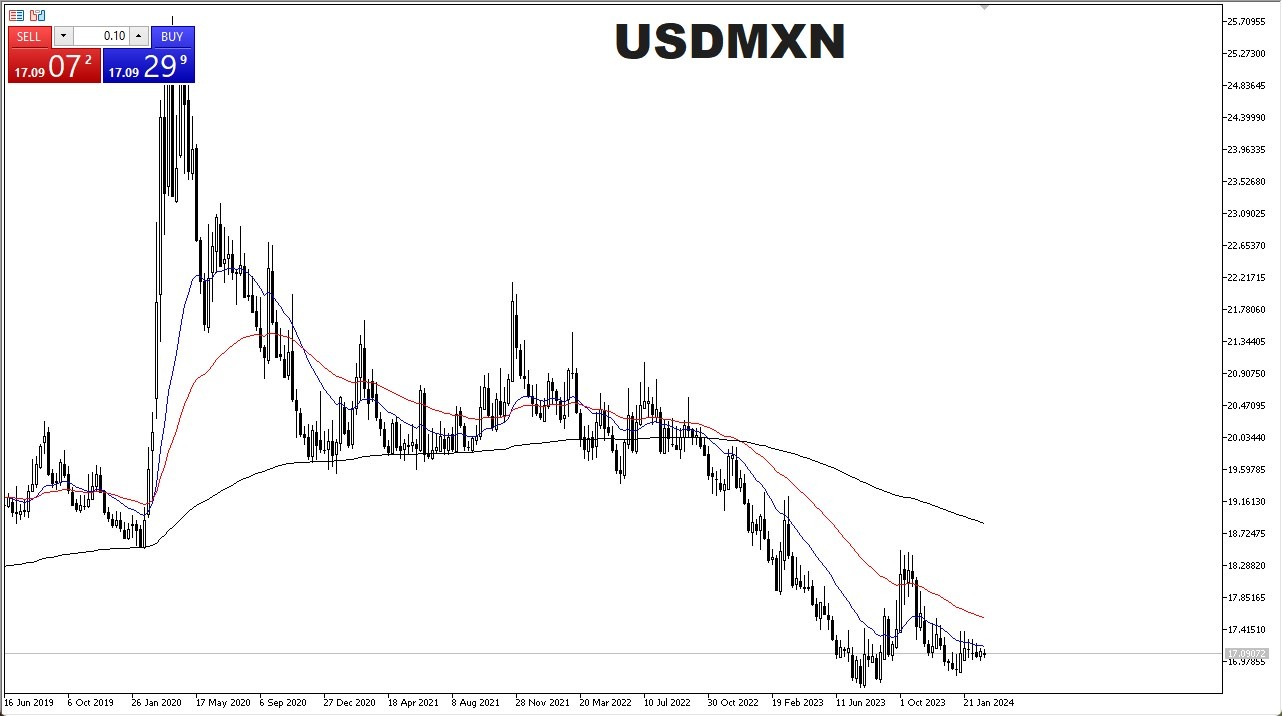

- The US dollar has gone sideways against the Mexican peso during the bulk of the month of February, and therefore I think we need to pay close attention to this pair because it could be trying to give us a little bit of a “heads up” as to what it does next.

- When you look at the longer-term chart, the area just below is a major support area, and I think that comes into the picture as to whether or not we bounce or not.

Just underneath, we have the 16.80 MXN level, an area that has been very important, and therefore I think we will continue to test that and probe that for signs of support. That being said, we are also in the potential beginning phase of forming a massive “double bottom” on the weekly chart, which would be interesting considering that the Federal Reserve is expected to cut interest rates this year. If that’s the case, the idea is that most traders would prefer to own the Mexican peso, because the Bank of Mexico offer such a high interest rate payment. However, if we bounce from here in the Federal Reserve continues to look like they are going to cut, this could be a sign of something ominous.

While a lot of you may not necessarily trade this pair from a longer-term perspective, it is worth watching because it gives you an idea as to how the US economy may be performing. Paradoxically, the worse the US economy performs, the better the US dollar will do here due to the fact that a lot of people will be throwing money into safety assets such as US Treasuries instead of emerging market currencies like the Mexican peso.

Top Regulated Brokers

The outlook

I’m not going to lie here, this is going to be a difficult pair to trade for the month of March, mainly because it is a thinly traded pair, and of course is traded during specific times of the day more than others as it has a lot to do with cross-border payments. Simply put, I will often use this pair as a gauge on what to do with not only the US dollar, but sometimes the US stock market. That being said, if we were to break down below the 16.80 MXN level, that would be a horrific sign for the US dollar, meaning that it will probably be losing strength against almost everything.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.