- Natural gas markets have faced ongoing challenges during recent trading sessions, although there are indications of a potential rebound from extremely low levels.

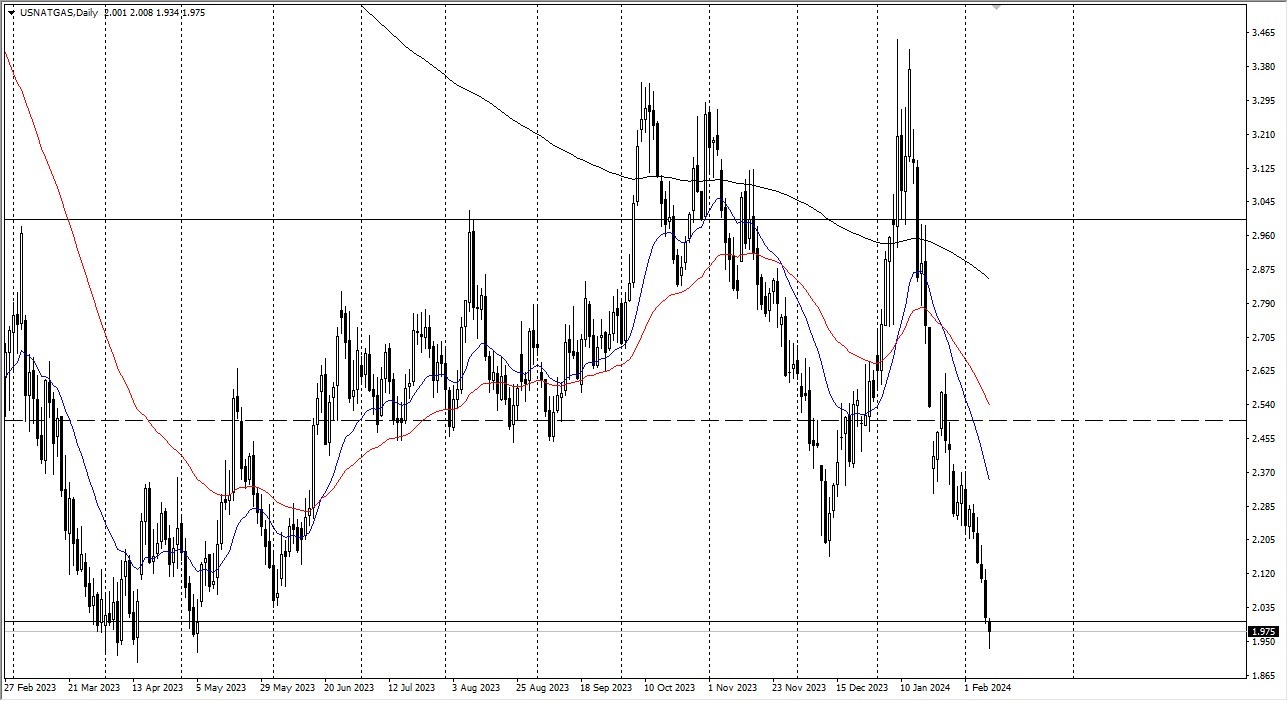

- The critical question now is whether the $2.00 mark will serve as a reliable support level.

- This is an area that has been important more than once, so that would be the hope for bulls.

The natural gas market initially experienced a slight downturn during Friday's trading session before displaying signs of renewed activity. With prices currently at extreme lows, short-term and active traders may be tempted to engage in quick, opportunistic trades. However, a breakdown below current levels could lead to a downward trajectory towards the $1.80 mark, which historically has shown considerable support. This is another area that a lot of people will be watching. This is a market that is desperately looking for some kind of buying pressure.

Top Regulated Brokers

Resistance Above is Possible

Resistance is anticipated at the $2.20 level, with further barriers likely at $2.50 if prices manage to surpass this threshold. Despite the potential for a short-term bounce driven by oversold conditions, the overall outlook for natural gas remains challenging, particularly due to a lackluster winter season that has dampened demand. Consequently, market sentiment is expected to remain range-bound until the next fall season. The question is whether or not we can reach $3 again?

While the oversupply of natural gas continues to make shorting the market more appealing than taking long positions, there is potential for profit-taking rebounds given the current oversold status. Although some swing traders may find this opportunity attractive, it is advisable to approach with caution and avoid overcommitting to positions. For longer-term swing traders, cautiously building up positions may be an option, but excessive aggression is discouraged, as any upward movement is likely to be driven primarily by short covering rather than significant fundamental shifts.

At the end of the day, natural gas markets are facing significant challenges, but there are signs of a potential rebound from extreme lows. While short-term trading opportunities may arise, caution is advised due to the uncertain outlook and the predominance of short-covering dynamics in driving price movements. Investors should carefully monitor support and resistance levels and exercise prudent risk management strategies when navigating the current landscape of the natural gas market.

Ready to trade Natural Gas Forex? Here’s a list of some of the best commodities brokers to check out.