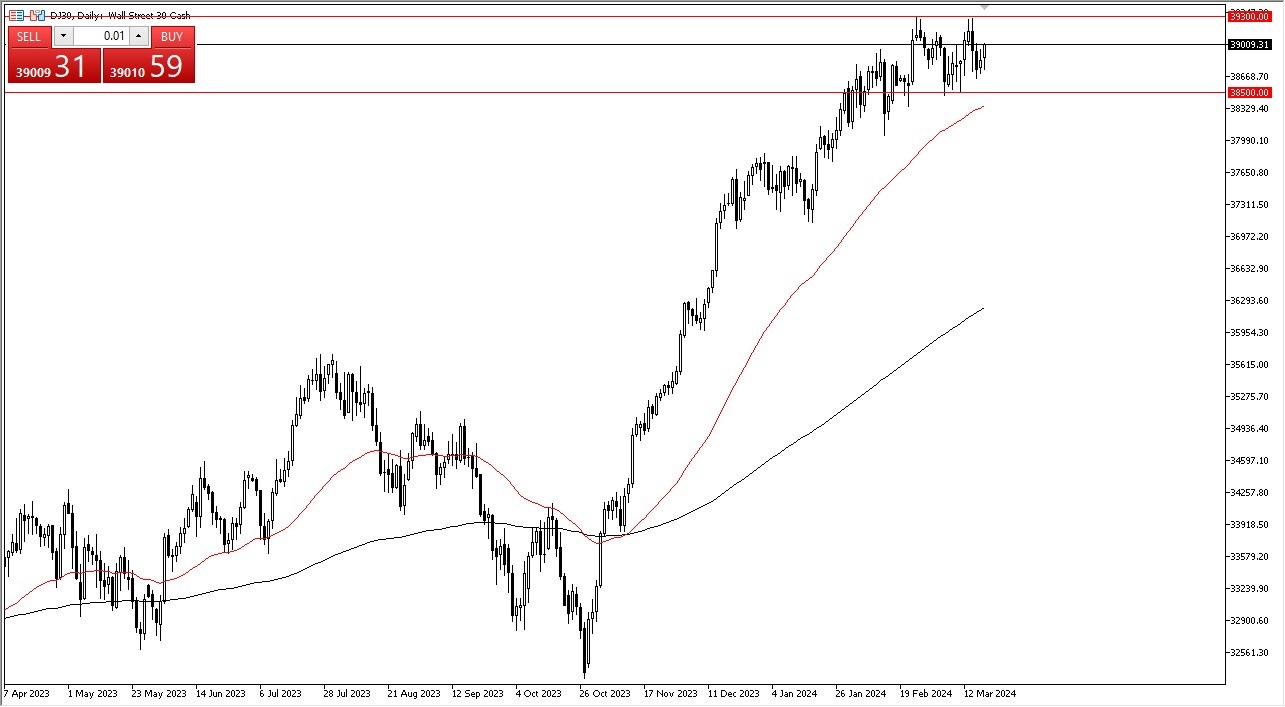

- The Dow Jones 30 initially fell during the trading session on Tuesday, only to show signs of strength.

- All things being equal, this is a market that still finds plenty of buyers underneath, as they look for some type of value.

- What’s interesting is that it seems like we have been following the same pattern for a while, meaning that we have seen Europeans show weak hands, but Americans picking the index back up later in the day.

Range bound waiting for the Fed

We are currently range bound and waiting for the Federal Reserve, so therefore it makes a certain amount of sense that we stay between the 2 massive areas of 39,300 on the top, and the 38,500 level on the bottom. I am bullish of the market overall, but I do recognize that we could see a major amount of noise over the next couple of days. After all, the Federal Reserve is going to have an interest rate decision on Wednesday, and that always has a major influence on what happens on Wall Street.

Top Regulated Brokers

What I do like about the 30,500 level as support is the fact that the 50-Day EMA is in that general vicinity, and therefore I think a lot of technical traders will be paying attention to it as well. Looking at this chart, I think this remains a “buy on the dip” market, but you need to be cautious as we see so much in the way of volatility just waiting to happen here. Ultimately, I like the idea of taking advantage of “cheap contracts”, but you also have to be cognizant of the fact that the volatility could get out of hand over the next 24 hours.

If the Federal Reserve does in fact sound more dovish than anticipated, we could blow right through the 39,300 level, opening up the possibility of a huge move. In that environment, we have the possibility of “FOMO trading” entering the fray, and that could send traders aggressively in the market. I think at this point in time you have to be bullish, but you also have to be cautious.

Ready to trade our Dow Jones trading signals? Here are the best CFD brokers to choose from.