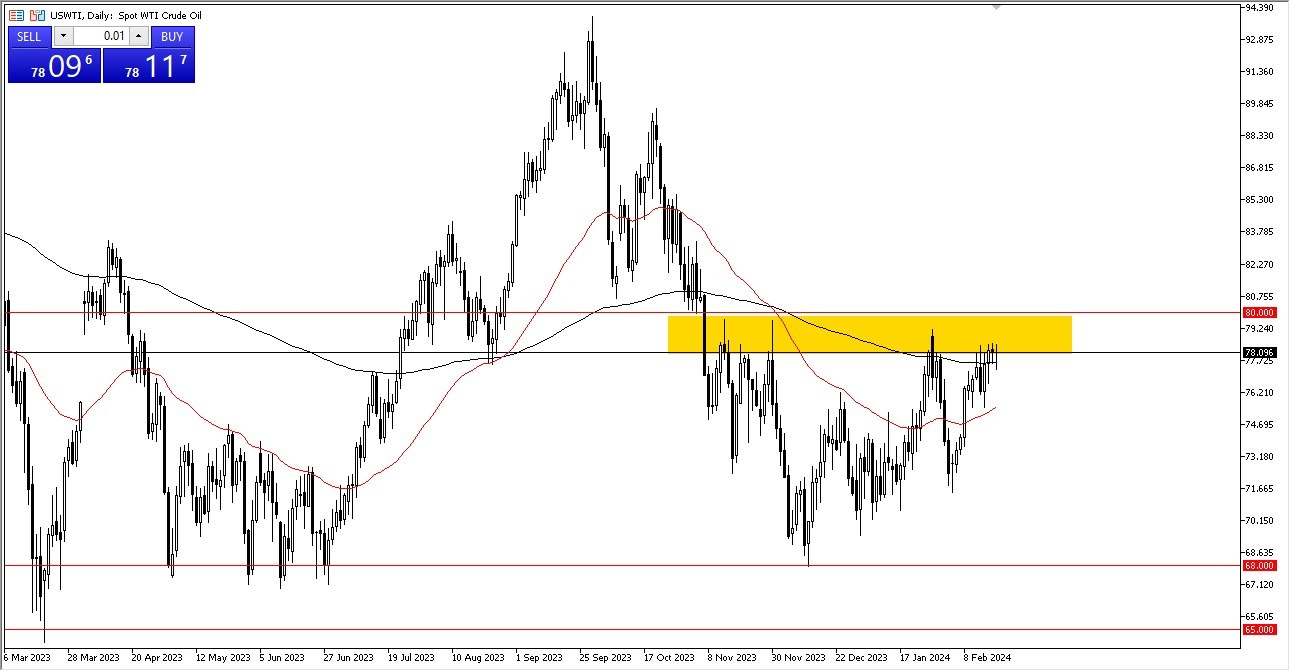

- As you can see, the WTI grade of crude oil has slightly declined before rising again and exhibiting life.

- That being said, the 200-day EMA is undoubtedly a signal to which many will be closely watching, and it appears that it is attempting to provide some support.

- When the market even slightly declines, purchasers are still drawn to this market because of its value.

I think the WTI grade, and the crude oil market might reach $82.50 and perhaps $88 if we can break beyond the $80 line. The 50-day EMA is included here as well, and it has the potential to provide a lot of support. Given that this is a frequently monitored technical signal, it is logical to focus on this particular region. This is an area I will be paying close attention to obviously, as it is so significant.

Top Regulated Brokers

Brent

At this time, Brent remains quite bullish, with resistance coming from the $84 level above and support from the 200-day EMA. I believe it's likely that we will reach the $90 level if we can pass that level. What I believe to be your short-term floor is the $80 level, where the 50-day EMA beneath is still providing support. Both of these, in my opinion, are going to develop rounded bottoms and turn upward. With summer quickly approaching and more people traveling, driving, flying, and other activities associated with it, crude oil is now benefiting from seasonality. Therefore, crude oil usually does okay at this time of year.

Having said that, all signs point to increased prices. And in a market where supply is beginning to taper off, I believe that temporary declines nevertheless present purchasing opportunities. That naturally enters the picture now. Additionally, I believe that traders are attempting to take notice of the possibility that rate cuts by central banks worldwide could boost economic activity. If that’s the case, we probably see most commodities take off, with oil being the biggest one typically. This market is a great indicator of how the global economy is doing but is obviously noisy to say the least. I am bullish, but I also see there is work to do.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.