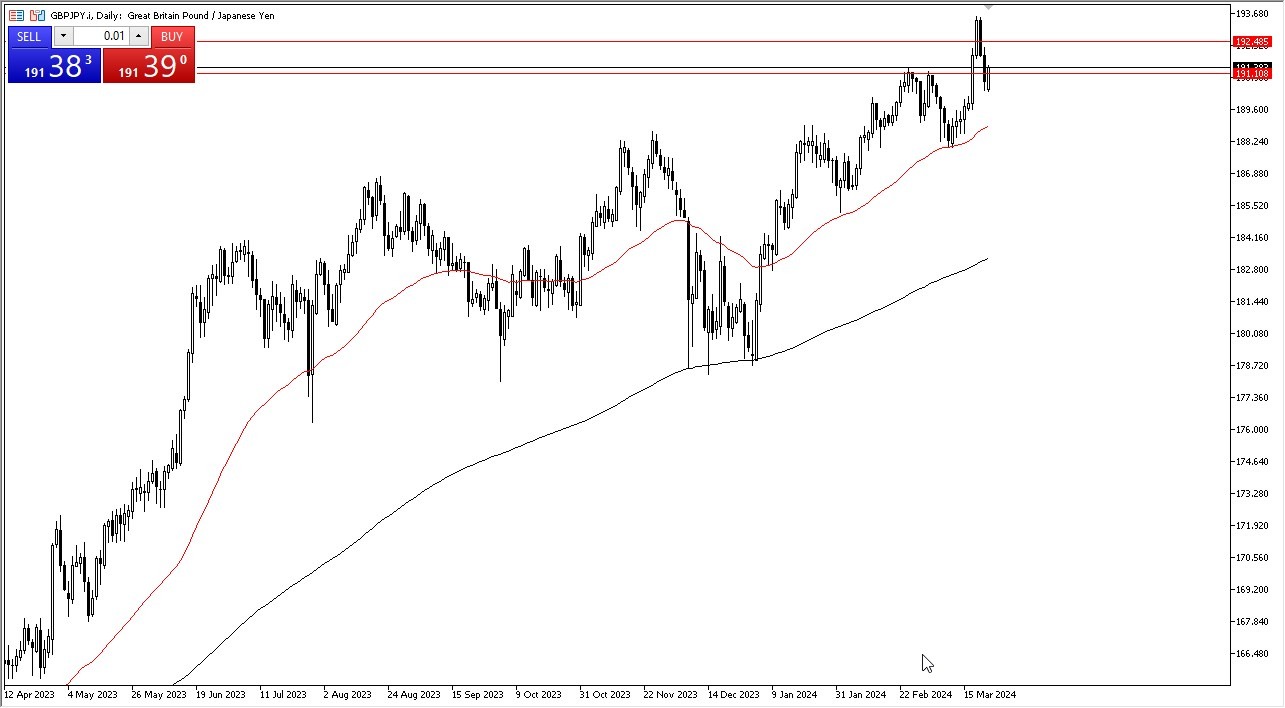

- The British pound has rallied significantly during the course of the session on Monday as it looks like the buyers have come back into the market to take advantage of the interest rate differential.

- I am bullish of this pair, and I think the fact that we are now taking out the ¥191 level is a good sign that we are going to go look into the ¥193.50 level.

- In general, this is a market that every time we pull back, people are willing to jump in and take advantage of this massive move.

Technical Analysis

The 50-Day EMA has acted essentially as a trendline recently, and therefore think we’ve got a situation where traders continue to pay close attention to it, and therefore every time we get close to that moving average, I think traders will continue to jump in and take advantage of any “cheap British pounds” that they can. If we were to break down below the 50-Day EMA, then I think you get a situation where traders will be very cautious and look to some type of pullback as an opportunity to get involved.

Top Regulated Brokers

On the other side of the equation, we break above the ¥193.50 level, then the market is looking to the ¥195 level. This is a market that given enough time will clearly be very noisy and bullish, but I also recognize that you have to look at this through the prism of getting paid at the end of every day due to the interest rate swap. I have no interest in shorting, and if anything I would just be on the sidelines because selling this pair means that you are going to be paying swap at the end of each session, something that institutional traders tend to shy away from.

Buy-and-hold has essentially been my mantra, adding to my position every time we pull back. That has served me quite well, and I am more than willing to continue taking advantage of short-term pullbacks in order to build up a much bigger position over the longer term. For what it is worth, I think the Japanese yen is essentially stuck in a deadly feedback loop.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.