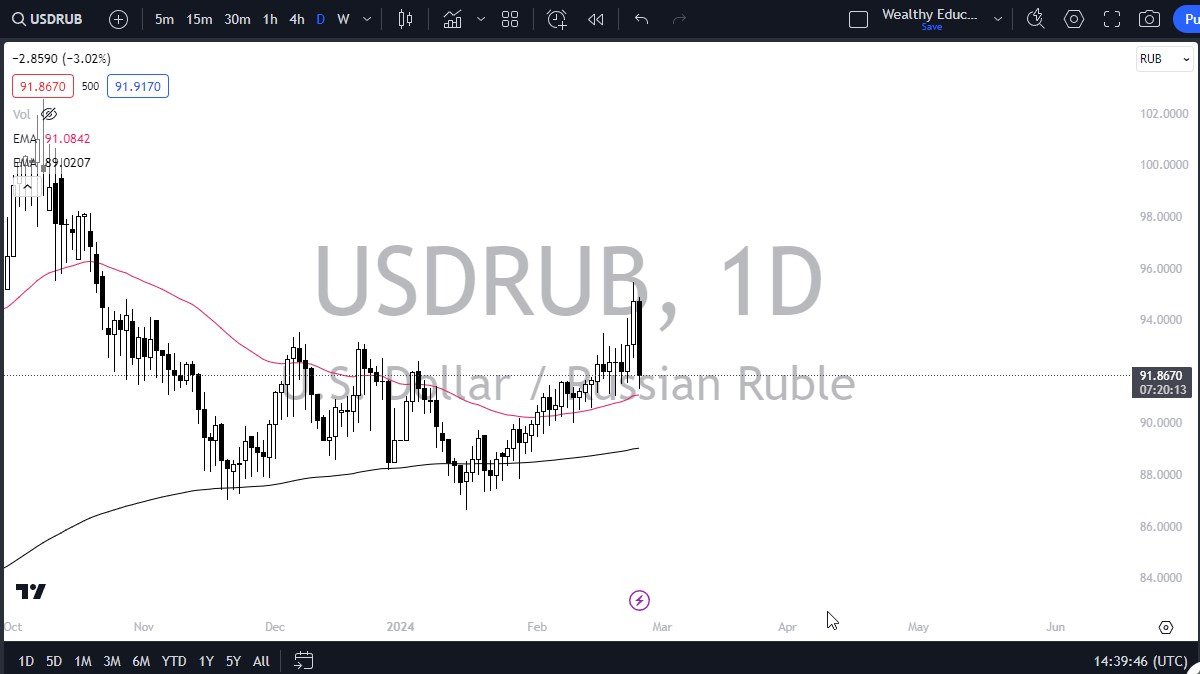

- The US dollar has plunged against the ruble 3% in early trading on Monday, as we see the market dig into the 92 region.

- The 92 region is an area that I think a lot of people will be paying attention to, as we had seen quite a bit of noise in this general vicinity so I think it all lines up for a potential buying opportunity but keep in mind the Russian ruble is greatly influenced by oil and oil does look like it's starting to pick up a little bit so this is a dynamic where you're trading crude oil and you're trading what's going on with the US dollar in general.

- That being said there is a huge area of consolidation just below and of course we have the 50-day EMA coming into the picture also

Underneath there we have the 200 day EMA, which could also be a big player for support. And in fact, it's really not until we break down below the 88 level that I think you can short and hold on to that position. I think this is setting up a potential buying opportunity, but we don't have the price action yet. Look for some type of bounce back above the 92.50 level, then you might have people jumping in to take advantage of cheap greenbacks.

Top Regulated Brokers

US dollar likely to turn things around

I do think that the dollar, more likely than that, continues to strengthen against the ruble, but I don't think it's going to be the home run that a lot of traders once thought it was. After all, sanctions against Russia have only meant that they are selling oil to India and China. So, with that being said, this is a market that I think goes higher, but I'm not looking for huge moves, and in fact, I'm just looking for stability and then a bounce above 92.50 that I can get long with. Keep in mind that the Russian ruble does have a much higher interest rate in the US dollar, so you do get paid if you are short of this market, but you are also fighting a ton of support just below.

Ready to trade our Forex daily analysis and predictions? Here are the best regulated trading brokers to choose from.