- The bitcoin market initially did rally early on Monday but gave back gains rather quickly.

- At this point, it looked like the market was going to pull back into a consolidation region, but what a difference just a couple of hours makes.

- Once the Americans came on board, it was bullish again, as Bitcoin took off to the upside.

- At this point, it looks like the market could go looking toward the next major resistance barrier, near the $52,000 level.

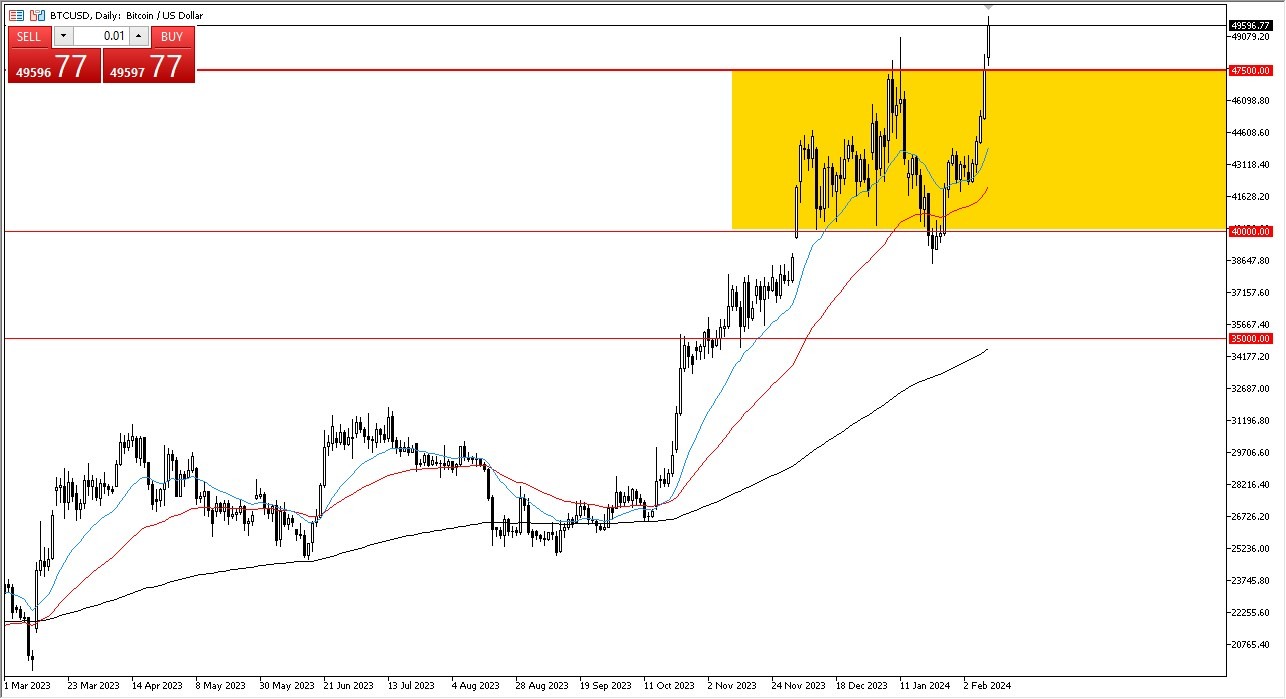

Underneath, the $47,500 level is an area where we have seen previous resistance, so therefore it should be a massive support level. All things being equal, the market is likely to continue to see that through the prism of “market memory”, and therefore I think you need to recognize that there could be buyers there. If we break down below there, then the 20-Day EMA could be the next support level, near the $44,000 level. Breaking below there then opens up the possibility of the 50-Day EMA. Furthermore, it’s also worth noting that the $40,000 level underneath is a major support level as well.

Top Regulated Brokers

Bitcoin Remains “Buy on the Dip.”

The bitcoin market continues to be propelled by the idea of central banks around the world loosening, and therefore it’s likely that you can see more of a “buy on the dip” type of situation as traders are trying to not only get involved in the market now that the ETF is here, but the idea that central banks around the world will continue to print currency. We are a bit overextended at this point, and I think it’s probably only a matter of time before we have to deal with a little bit of gravity.

Looking at this chart, there’s nothing on it that suggests that we would be looking to short the bitcoin market, and now it looks like we could go to the $52,000 level. If we were to break above there, then the market becomes more “buy-and-hold”, and therefore longer term traders will continue to take advantage of this. Quite frankly, it’s not until we break down below the $35,000 level that I would rethink the entire uptrend, although we have been overdone for a while and a pullback certainly could be in the cards.

Ready to trade BTC/USD? Here’s a list of some of the best crypto brokers to check out.