Fundamental Analysis & Market Sentiment

I wrote on 11th February that the best trade opportunities for the week were likely to be:

- Long of the NASDAQ 100 Index. This gave a loss of 1.31%.

- Long of the S&P 500 Index. This gave a loss of 0.51%.

- Long of Bitcoin following a daily close above $50,000. This gave a loss of 0.01%.

- Long of Cocoa Futures following a close above 5800. This did not set up.

The overall result was a loss of 1.83%, resulting in a loss of 0.46% per asset.

Last week saw even lower directional volatility in the Forex market, with no significant currency pairs or crosses fluctuating by more than 1%. There was important action in US stock markets. Last week again saw new all-time high prices reached by the benchmark S&P 500 Index, the Nasdaq 100 Index, and the Dow Jones 30 Index. However, this happened early in the week before a later selloff happened, which tech stocks in particular ended the week notably lower.

This rise in stock markets occurred despite the CME’s FedWatch tool showing strongly lowering expectations of a March rate cut by the Federal Reserve. Markets now see only a 10% chance of a rate cut in March, down from 36% one week ago. However, 38.4% expect some kind of a rate cut at the subsequent meeting in May.

Last week's agenda was relatively heavy, dominated by US CPI, PPI, Retail Sales, and Preliminary UoM Consumer Sentiment data.

The CPI (inflation) data was most important, showing that inflation is not falling as fast as expected, pushing up treasury yields and depressing expectations of rate cuts. This boosted the US Dollar and sent US stocks lower.

The PPI data was also notably stronger, suggesting inflation still has legs, coming in at a monthly increase of 0.3% when only 0.1% was expected.

Preliminary UoM Consumer Sentiment came in roughly as expected.

The UK was also in focus last week, as UK GDP data showed that the UK has entered a technical recession by showing economic contraction over the past two consecutive quarters. UK inflation ticked slightly lower, with the annualized rate now at 4.0%, while 4.1% was expected.

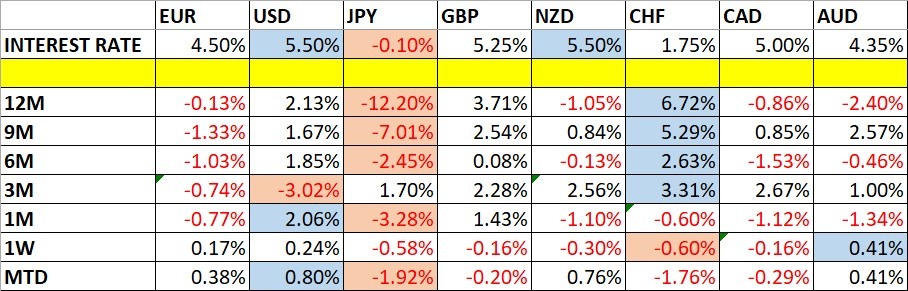

A strong Australian Dollar dominated the Forex market, while the Swiss Franc was the weakest major currency. The US Dollar is showing weak short-term bullish momentum and has established a new long-term bullish trend by the indicator I like to use, but it still looks fragile.

There were several other important economic data releases last week:

- US Unemployment Claims –as expected.

- US Empire State Manufacturing Index – slightly better than expected.

- UK Retail Sales – much better than expected, showing a 3.4% monthly increase when only 1.5% was expected.

- New Zealand Inflation Expectations – fell from 2.76% last month to 2.50%.

- UK Claimant Count Change (Unemployment Claims) -

- Australian Unemployment Rate – ticked up from 3.9% to 4.1% when only 4.0% was expected.

Top Regulated Brokers

The Week Ahead: 19th – 23rd February

The most important item over the coming week is the release of the US FOMC Meeting Minutes. Next week has a relatively light data schedule.

Other major economic data releases this week will be, in likely order of importance:

- RBA Monetary Policy Meeting Minutes

- Canadian CPI (inflation)

- Australian Wage Price Index

- US Unemployment Claims

- Flash Manufacturing & Services PMI

Monday will be a public holiday in the USA and Canada. Friday will be a public holiday in Japan.

Monthly Forecast February 2024

I made no monthly forecast for February, as there was no obvious long-term trend in the US Dollar that could be relied upon at the start of the month.

Weekly Forecast 18th February 2024

Last week, I made no weekly forecast, as there were no strong counter-trend price movements in any currency crosses, which is the basis of my weekly trading strategy.

I again give no forecast this week.

Directional volatility in the Forex market fell even further last week, with none of the most important currency pairs fluctuating by more than 1%. Volatility is likely to increase over the coming week, as such a low level of volatility is unusual for more than a few weeks.

Last week saw relative strength in the Australian Dollar and relative weakness in the Swiss Franc.

You can trade these forecasts in a real or demo Forex brokerage account.

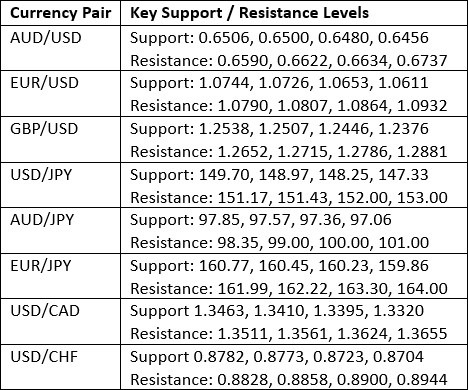

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

The US Dollar Index printed a candlestick that closed above its open last week, but it is an outside bar and a bearish pin bar. However, the weekly close was (barely) up on the price of 3 months ago and 6 months ago, presenting a new bullish long-term trend.

Despite this new bullish trend in the greenback, the direction still looks uncertain due to the price action, which does not suggest bullish momentum. However, there is a valid long-term trend here, and I believe in following this trend.

NASDAQ 100 Index

The NASDAQ 100 Index fell last week after initially reaching a new record high price at the start of the week. Its closing price was right on the low of the week, which is a bearish sign. However, there is no doubt that US stocks have a bull market and a valid long-term bullish trend. It may be wise to buy the dip, assuming this is just a normal bearish retracement.

Although we expect no rate cuts and a strong dollar until the summer, the long-term bullish momentum in stocks should be addressed.

Look for a long trade following a bounce at the nearest support level or a daily close above 17962.

S&P 500 Index

The S&P 500 Index closed a little lower last week after making a new record high on Monday. However, the price made up most of its losses earlier in the week. The S&P 500 slightly outperforms the NASDAQ 100, suggesting a relative weakness in technology stocks.

I still see the S&P 500 Index as a buy, as this bearish retracement is nothing to get excited about, but I would prefer to see a daily close at a new high before entering any new long trade.

Another reason the long-term outlook is bullish is that its first break to a fresh all-time high, as happened just a few weeks ago, has historically generated an advance of a median of 13% over the following year. Traders and investors should seriously consider going long here.

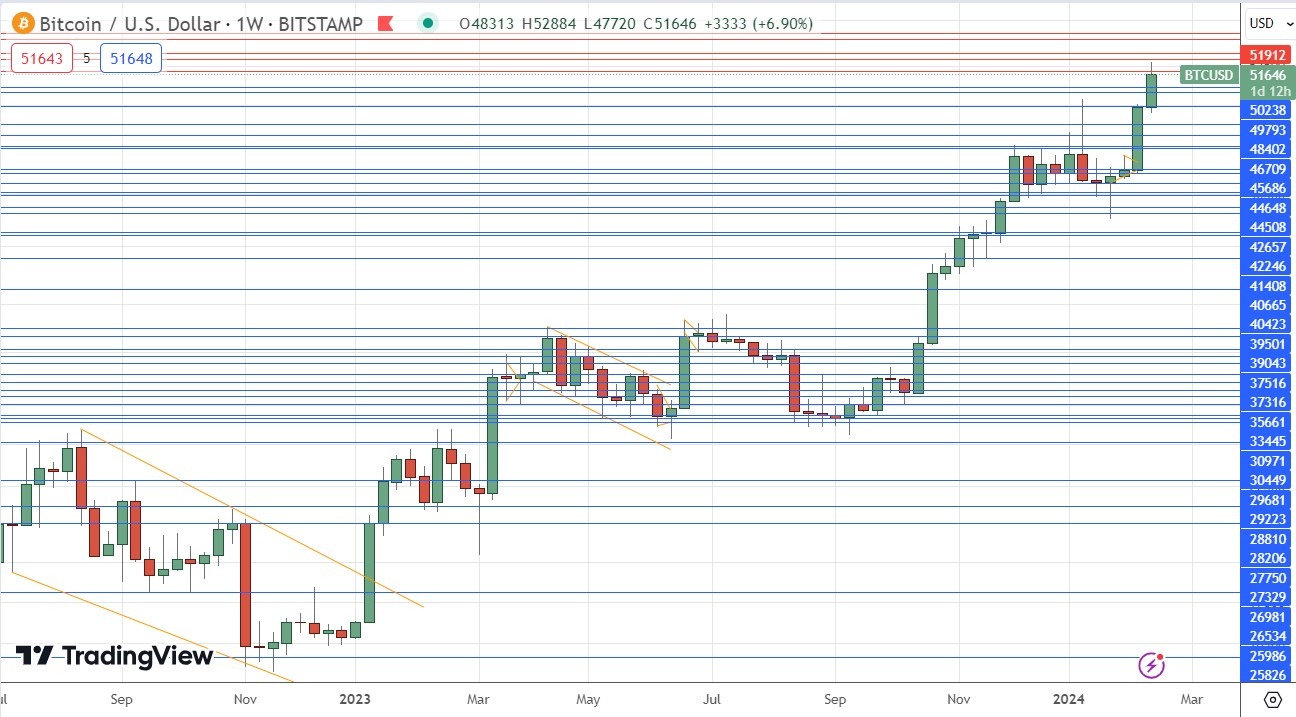

Bitcoin

Bitcoin made a firm bullish breakout two weeks ago, and an additional rise over the past week followed this. The price is now well above the important round at $50k. The price had made new 20-month highs. However, a note of caution can be found in the meaningful upper wick of last week's candlestick.

I see Bitcoin as a buy, given legs by the recent approval of Bitcoin ETFs, which attracts more retail investment, as it is now trading in bullish blue sky.

Bitcoin has shown before that it can make gains, which puts it on par with commodities so that trend traders will be interested here on the long side.

However, despite the weekly candlestick looking bullish, a zoom into the daily chart shows the price action over the past few days, suggesting a bearish topping out. Therefore, I would wait until we get a daily close above the high closing price of $52,161 before taking a new long trade here.

GBP/USD

I had expected the level at $1.2538 might act as support in the GBP/USD currency pair last week, as this price has acted previously as both support and resistance. Note how these “role reversal” levels can work well. The H1 price chart below shows how the price rejected the resistance level during last Wednesday’s London session with an inside bar, marked by the up arrow in the price chart below, signalling the timing of this bullish rejection. This can be a great time of the day to trade a major Forex currency pair like this one. This trade was profitable, giving a maximum reward-to-risk ratio of more than 3 to 1 based on the entry candlestick.

USD/JPY

I had expected the level of ¥148.97 might act as support in the USD/JPY currency pair. The H1 price chart below shows how this level was rejected right at the start of last Monday’s New York session, marked by the up arrow in the price chart below, signalling the timing of this bullish rejection. The beginning of the New York session can be a great time to trade major currency pairs such as this one, which is also part of the overlap of the London/New York session.

This trade was nicely profitable, giving a maximum reward-to-risk ratio of more than 5 to 1 based on the size of the entry candlestick structure.

Note that the Yen is showing some relative weakness, so this currency pair and others may be good vehicles to take advantage of. The Bank of Japan wants to move away from the well-established ultra-loose monetary policy but will find it hard to do so this year, leading to a weaker Yen.

Cocoa Futures

Cocoa futures have been in a strong bullish trend for over a year, but last week, the price fell quite strongly after reaching a new multi-year high price. The price chart below applies linear regression analysis to the past 74 weeks and shows graphically what a great opportunity this has been on the long side over the long term.

There are two things especially worth noticing here:

- Despite the downward move last week, The price is quite far above the linear regression channel.

- Volatility is extremely high, and Cocoa is getting much media attention.

These factors suggest an even stronger dip may be coming now, making it dangerous to enter a long trade unthinkingly here.

Trading commodities long on breakouts to new 6-month highs has been a profitable strategy over recent years, so I see this as a buy. However, it is worth waiting for a daily close above the recent high to be sure the extremely high volatility is not a sign of this trend ending, as it often can be.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index following a daily close above 17962.

- Long of the S&P 500 Index following a daily close above 5030.

- Long of Bitcoin following a daily close above $52,161.

- Long of Cocoa Futures following a daily close above 5800.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.