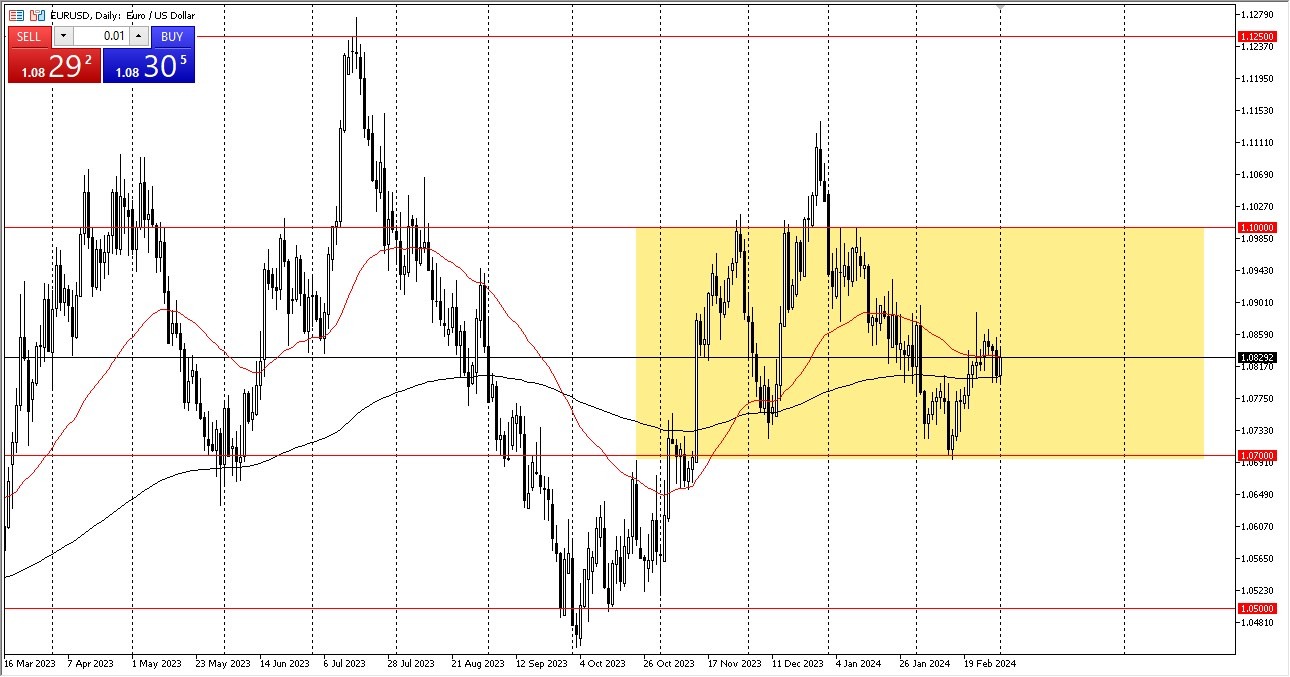

- We continue to observe a lot of noisy behavior as euro traders move this market back and forth.

- Still, I believe that we are witnessing the beginning of a sideways market, perhaps even for the bulk of the year, and this would be somewhat usual for this pair as it is often “tight.”

When comparing the Euro against the US dollar, it is clear that overall, the Euro is still treading water because there has been a lot of sideways movement. In the end, I believe that the 50 day EMA and the 200 day EMA indicators are the first technical indicators that are influencing this market. It wouldn't be a great surprise if we just bounce about those two indications because they usually produce some noise. Whatever the case, more than anything else, this market appears to be going very sideways.

Top Regulated Brokers

Technical Levels

Keeping in mind that the 200-day EMA is positioned approximately at the 1.08 level—a large, round number that carries some psychological significance—is definitely worth mentioning. However, given that both central banks are expected to ease monetary policy later this year, I also acknowledge that they have a role to play in the current situation. Owning one currency over the other won't really offer any benefits if that turns out to be the case.

It's also important to keep geopolitics in mind. While the Euro isn't always a risky currency, people tend to turn to the US dollar—or perhaps I should say the US Treasury market, which accepts US dollars—when there is a lot of risky behavior. There isn't much to do in the Euro because we are essentially in the middle of a broader consolidation area, but I do utilize this market to get a sense of what's going on with the dollar elsewhere. In general, you want to purchase the dollar relative to other currencies if the euro is depreciating versus the dollar. As a result, the pair is now more of a signal than anything else. However, the range between 1.07 at the bottom and 1.10 at the top is wider. You might have a tradeable event if we were to approach either of those two levels, but until then – there probably isn’t much to do at this point.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.