- During the trading session on Wednesday, the US dollar did very little against the Mexican peso which does make a certain amount of sense as the markets are waiting on the FOMC Meeting Minutes.

- This could give us an idea as to what the Federal Reserve is thinking behind closed doors, which honestly sense of what could happen with the US monetary policy going forward.

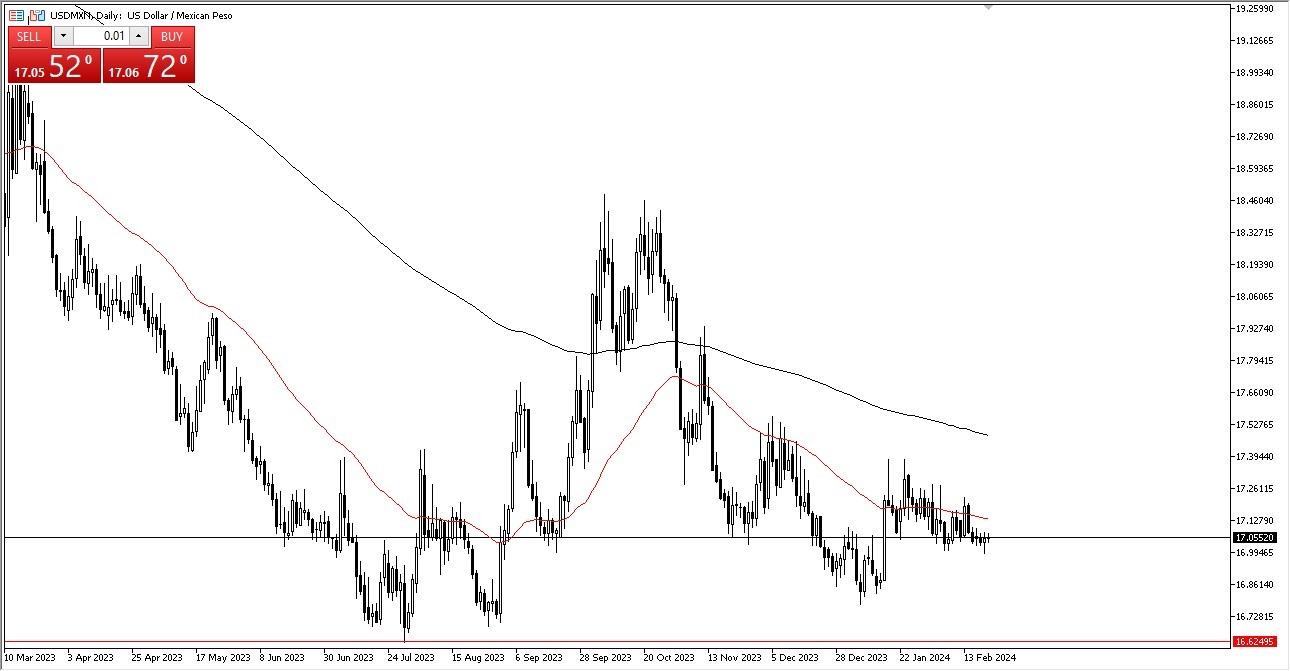

Currently, the US dollar is trading at 17 pesos somewhat reliably, and we have the 50-Day EMA sitting above it, currently causing a bit of resistance. At this point, we have to look at this as a potential bottoming pattern, or perhaps it’s just a range that we are about to be stuck in.

Top Forex Brokers

There were a couple of years there recently where Forex markets were rather quiet, and I think that we may be heading into that as central banks around the world continue to speculate on the idea of possibly cutting rates. If the market is in tune with this, we will have another “race to the bottom”, which more likely than not will affect all fiat currency, and perhaps have money running toward crypto and gold.

Latin America

Keep in mind that the Mexican peso is a proxy for Latin America with most Forex traders, and of course the Mexican peso is greatly influenced by what’s going on in the United States, as Mexico is the number one importer into the US. We also have to keep in mind that there are remittances that cross borders, so a lot of this cross wind noise is part of what keeps this markets of choppy in general.

The interest rate differential of course favors Mexico as it typically does, and the interest rate differential is quite wide. However, if there is some type of financial crisis or recession coming, money will run to the US dollar as it will bail on emerging markets such as Mexico. After all, Mexico is a very speculative economy to say the least, so you will have to be cognizant of this.

Underneath, we have the 16.62 pesos level as a major support level on the monthly chart, and therefore if we were to somehow drop down below that level, we could see the US dollar fall apart against the peso. We are light years from that happening right now, and simply just in the midst of a lot of noise.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.