- The US dollar demonstrated a notable rally during Friday's trading session against the Japanese yen, largely influenced by the release of a jobs report that surpassed expectations by doubling the anticipated figures.

- This development has cast doubt on the possibility of the Federal Reserve implementing monetary policy tightening measures in the near future.

The USD/JPY currency pair experienced a rapid upward surge, catching the attention of Wall Street, which found itself taken aback by the prospect that the Federal Reserve might not commence rate cuts in March. The job data revelation prompted a degree of market anxiety, leading to an influx of investments into the US dollar. The bond market had previously been anticipating significant cuts throughout the year, but this shift in economic data, particularly in the employment sector, suggests that the United States continues to maintain a robust economic trajectory. Consequently, the anticipated rate cuts may not materialize, thereby strengthening the US dollar.

Top Regulated Brokers

In contrast, the Japanese yen remains under the influence of a central bank that displays no inclination towards tightening its monetary policy. The existing interest rate differential between the US dollar and the Japanese yen remains substantial, creating favorable conditions for the former.

Bullish Flag?

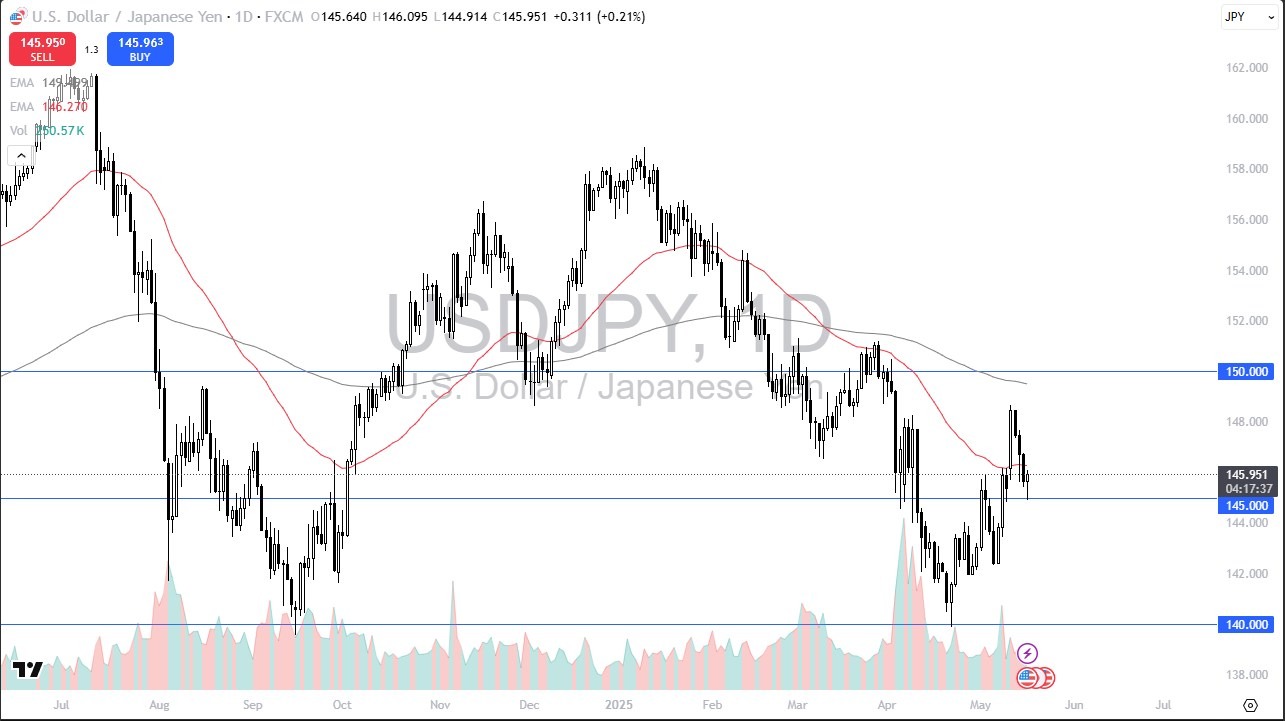

From a technical perspective, the situation can be viewed as resembling a bullish flag pattern, with the 50-day Exponential Moving Average (EMA) providing support beneath, complemented by support from the 200-day EMA.

Looking ahead, it is conceivable that the Japanese yen could target the 152 yen level, representing a zone where recent highs were observed. A breakthrough beyond this level could potentially usher in further upward momentum. However, in the event of a breakdown beneath the 200-day EMA, the US dollar may decline to the 141 yen level. This level had recently served as a robust support level following a significant bounce.

In the end, the prevailing approach is to capitalize on buying opportunities while remaining prudent and seizing profit-taking opportunities as they arise. Expectations include a persistent period of market choppiness throughout the year, driven largely by the ongoing deliberations regarding the Federal Reserve's stance on rate cuts. This turbulence is not limited to this specific currency pair but rather is likely to permeate financial markets across the board in the coming months as traders continue to speculate on the Federal Reserve's monetary policy decisions.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.