- Over the past two trading sessions, crude oil has been a little erratic, retreating early in the Friday session.

- Nevertheless, the market continues to consolidate just below a significant resistance barrier, and it may be beginning to indicate that a breakout is imminent.

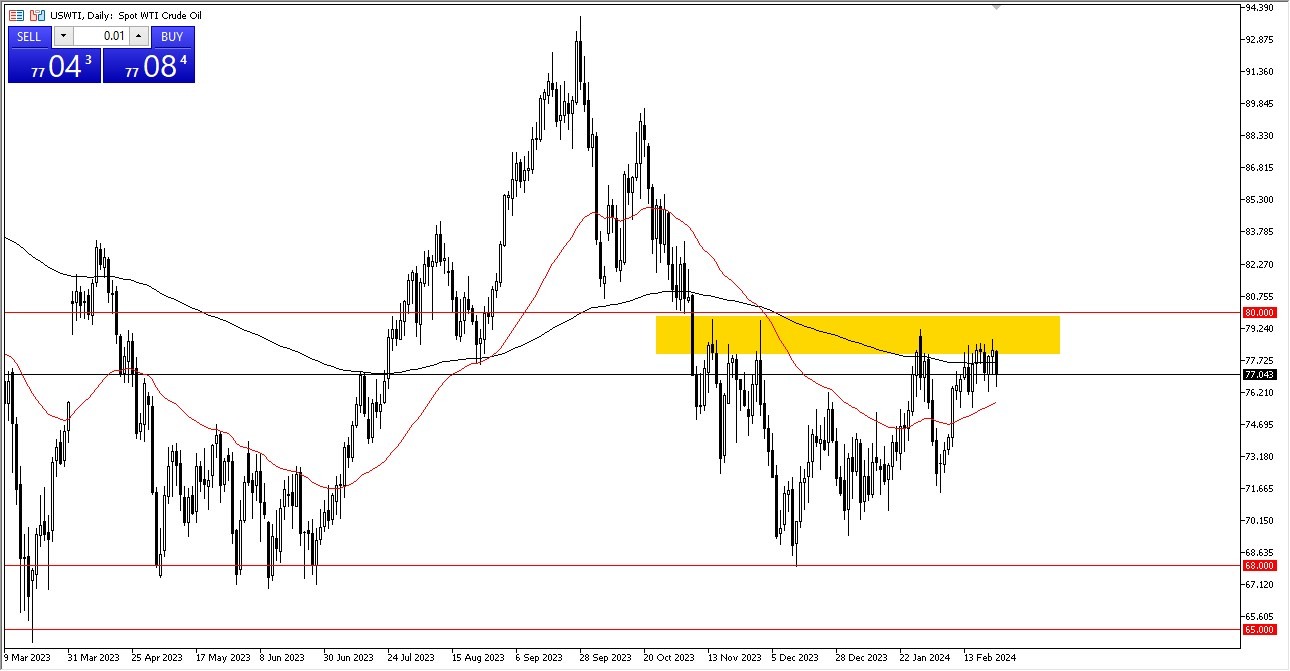

WTI Crude Oil

A small retreat was seen in the WTI oil market throughout the trading session. Friday, given that, all else being equal, we continue to witness a great deal of loud behavior. I believe you were observing this market near the 200-day EMA. Of course, there will still be some price magnetism around the 200-day EMA. The 50-day exponential moving average is shown below, and it also plays a role in providing support. I believe that this market will be extremely tough to short in general, so as long as we continue to drop like this, I will continue to purchase and then exit the position at the top of the range. On the longer term chart, we are starting to resemble a head and shoulders that have been turned inside out or a bottom that is rounding out. In the WTI grade, $85 would probably be the aim if we can break over the $80 mark.

Top Regulated Brokers

Brent

Brent is in an identical circumstance. Brent is circling the 200-day moving average (EMA) and the 50-day EMA beneath it, providing support at the $80 mark. I see the $84 level above as a major hurdle, and 89 could be the next goal if we can break over it. Dips that last a short while still present purchasing chances. And I do think there are a lot of reasons to assume that oil will rise, even though it will be quite noisy. First of all, there is seasonality; during this time of year, there is a significant increase in the demand for oil. Moreover, there has been a slight decrease in supply. Of course, central banks all over the world are also trying to lower interest rates, which can enhance demand when economic activity picks up. Given that, I do believe that this market will eventually break out and rise higher. I'm merely buying dips and using the short-term charts as a result in the interim.

Ready to trade the WTI/USD exchange rate? Here’s a list of some of the best Oil trading platforms to check out.