- The S&P 500 index continued to experience significant buying activity, despite a relatively quiet start to Monday's trading session.

- That being said, this is a market that is obviously very bullish, so you have to keep in the back of your mind that it is essentially a “one-way trade.”

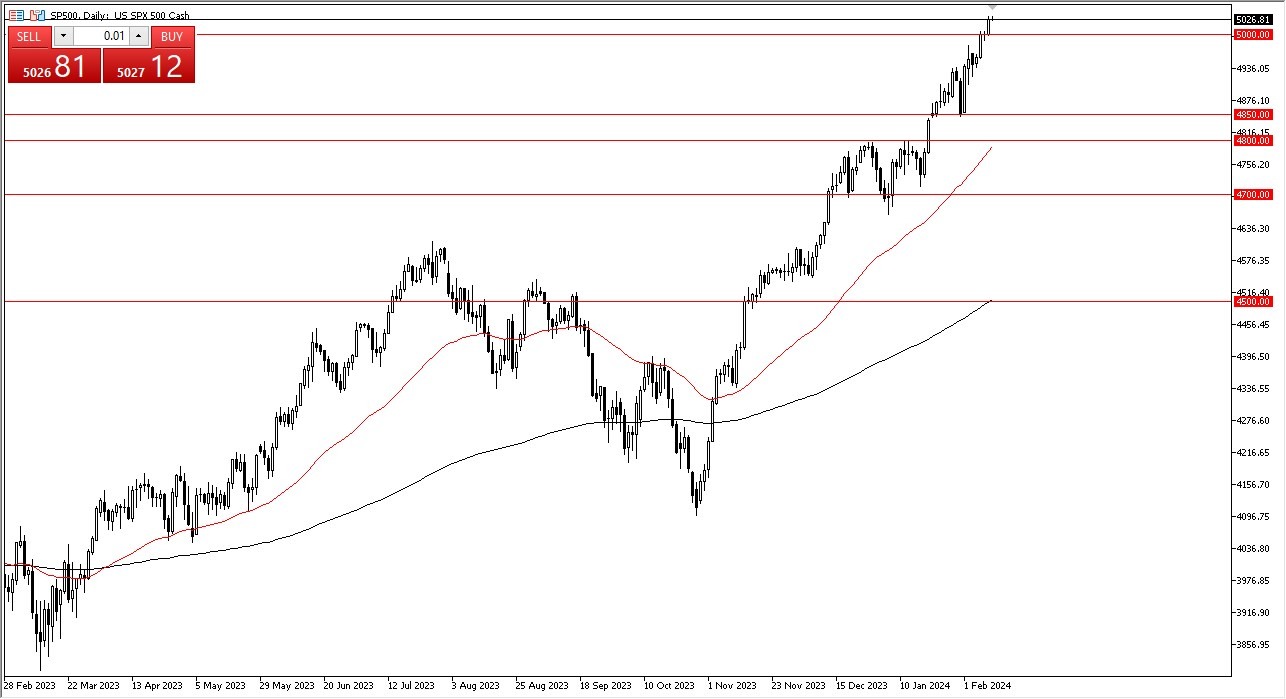

Throughout the early hours of Monday, there was little notable movement in the S&P 500, reflecting the ongoing trend of overextension in global stock markets. Traders, however, remain vigilant for any potential pullbacks, viewing them as opportunities to enter long positions. The key level to watch in such scenarios is the psychologically significant 5,000 mark. A breach below this level could pave the way for a decline towards the $4,850 level, where the 50-day EMA comes into play.

It's worth noting that the recent surge in the S&P 500 has been sustained over several months, highlighting the importance of value hunting in the current market environment. The index is heavily influenced by a select group of stocks, rather than being equally weighted, necessitating a strategic approach to trading.

Top Regulated Brokers

Prevailing Market Conditions

Given the prevailing market conditions, prioritizing value is absolutely mandatory. While the index has comfortably surpassed the 5,000 level, caution is warranted, as entering the market with overly large positions could be reckless in an environment that most people understand as being far too overdone. Consequently, traders are advised to view any downward movements as potential buying opportunities, at least until there are significant changes in interest rates or indications of panic rate cuts by the Federal Reserve.

It's important to recognize that attempting to short the market may not be advisable, given its current momentum and the lack of clear signals for a reversal. Instead, the prevailing strategy among investors seems to be buying into dips, aligning with the broader market sentiment.

At the end of the day, the S&P 500 continues to witness strong buying pressure, with traders monitoring key levels for potential entry points. While the index's ascent has been remarkable, caution is advised to avoid impulsive trading decisions. Prioritizing value and refraining from shortsighted approaches could prove beneficial in navigating the current market landscape. That could be said about most stock markets around the world, just due to the fact that everybody is betting on the same type of central-bank behavior.

Ready to trade our S&P 500 daily forecast? Here are the best CFD brokers to choose from.