- The gold markets began Monday's trading session with a slight downward slide as the short-term movement remains somewhat erratic.

- I don’t think this means anything other than we don’t have any clear economic announcement or geopolitical concern to move things as things stand currently.

Gold Waits for Momentum

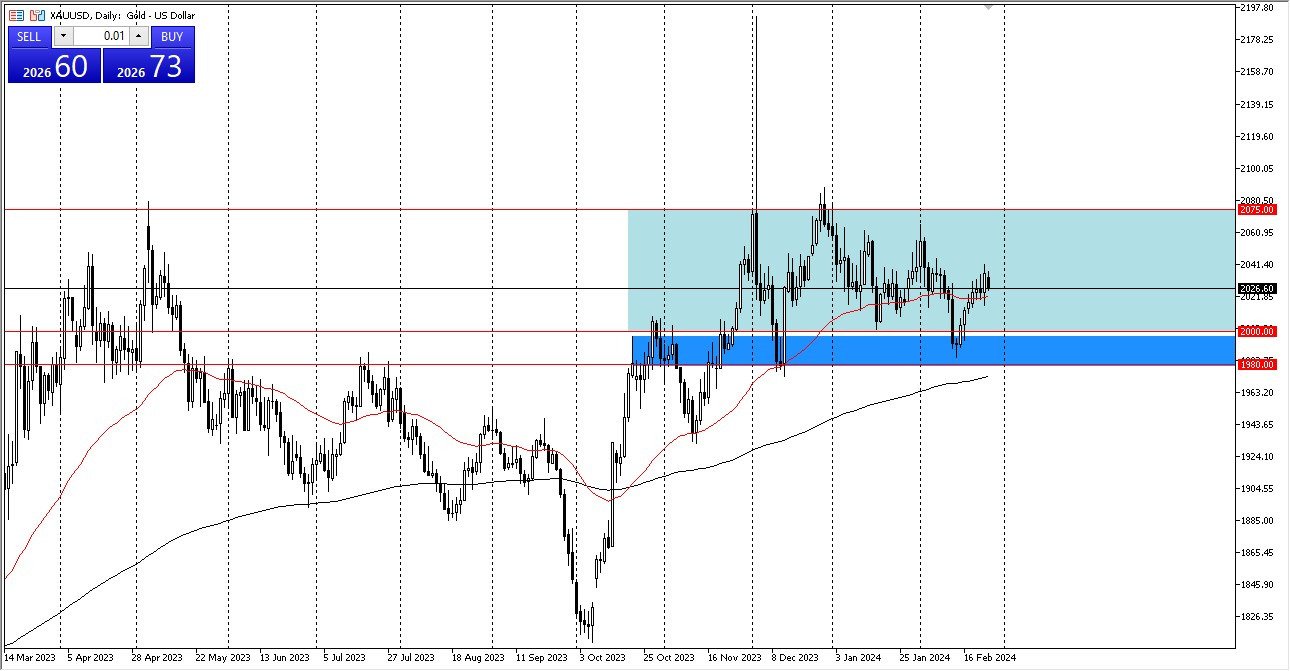

Due to a lack of significant economic data to influence trading, the gold market did not move much on Monday throughout the trading session. Having said that, the market is essentially waiting to make a significant move, hovering around the $2,030 mark. Although the 50-day EMA beneath it still provides short-term support, a break below it might lead to a slide as low as $2,000 in the future. A strong support level that descends to the $1,980 level starts at the $2,000 level. Remember that the gold will be monitoring many various factors at once, the Federal Reserve's expectations being the least of which, of course.

Top Regulated Brokers

I do believe that gold will rise in the long run since longer-term interest rates in the US are predicted to decline, but there may be a slight short-term pullback. Everything I'm seeing suggests that this retracement will ultimately present a buying chance, therefore I'm searching for value below to reverse course and begin purchasing once more. In my opinion, the $2,060 mark represents a significant resistance barrier on the upside in the event that the market rallies. The $2075 level is the one that comes next. Since it would represent a significant breach of resistance, anything above $2075 then permits additional FOMO trading, possibly even more buy and hold trading.

Remember that the 200-day EMA is currently trading slightly below the $1,980 mark. That, in my opinion, will increase the viability of the support range underneath it. Remember that there are geopolitical issues in addition to interest rate worries, which should keep gold in demand and possibly even bullish in the long run. As a result, I predict that it will not be long until we see a pullback of some kind that the value hunters will be quick to seize. Remember that central banks are currently net purchasers of gold as well, and this can be a huge driver in and of itself due to the fact that there is so much buying power behind them.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.