- The GBP/USD pair faced significant downward pressure during Thursday's trading session, as the US dollar exhibited strength across the board.

- This ongoing dynamic reflects a broader market sentiment characterized by uncertainty and volatility.

- This is a market that doesn’t know what it wants to do at the moment, so be cautious with your sizing of positions.

Amidst the prevailing market turmoil, investors are closely monitoring developments in the bond markets, particularly the fluctuations in the 10-year Treasury yield in the United States. A rise in yields typically strengthens the US dollar, thereby exerting downward pressure on the British pound. While the pound may exhibit relative strength against some other currencies, its performance against the dollar remains subdued.

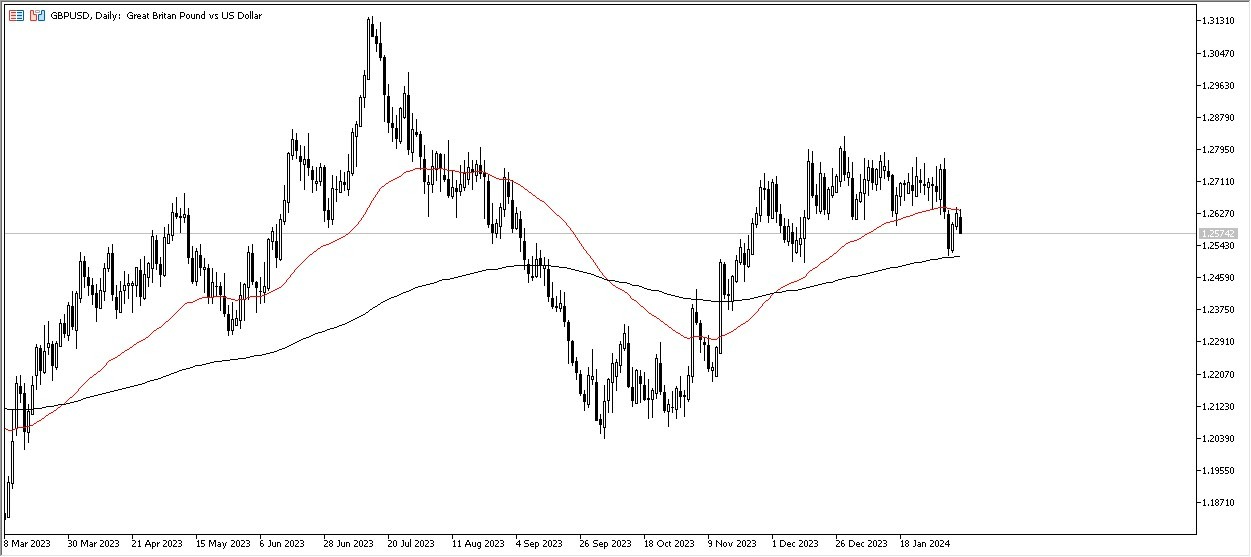

Currently, the GBP/USD pair finds itself sandwiched between the 50-day Exponential Moving Average (EMA) above and the 200-day EMA below. This positioning suggests a period of consolidation and heightened noise in the market. However, a potential bounce from the 200-day EMA cannot be ruled out, offering temporary respite amidst the prevailing turbulence.

Top Regulated Brokers

Uncertainty Abounds

Nevertheless, the outlook for the GBP/USD pair remains uncertain, contingent upon various factors such as bond yields and monetary policy developments. A breakdown below the 200-day EMA could signal further downside potential, potentially driving the pair towards the 1.23 level.

The 1.25 level currently serves as a critical support zone, coinciding with the presence of the 200-day EMA. Beyond these technical levels, market participants will closely scrutinize any statements or actions from the Bank of England (BOE) that could impact market sentiment.

Until there is a discernible shift in the fundamental landscape, caution remains warranted when approaching the GBP/USD pair. Given the inherent noise and volatility, prudent risk management strategies are essential for investors navigating this market environment.

At the end of the day, the GBP/USD pair continues to face downward pressure amidst the prevailing strength of the US dollar. While short-term fluctuations are expected, the broader outlook remains uncertain. Monitoring key technical levels and staying attuned to market developments will be crucial for traders seeking to navigate this challenging landscape effectively.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.