- The AUD/USD pair experienced a slip during Thursday's trading session, a move attributed to the growing influence of the US dollar on global markets.

- Despite this downward trend, it appears that the currency is nearing a potential support level rather than facing significant resistance.

- Consequently, there is a possibility of a modest rebound in the near future.

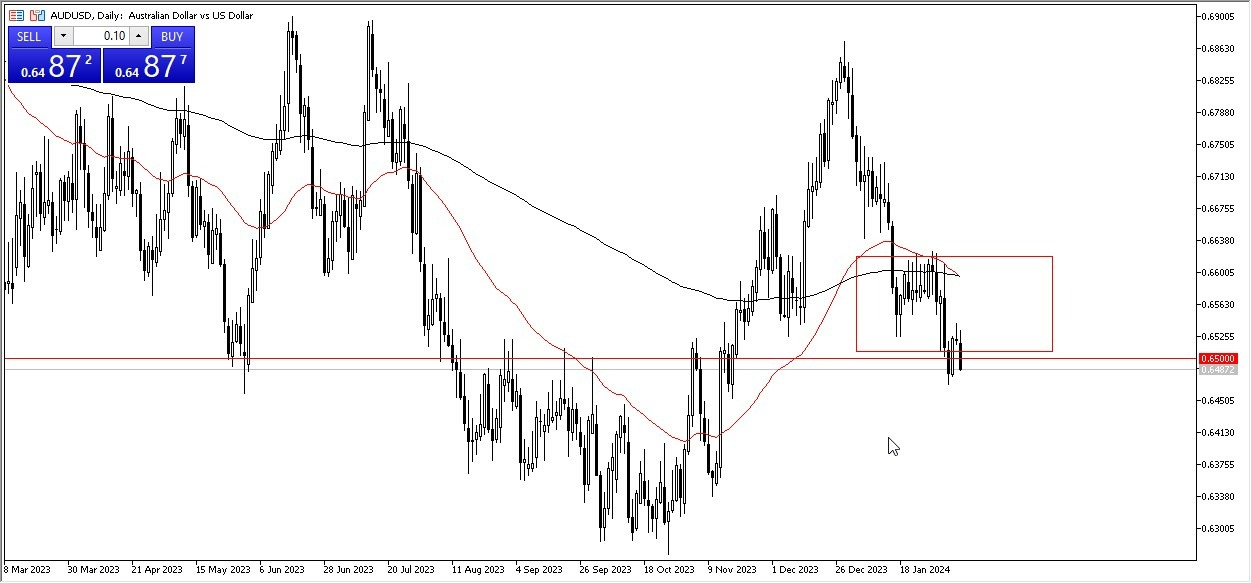

The key level of 0.65 is likely to remain a focal point for market participants, regarded as a zone of fair value. Hence, it's unsurprising to observe further consolidation in this area. However, should the downward momentum persist, attention may shift towards the 0.6350 level as a critical support threshold. A breach below this mark could trigger substantial selling pressure, potentially leading the pair towards the 0.60 level.

Top Regulated Brokers

AUD Breaking 0.6550 – A Good Sign

Conversely, if the AUD/USD pair manages to break above the 0.6550 level, it could pave the way for a bullish scenario, with the 0.66 level becoming the next target. Notably, this level aligns with the convergence of the 50 and 200-day Exponential Moving Averages (EMAs), further reinforcing its significance. Any movement beyond this point would likely indicate a notable strengthening of the Australian dollar.

Such a scenario could coincide with a broader weakening of the US dollar, reflecting a substantial shift in market sentiment. However, achieving this outcome would require considerable effort, given the current economic uncertainties surrounding the Federal Reserve's potential rate cuts and concerns about a global economic slowdown, which particularly impact commodity currencies like the Australian dollar.

In the end, the AUD continues to navigate through a period of volatility, with its trajectory influenced by both domestic and international factors. While near-term fluctuations are expected, the resolution of key levels such as 0.65 and 0.6550 will likely determine the currency's direction in the coming sessions, offering valuable insights into its future trajectory.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.