- As we are once again staying in the same area, the natural gas market was relatively quiet in the early hours of Tuesday's trading session.

- Price continues to be drawn to this location like a magnet.

- This area could be where we fight for the foreseeable future, although there is some hope out there for the gas markets overall.

Natural Gas Continues to be a “Waiting Game.”

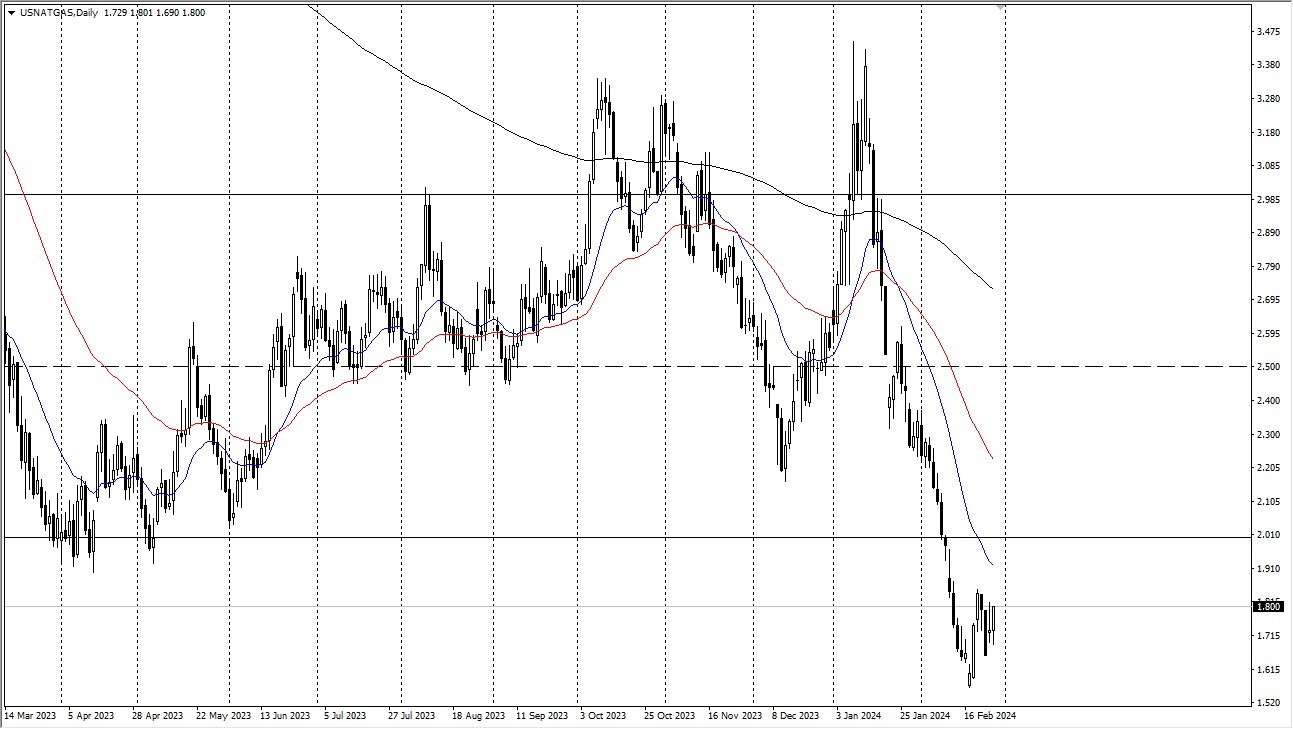

The natural gas markets have somewhat pulled back during Tuesday's trading session, but overall, we have a situation where a lot of noisy behavior is likely to occur in the market. Based on longer-term charts, I do believe that the $1.50 level underneath will be extremely important as a floor. The 20-day EMA provides resistance in between these two points, and the $2 level above might potentially act as enormous resistance. If all else is equal, I believe that there is still a lot of choppiness in this market, with many individuals paying close attention to the notion that spring is approaching and that means demand is declining. However, there are also numerous geopolitical worries over the movement of liquefied natural gas throughout the Middle East.

Top Regulated Brokers

In addition, bear in mind that if prices don't rise, drillers in America might begin to leave the fields. We're running out of storage and, to be honest, they're not generating any money at all, so it will be fascinating to see how this works out. The short-term spike that this market sorely needs could occur if there is a winter storm in the United States. If not, we might merely go in a different direction and keep constructing a small base. That basing pattern might continue for a while.

The possibility of this value being realized has undoubtedly longer-term swing traders licking their chops, but I also understand that you have a situation where you need to avoid using leverage because, quite honestly, this could take some time. If you want to make a greater move, you will need a lot of patience, so be careful not to overleverage your positions. This market is in dire need of a catalyst to push higher. Maybe drillers simply walking away from fields might be it, we don’t know yet.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.