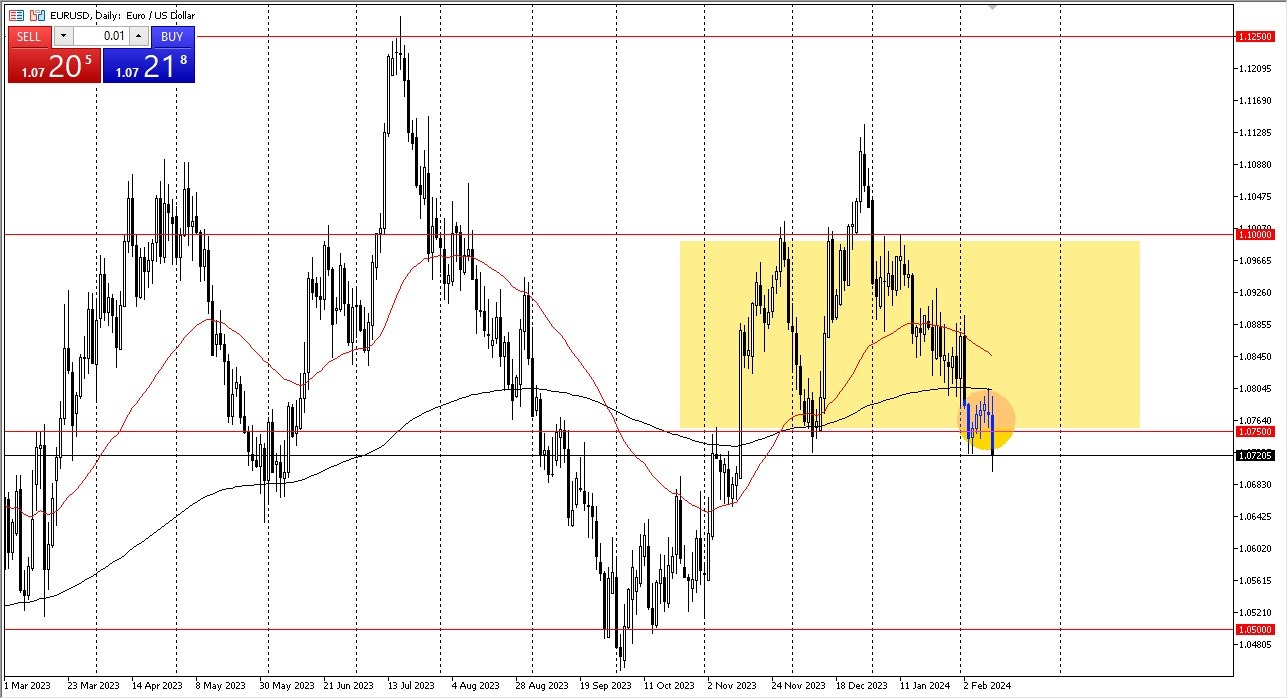

- The Euro initially tried to rally during the trading session here on Tuesday, but the 200-day EMA looks as if it is going to continue to cause some issues.

- With that being the case, I think you've got a situation where market participants will continue to look at central bank actions.

- And the fact that the CPI numbers in the United States came out hotter than anticipated certainly has thrown a monkey wrench in this market.

With that being said, I think you've got to look at this as a question of whether or not the bottom is going to hold in the previous consolidation area. The Americans almost certainly will sell off the dollar. It's what they do. So by the end of the day, we could find ourselves above the 1.0750 level. If we do, that would be a bullish sign, but just bullish in the sense that we would have a certain amount of support that is holding.

Top Regulated Brokers

Ultimately, I do think you have to look at this through the prism of whether or not we can break above the 200 day EMA, because that is going to be a major factor in how we behave as well. Because above the 200 day EMA opens up the possibility of 1.09 and then eventually 1.10 above, which is the top of the overall consolidation area. We already are starting to see the euro recover a bit, or

Perhaps better put, we are starting to see the US dollar cool off a little bit later in the day. So, we'll see. If we get a daily close below 1.0650, then I'll be convinced that we are dropping down to the 1.05 level. That being said, the market is very unpredictable at the moment, because we are paying close attention to inflation overall, and therefore I think you have a couple of currencies that are going to have very little in the way conviction, so ultimately this is a market that sooner or later we will carve out a bigger consolidation area that we can trade in. As things stand right now, it looks like chaos reigns as the market continues to over react to every little piece of information that it gets involving inflation.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.