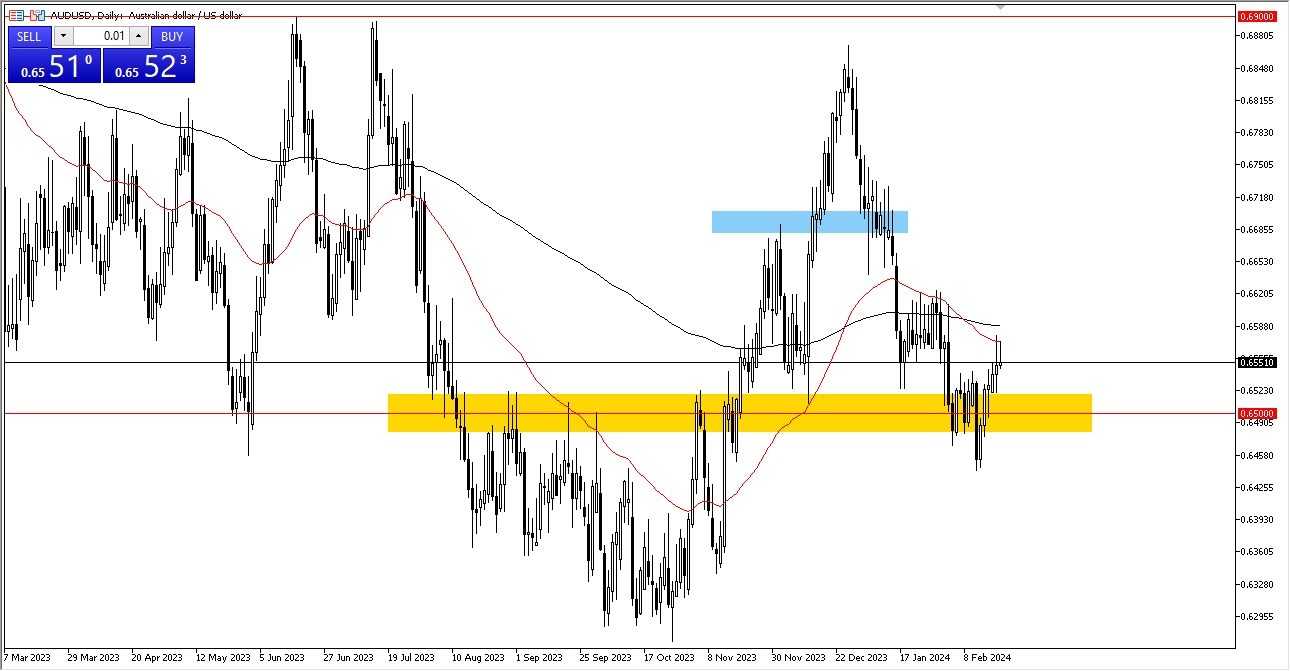

- The Australian dollar still having trouble breaking above both the 200-Day EMA and the 50-Day EMA during the Wednesday session.

- Assuming nothing else changes, we are at an inflection point, but nothing worth writing home about. At this point, it’s just noisy to say the least.

As you can see, the Australian dollar made progress toward the 50-day moving average, but it lost a significant amount of its early-session gains. This follows a session on Tuesday that saw advances pierce the 50-day EMA at first, but it also saw losses. Put another way, it appears that the market will continue to struggle in this broad area as traders attempt to determine whether or not the market will be able to pick up any kind of momentum. Momentum is something that we are desperate to get in this market.

Top Regulated Brokers

This indicates to me that it will be exceedingly challenging to move higher and beyond this 200-day EMA. That doesn't necessarily indicate that the couple breaks up after this; it just means that we'll keep acting tense and erratic. I believe that the 0.65 level underneath is a rather significant area. We've already jumped through it a few times, but it's a big round number that will definitely draw notice from market participants overall.

Factors for Movement in the Aussie

If we are able to reach it, the 0.66 level is a clear resistance on the upside. And in essence, as the Australian dollar has climbed over the past two days, we have only moved halfway between those two levels. Your next objective is 0.67 if we can break out above 0.66. When all else is equal, the Australian dollar is still influenced by the US interest rate environment, international commerce, and the Chinese economy.

Recall that for foreign exchange traders, the Australian dollar serves as a stand-in for China. It's also sometimes used as a stand-in for gold, though this chart doesn't truly show that. Naturally, as hard commodities make up the majority of Australia's exports, merely hard commodities in general. A lot of traders simply view the Australian dollar as a "riskier currency" than the US dollar beyond that. Having said that, the FOMC Meeting Minutes from the US are received late in the meeting, so that may be relevant in some way.

Ready to trade our daily Forex forecast? Here’s some of the top Australian fast execution forex brokers to check out.