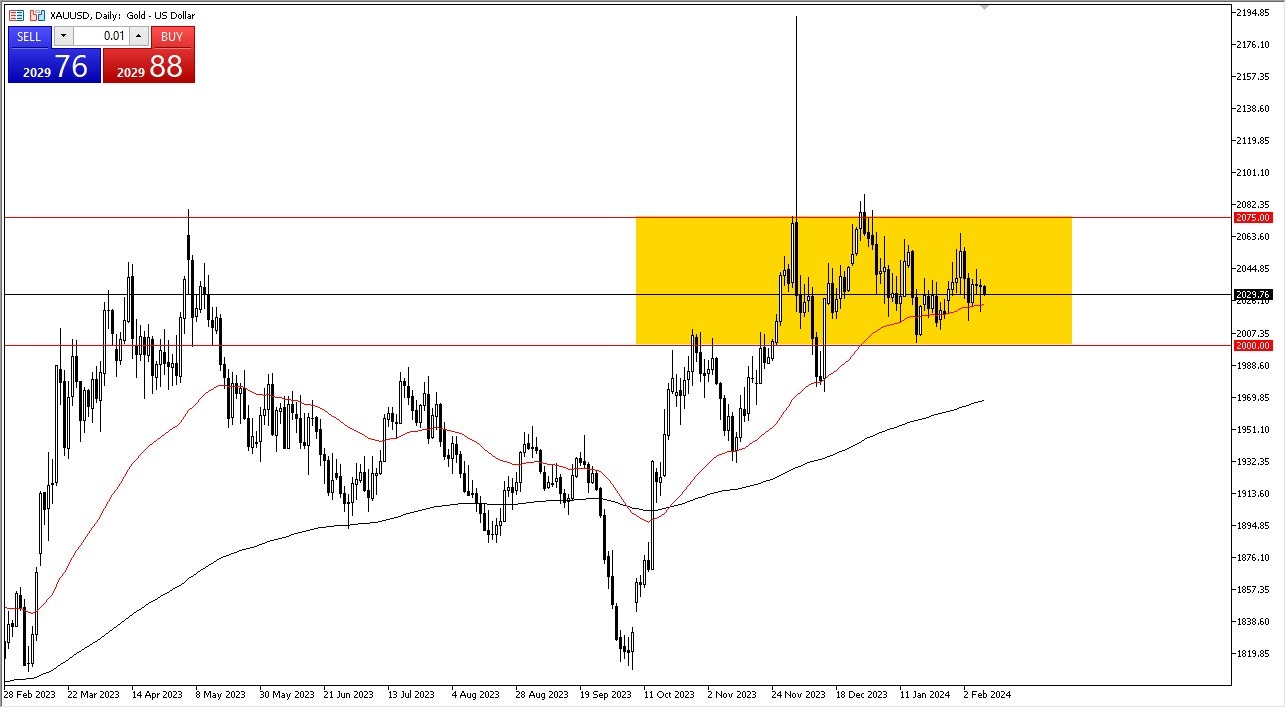

- Gold markets experienced a modest retreat during Friday's trading session as they aimed to approach the 50-Day Exponential Moving Average.

- This is an indicator that a lot of people pay attention to, so it might be a sign to pay attention to this market.

The observed pullback may be viewed as a short-term corrective movement, potentially signaling further downside if the market breaches the 50-day EMA. Such a scenario could lead to a descent towards the $2,000 level, which holds significance as a major support threshold. Additionally, a breakdown below this level could pave the way for a deeper correction, with the $1,980 level emerging as another crucial support zone.

Conversely, a rebound is anticipated, with gold likely targeting price levels around $2050 or even $2060. However, investors should note that the $2075 level presents a formidable resistance barrier, the breach of which could indicate heightened demand for gold, potentially driven by geopolitical tensions or interest rate dynamics.

Top Regulated Brokers

Despite persistent buying interest, the gold market remains susceptible to various sources of market noise, including fluctuations in interest rates and geopolitical uncertainties. Given these factors, investors are advised to approach buying positions cautiously, considering the inherent uncertainties in the market. While the broader trend suggests an upward trajectory, the lack of clarity necessitates prudent risk management strategies. Getting too big into the market would not be something that you should be doing at this point in time. This market has a lot of noise in it – which makes sense as the world is essentially on fire at the moment it seems.

Many investors view the current phase in the market as an opportunity for accumulation, gradually building positions with each downward movement. However, it's crucial to remain vigilant, as a breakdown below the $1980 level could signal a significant shift in market sentiment. In such a scenario, widespread selling pressure may ensue, prompting investors to reconsider their long positions.

At the end of the day, the recent retreat in gold prices towards the 50-day EMA warrants close monitoring, with potential implications for short-term price movements. While downside risks persist, particularly below key support levels, the market's underlying uptrend remains intact. Nevertheless, investors should exercise caution and implement prudent risk management measures amid ongoing uncertainties surrounding interest rates and geopolitical dynamics.

Ready to trade our Gold forecast? We’ve shortlisted the most trusted Gold brokers in the industry for you.