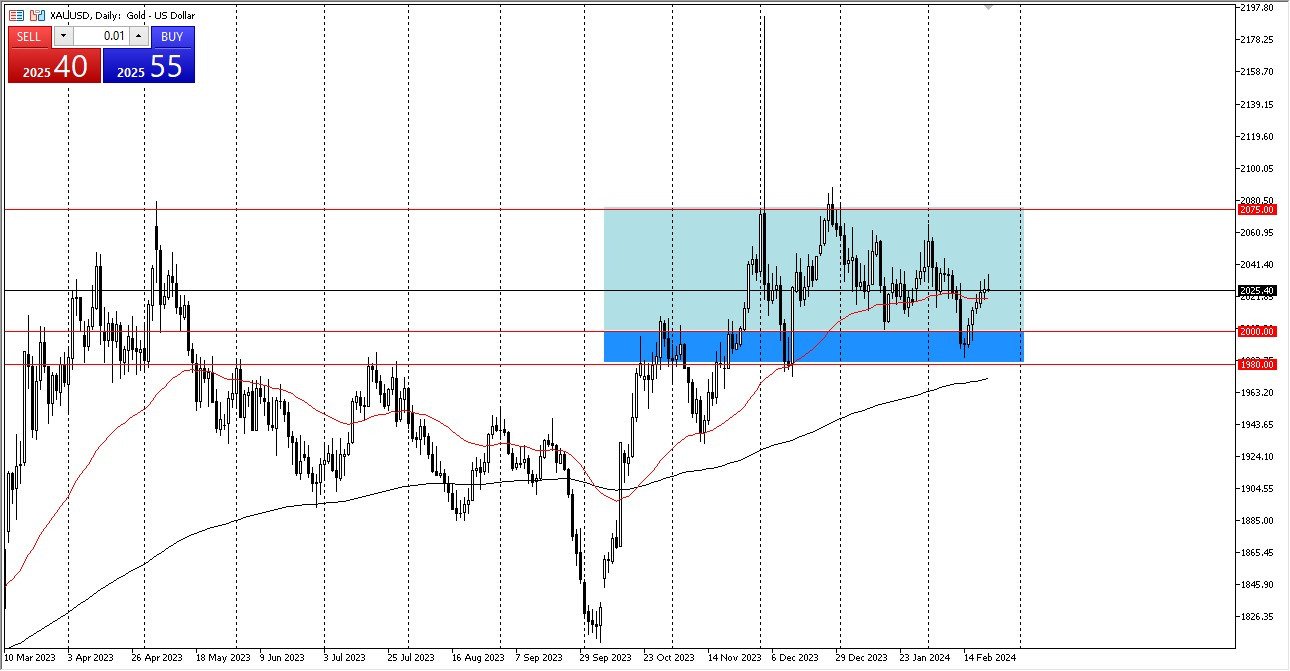

- As you can see, we did bounce a little early in the gold trading session on Thursday as the market found support at the $2,030 level, which also happens to be the point where the market collapsed following the unexpected CPI data last week.

- Naturally, traders will continue to be very aware of how the market performs at that price since this is a segment of the market that will always be significant.

- As a result, given that there is some market memory shown on short-term charts, I believe a small retreat would be reasonable.

Additionally, we are now in the midst of the general consolidation, which is typically when some minor issues arise. Because every time we rally and give up some gains, we turn around and rally again, only to give them up again, this upward advance has been extremely robust and persistently bullish. A small pullback, in my opinion, makes a lot of sense, and the $2,000 level below provides strong support that goes all the way down to the $1,980 level. It is a significant area that I believe people will need to monitor closely, and at that point, I believe it would be really negative if we were to fall below the 1,980 level. However, I don't see that occurring.

Top Regulated Brokers

Very unlikely to change longer-term

However, it would obviously change everything if we did. With central banks all over the world continuing to cut rates this year, I believe you have a scenario where traders will try to locate value beneath, push this market higher, and I think revisit the $2075 level. We will have to wait and watch if we can break above $2075, which in my opinion presents a significant opportunity for a buy and hold—possibly even a FOMO trade—as we had observed during that insane price increase on December 4. However, in the interim, these are the kinds of situations where short-term pullbacks present buying opportunities as value in gold will continue to be the main driver of every time we get that set up.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.